Oil Review Middle East caught up with Noritsugu Mifune, CEO of Al Gharbia Pipe Company LLC at ADIPEC, where he highlighted the company’s encouraging growth prospects

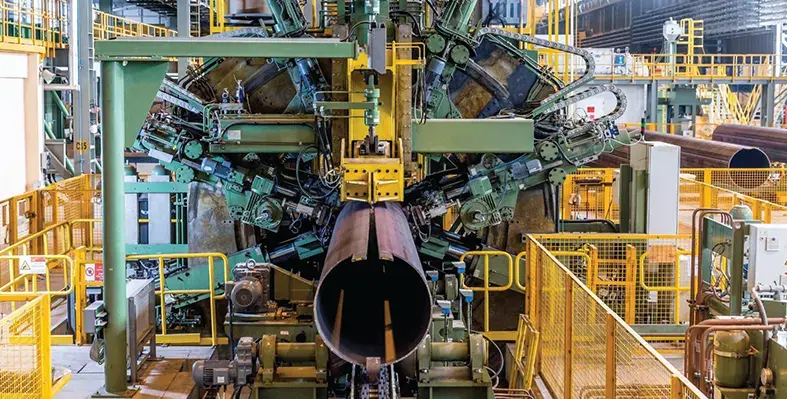

Abu Dhabi-based Al Gharbia Pipe Company (AGPC) is one of the most technologically advanced Longitudinally Submerged Arc Welded (LSAW) Pipe manufacturers in the world, and one of the first large scale manufacturers to embrace Industry 4.0. Established in 2015, it is a joint venture between three partners: ADQ, Abu Dhabi-based investment and holding company; Japan’s JFE Steel, the 13th largest steel manufacturer in the world, and Japan’s Marubeni Itochu Steel, provider of commercial and logistical support to some of the world’s largest oil and gas companies.

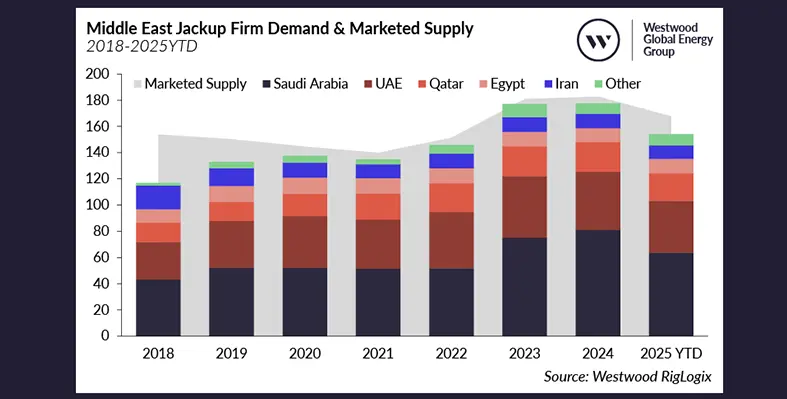

Noritsugu Mifune notes that the company in October recorded the production milestone of 700,000 MT of steel pipes, of which almost 500,000 tonnes was produced in 2024-2025 alone. Production is mainly destined for the UAE market, which Mifune describes as a “very good and promising market”. He forecasts continuing strong demand given the high level of activity in both the onshore and offshore sector.

Mifune stresses the company’s ability to meet even the most challenging customer requirements, thanks to the deployment of cutting-edge technology and the expertise of its Japanese shareholders. The plant is equipped with the most advanced production and testing technology from Europe and Japan, including a state-of-the-art automated pipe manufacturing line, a 2nd generation JCO pipe forming press, and a Manufacturing Execution System (MES). The company can produce pipes for the harshest environments, such as sour service pipes for H2S, and deep-sea pipes that can withstand depths of up to 3,000m.

The main challenges for the company are cost and delivery, given the current tough international market conditions, with materials needed to be imported from abroad. However, the UAE’s strategic position as a trading hub with excellent port and logistics facilities facilitates trade. Located in KEZAD, Al Gharbia benefits from competitive utility rates, along with good infrastructure and logistics.

“It is a very good place for our business,” Mifune says. “It gives us peace of mind.”

These factors, along with the UAE’s supportive business environment, attractive labour market and strategic location with easy access to Europe, Africa and Asia have contributed to the company’s success, he adds.

While local demand continues to be strong, Al Gharbia is also looking to grow its exports to Europe, Asia and Africa. Last year the company exported 60,000 tonnes to Iraq. It is looking to further grow its capacity, which now stands at up to 360,000 tonnes a year, with production of approximately two kilometres of pipe a day.

Industry 4.0 Digital Leader

Mifune highlights the company’s commitment to innovation and continual development, noting how it leverages Industry 4.0 technologies to improve quality, safety and production. All plant processes are connected through Smart Manufacturing Execution System (MES 4.0) that executes, monitors, tracks and reports operations on the plant floor in real-time. Pipe traceability and real-time data are collected by fully automated Smart Devices using artificial intelligence and machine learning, guaranteeing total quality control and traceability throughout all steps of the manufacturing process.

The company’s efforts have been recognised by the UAE’s Ministry of Industry and Advanced Technology, which has certified the company as an Industry 4.0 Digital Leader.

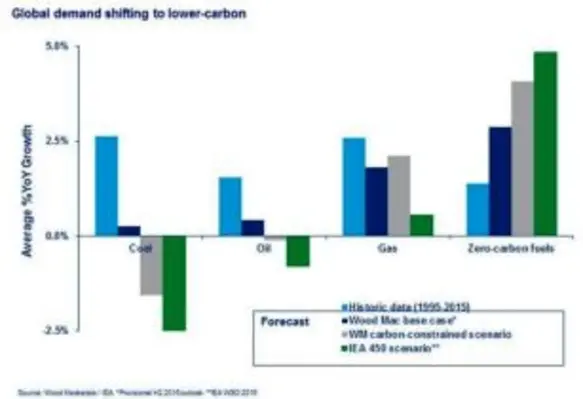

Mifune points out that while oil and gas is currently the focus of production, the company is looking to the future and is already prepared for the production of pipes for hydrogen and CO2, developed with JFE Steel, which are likely to become increasingly important.

Mifune highlights the company’s strong commitment to Emiratisation, as illustrated by its initiatives for the training and development of local talent. The company is involved in training young graduates from local universities and facilitates education exchanges with Japan and other countries. It is something which Mifune is passionate about; he himself has a personal involvement in the company’s training programmes.