The Middle East offshore drilling rig market is undergoing a significant recalibration, says Teresa Wilkie, director – RigLogix at Westwood Global Energy Group

Following a few years of aggressive supply expansion, particularly in Saudi Arabia, the region continues to grapple with the fallout from rig suspensions and shifting investment priorities.

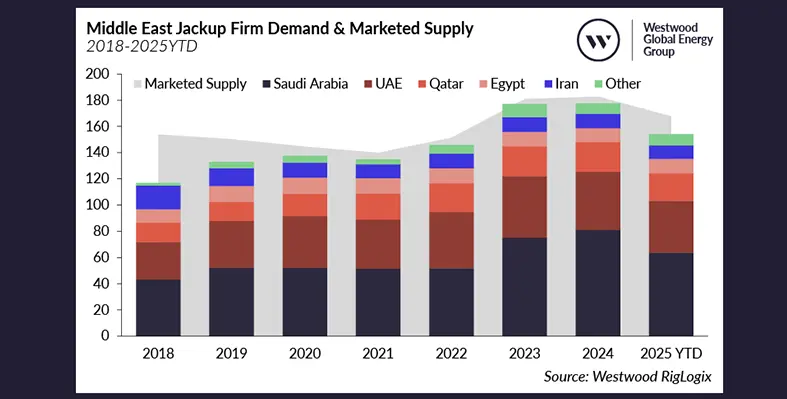

Between 2021 and 2024, the Middle East jackup market saw a dramatic increase in activity. Saudi Aramco’s push to grow its working jackup fleet from the mid-50s to 90 units drove a surge in marketed supply in the region, which peaked at an annual total of 183 units in 2024 – a 31% increase from 2021. This expansion was supported by reactivations, newbuild deliveries, and rig relocations from across the globe.

However, in early 2024, Aramco revised its plans, leading to the suspension or termination of 36 jackups and leaving drilling contractors to reassess their fleet strategies. Many of these rigs have been redeployed, with several regions absorbing the majority of excess capacity such as West Africa, Southeast Asia, China, other parts of the Middle East, as well as Brazil and Mexico to a smaller extent. Drilling contractors have also taken measures to rebalance their fleets and the wider global market, such as moving units to cold stack, selling these assets for non-drilling purposes, or returning bareboat-chartered jackups to their owners.

While Middle Eastern committed utilisation remains relatively high at 89%, actual working utilisation has dropped to 83%, and this supply and demand imbalance is now showing up in pricing.

Global jackup dayrates have dropped by around 17% year-to-date versus the full year figure for 2024, as contractors face intense competition, with more rigs chasing fewer opportunities following the influx of available supply from Saudi Arabia. The result? Lower bids, tighter margins, and a clear shift in operator leverage. Dayrates for contracts fixed in the Gulf Cooperation Council (GCC) this year are sitting around 16% lower on average when compared to contracts fixed in 2023.

Signs of market uptick

Despite the recent disruptions, the Middle East remains a cornerstone of offshore drilling. Qatar and the UAE continue to invest in major offshore gas projects, and Saudi Arabia is still pursuing brownfield revitalisation, albeit at a slower pace. These developments provide a foundation for continued rig demand.

The region’s long-term fundamentals remain strong. Committed utilisation figures shows that future backlog is still healthy, especially now that Saudi Aramco has started calling back some of the remaining idle rigs (with current indications that it could take back six to nine rigs from early 2026) and award activity in the region this year is already higher than it was for the full year of 2024. Meanwhile, the redeployment, cold stacking and retiring of rigs has helped mitigate some of the supply surplus.

Global implications and strategic lessons

The Middle East jackup market is transitioning from a phase of aggressive expansion to one of strategic recalibration. Saudi Aramco’s rig suspensions have reshaped the regional and global landscape, but the absorption of rigs to other markets and continued investment in gas and brownfield projects suggest that the market will remain buoyant.

The redeployment of rigs from Saudi Arabia underscores the importance of fleet flexibility and geographic diversification. Drilling contractors with the ability to quickly reposition assets have fared better, while those heavily exposed to the Middle East have faced greater challenges.