In The Spotlight

PC Oman Ventures Ltd (PCOVL), a subsidiary of PETRONAS, has signed a Concession Agreement with the Government of the Sultanate of Oman and OQ Exploration and Production Batinah Offshore LLC (OQEP) for the exploration of oil and gas in Block 18

Block 18 is a large offshore exploration area located in Northeast Oman, spanning more than 21,000 sq km and offering significant frontier exploration potential across diverse geological settings, from shallow to ultra-deep water. Under the concession agreement, PCOVL will become operator of Block 18 in partnership with OQEP.

PCOVL has been active in the Sultanate of Oman since 2018 and currently holds a participating interest in Block 61. This collaboration builds on the Memorandum of Understanding (MoU) signed between PETRONAS and OQEP in October 2025, strengthening the strategic partnership between both companies and reinforcing PETRONAS’ long-term presence in the Sultanate of Oman.

The partnership supports PETRONAS’ aspiration to enhance its competitive upstream portfolio by aligning its offshore exploration capability with OQEP’s regional expertise, laying the foundation for a mutually beneficial venture.

"Building on our technical strengths and successes, PETRONAS continues to expand its exploration activities into new frontiers. Through our innovative exploration approaches and OQEP’s basin expertise, we aim to jointly unlock the potential of Block 18, contributing to Oman’s long-term energy security. The addition of Block 18 aligns with our commitment to disciplined portfolio expansion, providing strategic optionality across our international portfolio," said Mohd Redhani Abdul Rahman, vice president of International Assets, PETRONAS.

Aramco and Microsoft are building on their long-standing collaboration with an agreement that will help Aramco accelerate industrial AI adoption, enhance digital capabilities, and strengthen workforce development in Saudi Arabia as part of its broader digital transformation

Key areas of focus include:

• Digital Sovereignty and Data Residency: Exploring the development of a roadmap for deploying solutions on the Microsoft cloud, enhanced with sovereign controls to further Aramco’s digital sovereignty objectives

• Operational Efficiency & Digital Infrastructure: Discussing streamlining and optimising digital frameworks that support Aramco’s global operations

• Industry Alliance Framework: Scoping possible engagements with Saudi Arabia’s technology integrators and industry collaborators to broaden the adoption of AI across the industrial value chain in the Kingdom

• Industrial AI IP co-innovation: Exploring the establishment of a global marketplace for innovative industrial AI solutions by co-developing and commercialising operational systems for the energy sector that set new standards of excellence and promote Saudi expertise internationally within the industry.

Aramco and Microsoft are also exploring initiatives to help accelerate digital and technical skills development across the Kingdom, including building capabilities in AI engineering, cybersecurity, data governance, and product management. Microsoft is already training thousands of Saudi learners across cloud, AI, and data programmes.

Ahmad O. Al Khowaiter, Aramco executive vice president of Technology & Innovation, said: “Aramco is driving the energy sector’s digital transformation by creating a secure, intelligent, and collaborative digital ecosystem. In partnership with Microsoft, we seek to further scale cutting-edge digital and AI solutions in that sector to achieve efficiency and innovation — without compromising the highest standards of security and governance.”

Brad Smith, vice chair and president of Microsoft, said, “This marks the next step in our long-standing collaboration with Aramco, exploring how industrial AI can move from pilots into core operations to improve efficiency and resilience at scale. Our focus is on building strong foundations – sovereign-ready digital infrastructure, trusted governance, and the skills needed for responsible industrial AI adoption.

"As a global industry leader, Aramco has the opportunity to set a reference for large-scale, responsible industrial AI transformation aligned with Saudi Arabia’s Vision 2030.”

See more on Aramco’s AI innovation here: https://oilreviewmiddleeast.com/magazines/orme_2025_12_22/spread/?page=22

https://oilreviewmiddleeast.com/technical-focus/aramco-highlights-its-ai-leadership-at-world-economic-forum

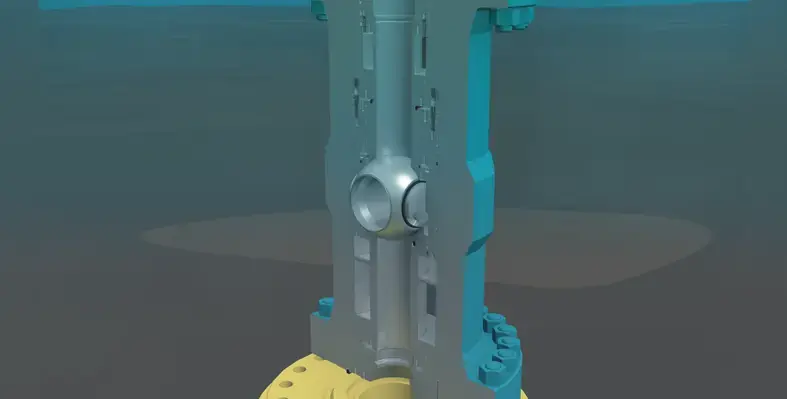

Halliburton has launched the XTR CS injection system, a wireline-retrievable safety valve solution engineered for CO₂ injection in carbon capture, utilisation, and storage (CCUS) wells

Operators face unique challenges in CCUS environments, including ultra-low temperatures and the need for reliable flowback prevention. The system addresses these challenges with a depth-insensitive design that can be installed at any point in the wellbore, delivering reliable performance with high injection rates and smooth flow. This eliminates concerns about hydraulic fluid mobility and reduces planning complexity.

The system can be used as a primary or contingency safety valve or as a deep-set reservoir fluid-flowback prevention device. Unlike traditional surface-controlled wireline valves, the XTR injection system’s non-elastomeric design helps minimise leak paths and eliminate reliance on hydraulic operation systems. This system remains at steady performance at any setting depth, to simplify operations and inventory management.

A large flow area, combined with low opening pressure, promotes smooth flow and supports high injection rates with minimal pressure drop. The proprietary anti-throttling mechanism helps keep the valve fully open during injection, reducing wear and extending service life. The self-cleaning design incorporates integrated bypass ports and optimised poppet geometry to minimise debris buildup and erosion. For added flexibility, wireline retrievability allows easy retrieval and replacement, supporting contingency planning when needed.

The valve features an anti-chatter mechanism to extend service life while meeting API 14A standards for safety and compliance.

The rigorous CS qualification programme ensures the system’s operational integrity and ability to withstand harsh CCUS environments.

The injection system can be tailored for specific injection media and fluid properties, offering low opening force, minimal pressure drop, and a wide range of injection rates. To extend operational life, high-velocity flow is directed away from seal areas, and a novel anti-throttle feature reduces valve wear, maximising system reliability.

Maxime Coffin, vice president, Halliburton Completion Tools said, “The XTR CS injection system expands Halliburton’s Completion Tools technology leadership in low-carbon technology solutions, allowing operators to maximise CCUS well performance. This technology helps ensure reliability and flexibility in harsh environments, allowing operators to inject CO₂ efficiently and safely.”

The strategic partnership agreement sets out the framework for NOC and MOL to exchange information and jointly explore potential areas of cooperation. (Image source: Adobe Stock)

Hungary’s MOL Group has signed a memorandum of understanding (MoU) with Libya’s National Oil Corporation (NOC) for cooperation in hydrocarbons exploration, technological innovation and crude trading, as international interest in Libya hots up

The strategic partnership agreement sets out the framework for NOC and MOL to exchange information and jointly explore potential areas of cooperation. These include hydrocarbon exploration and production, technological and field development innovations, oilfield services opportunities in Libya, crude supply and trading activities.

"We recognise Libya’s oil and gas industry as a pillar of strength and expertise. I am sure that this new agreement will act as a catalyst for further expanding our international portfolio, creating clear mutual value for both companies and reinforcing the resilience of our region. From the perspective of security of supply and energy sovereignty, particularly for landlocked countries, diversification of sources is of crucial importance. Our cooperation also goes beyond business, as we have agreed to rebuild our educational, scientific, and university ties in order to learn as much as possible from each other. Such partnerships can also help Europe to find its own path to competitiveness, rather than switching between different forms of energy dependency,” – said Zsolt Hernádi, chairman and CEO of the MOL Group.

The agreement comes as MOL is looking to expand its international portfolio to maintain its strategy target of at least 90,000 barrels of oil equivalent/day production level over the next five years, recently signing cooperation agreements with the national oil company of Kazakhstan (KazMunayGas), the national oil company of Azerbaijan (SOCAR), and the national oil company of Türkiye (Turkish Petroleum). The company has oil and gas exploration and production assets in nine countries, with production in eight countries: in Croatia, Azerbaijan, Iraq, Kazakhstan, Russia, Pakistan, Egypt, and Hungary.

The agreement also reflects the hotting up of international interest in Libya. Chevron recently signed an MoU with NOC to evaluate exploration and development opportunities, while TotalEnergies has signed an agreement extending the Libya Waha Concessions up to 2050, paving the way for further investments. TGS has a global provider of energy data and intelligence, has just signed a Letter of Intent (LOI) with North Africa Geophysical Company, (NAGECO),a subsidiary of the NOC to advance high-quality subsurface data, supporting Libya’s upstream development through modern, fit-for-purpose data and technology solutions. Libya’s latest upstream licensing round launched in March 2025, the first in 18 years, has attracted more than 40 bids, signalling growing international interest in Libya’s largely untapped hydrocarbon potential.

Independent assurance and risk management provider DNV has launched Industrial Services, in response to growing demand from customers navigating increasingly complex energy transition projects, expanding infrastructure investment and more stringent quality and compliance requirements

The new name signals a broader industrial focus, spanning traditional energy, renewables, power transmission, hydrogen, carbon capture, rail and industrial manufacturing, with support for customers across the full asset lifecycle, from fabrication and construction through to operations and in-service performance. It represents an evolution of DNV's inspection business into a dedicated global provider of quality assurance and inspection services for energy, infrastructure and complex industrial supply chains.

Mohamed Houari, CEO of Industrial Services at DNV, said, “Industrial assets today are larger, more interconnected and more critical to society than ever before. At the same time, regulatory scrutiny and supply chain complexity are increasing.

“Our customers need partners who combine technical expertise with global reach and local presence. DNV’s Industrial Services reflects that evolution, we are strengthening our role as a trusted industrial partner helping safeguard performance, manage risk and accelerate delivery of vital energy and infrastructure projects.”

Originally rooted in oil and gas inspection, the business has significantly expanded in recent years into offshore wind, power, transmission and distribution, hydrogen and carbon capture and storage. The recent integration of DNV’s railway business further strengthens its capabilities across transport and critical infrastructure.

Operating as a standalone business unit within DNV Group, DNV’s Industrial Services looks to deepening customer partnerships, expanding into adjacent industrial markets and enhancing digital and data-driven capabilities to improve service delivery and asset performance.

Aramco, Honeywell and King Abdullah University of Science and Technology (KAUST) are collaborating to scale up the development of Crude-to-Chemicals (CTC) technology in a bid to maximise the value of crude oil and reduce costs associated with CTC conversion

The new CTC pathway will entail converting crude oil directly into light olefins and other high-demand chemicals, resulting in improved fuel efficiency, carbon utilisation, and process economics—allowing for more efficient and cost-effective production at scale.

The collaboration aligns with Saudi Arabia’s Vision 2030 by helping to advance economic diversification, build national research and technology capabilities, and strengthen the Kingdom’s position in the global chemicals market, combining academia and industry expertise to accelerate technology development and national capabilities.

Dr. Ali A. Al-Meshari, Aramco senior vice president of technology oversight & coordination, said, “This collaboration with Honeywell UOP and KAUST furthers Aramco's efforts to drive innovation and shape the future of petrochemicals. By harnessing the power of cutting-edge technologies, we aim to enhance energy efficiency and unlock increased value from every barrel of crude. This novel Crude-to-Chemicals process is aligned with our vision of supporting the global transition towards cleaner, high-performance chemical production. Moreover, this initiative demonstrates our focus on contributing to the growth of a vibrant ecosystem, where the deployment of innovative technologies can create lasting value for our stakeholders, our communities, and the environment.”

Rajesh Gattupalli, Honeywell UOP president, added, “This agreement marks a defining moment in our strategic collaboration with Aramco and KAUST – and in the global evolution of Crude-to-Chemicals technology. With Honeywell UOP’s deep expertise in catalytic process design and commercial scale-up, we’re well positioned to drive this innovation forward.”

Sean Donegan, CEO, Satelytics discusses the potential of AI-powered geospatial analytics to detect pipeline leaks

The importance of the Middle East to the global energy market is well-understood but worth emphasising. Between 2024 and 2025, roughly a third of the world's oil flowed from the region. With domestic and international demand continuing to soar, it is clear that both the past and the future of global oil and gas run directly through the Middle East.

At the same time, the Middle East, in ramping up its oil production, is increasingly running up against a problem endemic to all oil-producing regions: the fallibility of ageing or otherwise defective pipeline infrastructure, and the subsequent damage caused by leaks. These leaks cause significant environmental damage, divert limited resources to remediation efforts, and put oil and gas personnel, as well as (in some cases) surrounding residents, at risk.

Any increase in oil production would entail a concomitant increase in dangerous leaks. But as recent technological advancements have demonstrated, this doesn't have to be the case. In recent years, AI-powered geospatial analytics has emerged as a highly effective method of leak detection – one that is already sparing oil and gas producers from catastrophe in the Middle East and around the globe.

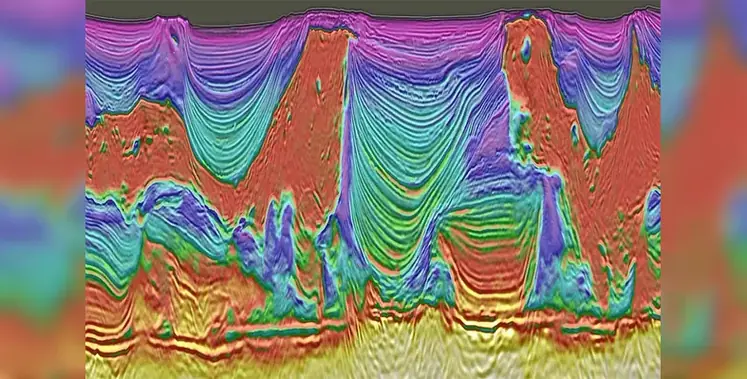

What is geospatial analytics? How does AI fit in?

Geospatial analytics is the analysis of satellite imagery, and is fundamentally, a high-tech method of identifying problem points across unusually vast swathes of terrain. It begins with multispectral and hyperspectral imagery, which is gathered from a variety of sources, including unmanned aerial vehicles, planes, and fixed cameras. This imagery is then analysed by advanced artificial intelligence, which pinpoints precisely where leaks are occurring, near-instantly alerting businesses to potential issues.

The sheer scale of most oil and gas assets, more sprawling by far than those found in any other industry, helps explain why this technology is so useful. Take the example of Aramco, which is responsible for 3,140 miles of crude oil pipelines, according to the Organization of Arab Petroleum Exporting Countries. In any region, this degree of sprawl would be impossible to oversee by manual means. But the nature of the terrain involved makes the problem even more vexing. Aramco's Petroline, for instance, runs through the Empty Quarter, or the Rub' al-Khali, which is the largest continuous sand desert in the world. This challenging terrain has no permanent settlements, which means that when leaks do occur, days or weeks can pass before they're properly noticed.

The use of geospatial analytics, by contrast, ensures that these leaks are flagged in close to real-time, with an abundance of information for businesses to act on – including the specific problem, the location, and the magnitude of the disruption. This allows oil and gas producers to delegate relevant remediation personnel to take care of the issue before it spirals out of control.

Today, the technology is able to assist oil and gas producers in the US and Europe through the use of AI-powered geospatial analytics, and the technology is also being deployed to the Middle East as part of a broader global rollout.

US initiatives

North Dakota has a long history of pipeline leaks, which in 2017 compelled Governor Doug Burgum to take substantial measures to address the problem. The Intelligent Pipeline Integrity Program (iPIPE), as it was called, was launched with the aim of creating a fruitful partnership between government and industry on the pipeline problem. Through geospatial analytics, leak reports were delivered to consortium makers within hours of capture, showing results including the location and magnitude of liquid leaks.

The result was a significant reduction in pipeline leaks in the area. This reduction so impressed one of iPIPE's founding members that Satelytics was contracted to monitor their entire fleet of assets in the region, spread across nearly 10,000 sq.km. This effort, too, identified countless leaks in their infancy and spared the oil company from a number of potential disasters.

These successes piqued the interest of producers in Texas and led directly to a new initiative in the region: an unprecedented, industry-led collaboration designed to monitor infrastructure throughout the Permian Basin for liquid leaks, methane leaks, encroachment, and similar risks.

Geospatial analytics in the Middle East

From these origins, Satelytics has since scaled globally. Beyond our operations in Europe, we are now monitoring pipelines for a wide range of Middle Eastern companies, including operators in the UAE, Iraq and Qatar. These efforts have already helped to detect numerous leaks, in addition to flagging potential land encroachments and even testing water quality.

Conclusion

The environmental benefits of AI-powered geospatial analytics in an oil and gas context are indisputable: major players across the industry agree that it has a significant role to play in reducing emissions and forestalling negative climate events down the line. But its present-day benefits are just as striking, which explains why oil and gas companies across the world – from the Permian Basin to the Rub' al-Khali – have rushed to integrate the technology.

Satelytics uses cloud-based, geospatial analytics to analyse multispectral and hyperspectral imagery to identify pipeline leaks and other environmental issues.

Oil and gas operations in the Middle East span harsh deserts, sprawling refineries and high-risk offshore environments. (Image source: Adobe Stock)

In the oil and gas industry, where every second counts and every decision impacts profitability and safety, robust security is not just a luxury – it's a necessity

From protecting critical assets to safeguarding human lives, security systems must meet the highest standards of reliability and performance.

Pelco, a leader in video security, is uniquely positioned to address the challenges faced by oil and gas companies in the Middle East, offering a fresh perspective on how to optimise security systems seamlessly. With our upcoming online event, we invite you to explore how Pelco can help tackle worker safety, asset protection and operational efficiency in this complex industry.

Addressing oil and gas challenges head-on

Oil and gas operations in the Middle East span harsh deserts, sprawling refineries and high-risk offshore environments. Physical, environmental and digital threats are converging, and security systems must evolve to meet these overlapping demands. Our upcoming online event will focus on three critical areas where Pelco's expertise can make a difference:

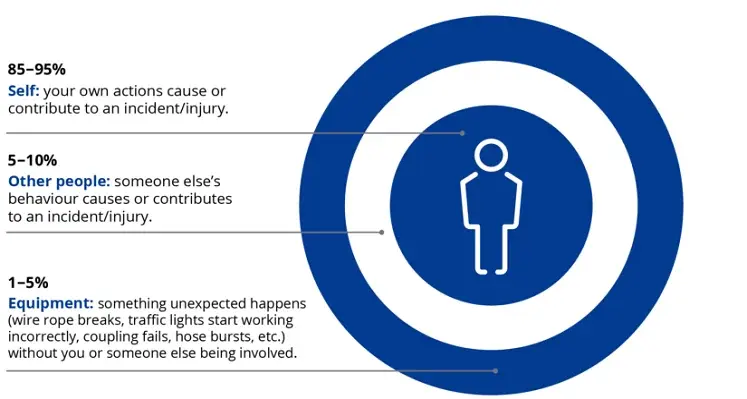

1. Improve worker safety and HSE compliance

Ensuring worker safety is both a moral responsibility and a regulatory imperative. Health, Safety and Environmental (HSE) compliance is a top priority for oil and gas operations. Pelco's advanced portfolio is designed to help you meet these standards.

Edge-based analytics and intelligent video security can be valuable tools in supporting site safety. These systems can help detect safety incidents, such as slips or falls, especially in areas where oily surfaces, heat or dust create additional hazards. When incidents occur in remote areas, automated detection can prompt faster intervention, thereby closing the gap between the event and the response.

Personal Protective Equipment (PPE) compliance is another key safety concern. High temperatures in the Middle East can lead to discomfort, and in some cases, workers may be tempted to remove protective gear, such as hard hats or vests, for temporary relief. In this case, AI-enabled video analytics can help identify instances of non-compliance, enabling safety teams to address the issue before it becomes a liability.

Zone-based behavioural analytics can help detect when someone enters a restricted or hazardous area or remains in a dangerous zone longer than necessary. For example, loitering detection near flare stacks or storage tanks can support situational awareness and proactive incident mitigation.

2. Improve security and asset protection

From refineries in the desert to offshore rigs in corrosive marine environments, your assets operate under pressure, so your security systems must withstand these harsh conditions. In areas where explosive gases or dust particles may be present, even basic equipment can pose risks. That’s why choosing video solutions built for hazardous environments is critical.

ExSite Enhanced cameras, featuring 316L stainless steel construction and certifications such as ATEX and IECEx, are designed for use in hazardous atmospheres. Whether it’s observing pipeline manifolds, wellheads or chemical storage areas, these systems deliver dependable performance in high-risk environments. In corrosive coastal locations, such as LNG terminals or offshore rigs, Pelco’s anti-corrosion models withstand salt spray, humidity and chemical exposure without compromising visibility.

For perimeter defence, long-range Silent Sentinel cameras give security teams early warning of approaching threats, detecting vehicles, vessels or drones from kilometres away in fog, darkness or dust. These systems are especially valuable for remote desert pipelines or unstaffed offshore installations, where rapid detection is critical to prevent disruptions.

3. Minimise downtime and maximise uptime

Every minute of downtime impacts revenue. For oil and gas operations, the cost of unplanned outages is measured in millions of dollars. With Pelco, your video security can become an operational asset.

Radiometric thermal cameras can detect overheating in transformers, compressors and electrical panels, allowing teams to take action before equipment failure occurs. At the same time, Pelco’s camera image health analytics help ensure your video infrastructure is always performing at its best. Our cameras automatically detect issues such as lens obstructions, misalignment or tampering, reducing the need for manual inspections and helping ensure your security coverage is always clear, optimised and ready when it matters most.

Join us to discover the Pelco advantage

We invite you to join our upcoming online event, where industry leaders and Pelco experts will dive deeper into these challenges and solutions. Together, we'll explore how Pelco can be the missing ingredient to supercharge your security and drive operational excellence in the Middle East oil and gas sector.

Don't miss this opportunity to gain actionable insights and position your operations for success. Register now and discover how Pelco can transform your approach to security.

Progress has been reported in developing action plans to reduce methane emissions and end routine flaring. (Image source: Adobe Stock)

Coinciding with COP30, significant progress has been reported in driving forward the aims of the Oil & Gas Decarbonization Charter (OGDC) launched at COP28

The Oil & Gas Decarbonization Charter (OGDC), a global coalition of leading energy companies championed by the CEOs of ADNOC, Aramco, and TotalEnergies and supported by the Oil and Gas Climate Initiative (OGCI), highlights expanded reporting coverage, strengthened action plans for emissions reduction and enhanced collaboration to accelerate industry decarbonisation in its 2025 Status Report: Implementing Action.

The Charter now brings together 55 signatories operating across more than 100 countries, representing around 40% of global oil production. Signatories invested approximately US$32bn in low-carbon solutions including renewables, carbon capture, hydrogen and low-carbon fuels in 2024.

This year, for the first time, the companies shared emissions data based on the OGCI Reporting Framework, laying the foundation for consistent reporting across 55 companies. 50 of the 55 signatories submitted data for this year’s report, covering 98% of OGDC operated production, most of which has received third-party assurance.

Forty-two signatories have now set interim Scope 1 and 2 emissions reductions ambitions for 2030, and 36 have developed corresponding action plans, reflecting tangible progress since the Charter’s 2024 Baseline Report, with six more companies sharing interim ambitions and seven more developing corresponding action plans on methane and flaring.

Extensive collaboration programme

An extensive collaboration programme is underway, with a focus on methane, flaring and reporting. TotalEnergies for example is sharing its AUSEA technology with several national oil companies to strengthen methane detection and measurement. Peer-to-peer exchanges, regional partnerships and technical workshops have strengthened capacities, while engagement with OGCI, the United Nations Environment Programme, the World Bank and many others, are helping scale practical solutions. At the company level, OGDC is helping to embed tailored, industry-specific training programmes.

Dr Sultan Ahmed Al Jaber, managing director, Group CEO of ADNOC, COP28 president and OGDC CEO Champion, said, “Two years ago, at COP28 we came together to create the world’s first truly industry-wide coalition to decarbonise at scale. Together, we are turning the Charter’s words into action by delivering tangible progress, scaling innovation and reporting transparently against our shared commitments.”

Patrick Pouyanné, chairman and CEO of TotalEnergies and OGDC CEO Champion, added, “OGDC is about action and collective delivery. This year we moved from baseline to implementation, with almost all signatories reporting data that covers 98% of operated production and more companies setting 2030 targets backed by plans. This reflects that progress starts with what we measure and a shared reality that this is a journey where we advance faster together. Our focus now is clear. We must cut methane, end routine flaring and report progress consistently. We invite all IOCs and NOCs to join and show measurable results by the next COP.”

Bjørn Otto Sverdrup, head of the OGDC Secretariat, said, “With OGDC, we have established a platform for companies willing to take action and collaborate across North, South, East, West, to share best practices and accelerate decarbonisation – particularly towards reducing methane and zero flaring by 2030.”

“We are encouraged by the progress made, and we look forward to the work ahead.”

At COP30, TotalEnergies announced a US$100mn commitment to Climate Investments Venture Strategy funds, which supports technologies that cut emissions across the oil and gas value chain. Climate Investments (CI) is an OGDC Partner.