In The Spotlight

Cloudera and Aramco have agreed to collaborate to build AI-powered solutions to support the growth of the digital oil and gas sector in Saudi Arabia, combining Aramco’s industry expertise with Cloudera’s innovative data solutions

A particular focus will be developing and upskilling Saudi local talent in data engineering, data science, and analytics.

Cloudera and Aramco will jointly develop and implement data-driven solutions that leverage Cloudera's platform to further enhance Aramco's operational efficiency and competitiveness, unlocking new insights and driving business value through advanced data management, security, and analytics capabilities.

Cloudera and Aramco also plan to advance AI and data research, exploring emerging trends and technologies in big data, AI, and data science.

Cloudera's hybrid data-cloud solutions offer a robust foundation for securely managing data across environments while maintaining unified governance and real-time analytics capabilities. This aligns with Aramco's forward-looking vision in the data and AI field.

Ahmad Issa, regional vice president of the Middle East for Cloudera, said, “In seeking to collaborate with Aramco, our goal is to empower local professionals with the tools and knowledge they need to thrive in a data-driven economy. By investing in human capital, we’re supporting individual careers while contributing to the broader ecosystem of innovation and growth in Saudi Arabia.”

“We’re excited about the opportunity to contribute to Saudi Arabia’s digital economy, working with world-class organizations like Aramco to make smarter, data-driven decisions to stay ahead in today’s fast-paced world.”

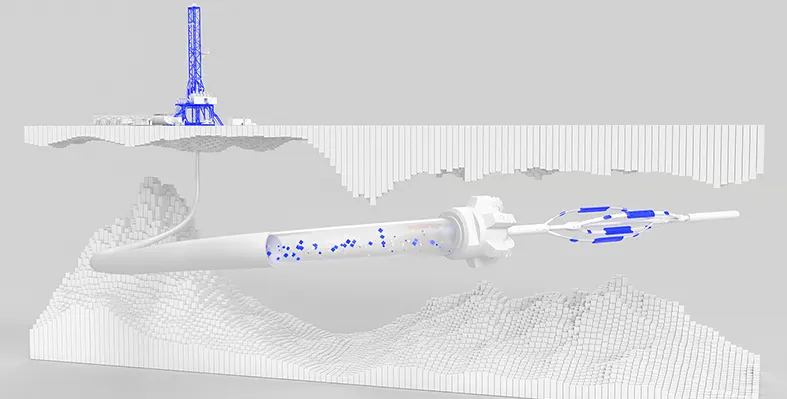

DUG shows how you can leap entire workflows in a single bound with DUG Elastic MP-FWI Imaging

DUG Elastic MP-FWI Imaging is a unique approach to seismic processing and imaging which turns the traditional paradigm on its head. It replaces not only traditional processing and imaging workflows, but also the subsequent inversion workflow for elastic rock properties.

The traditional processing workflow involves the testing and application of dozens of steps such as deghosting, designature, demultiple and regularisation, which are all designed to overcome the limitations of conventional imaging. These workflows are complex, subjective, and very time-consuming due to their serial nature and they rely on many assumptions and simplifications. All of these issues impact the output data quality. The resulting, primary-only data then undergoes a similarly complex model-building workflow to derive an estimate of the subsurface velocity, which is used for depth imaging. Post-migration processing is performed before the pre-stack reflectivity undergoes another workflow to derive rock properties that feed into quantitative interpretation, also relying on simplifications of the actual physics. As a result of these workflows, projects can take many months to years to complete.

Elastic MP-FWI Imaging accounts for both compressional and shear waves, handling variations in seismic wave dynamics as a function of incidence angle, including in the presence of high impedance contrasts and onshore near-surface geological complexity. Multiples and converted waves are now treated as valuable additional signal, increasing sampling, resolution and constraining the inverted parameters.

As well as three-component reflectivity and velocity, DUG Elastic MP-FWI Imaging enables the estimation of fundamental rock properties like P-impedance, density and Vp/Vs from field data, without the need for a secondary amplitude variation with angle (AVA) inversion step. DUG Elastic MP-FWI Imaging simultaneously resolves not only subsurface structural features but also quantitative rock property information while avoiding the need for extensive data pre-processing and (post-imaging!) AVA-inversion workflows.

Get in touch

DUG Elastic MP-FWI Imaging leaps entire workflows in a single bound, delivering unsurpassed imaging and high-resolution rock properties from field-data input. Superior outputs, in a flash!

Talk to us today. Contact

Dana Gas has reported success in the initial stages of its US$100mn investment programme to increase Egypt’s gas production

The US$100mn investment programme, which involves the drilling of 11 new wells, is expected to significantly increase Dana Gas’s long-term production in Egypt and add approximately 80 bcf in recoverable gas reserves over the course of the two-year plan.

The company has received encouraging initial results from the ‘Begonia-2’ appraisal well, the first appraisal well within the Begonia development area in Egypt’s onshore Nile delta and the first of eleven appraisal and exploration wells planned under the investment programme. The well is estimated to contain nine billion cubic feet (bcf) of gas as an initial estimate, which is subject to increase. Begonia-2 will produce an additional five million cubic feet per day. The well is located in the "New El-Manzala" concession and is operated by the El-Wastani Petroleum Company (Wasco).

The company has also begun to re-complete several wells in other geological layers, which are expected to add more reserves and enhance production. Work is currently underway on the Balsam-3 well, where estimated reserves are 4 bcf, with an anticipated additional production of 3 million cubic feet of gas per day. The successful recompletion of Balsam-3 is expected to reduce the risk associated with drilling exploration wells in the area and further enhance output.

Richard Hall, CEO, Dana Gas, said, “We have been developing and producing gas in Egypt for over a decade, and the signing of the concession area consolidation agreement with the Egyptian Natural Gas Holding Company (EGAS) late last year has allowed us to acquire additional areas under improved financial terms, enabling us to launch this new phase.

“The success of drilling this well opens vast prospects for gas production in the 'Begonia' area and presents promising future opportunities for expansion and growth. It will also extend the operational life of our assets in Egypt. We are fully committed to making every effort to ensure the success of the programme and its efficient and timely execution. Dana Gas reaffirms its strong commitment to reinvesting the payments it receives from the Egyptian government into executing this ambitious programme and supporting future development projects in the country.”

-

GPT Industries - Iso-Smart

-

ADIPEC 2024 - Exclusive Interview with Joseph El Bitar, Hexagon

-

ADIPEC 2024 - Exclusive Interview with Alexander van Veldhoven, Bapco Energies

-

ADIPEC 2024 - Exclusive Interview with Friedrich Portner, Safeen Group

-

ADIPEC 2024 - Exclusive Interview with Kevin Brilz, Fishbones

-

ADIPEC 2024 - Exclusive Interview with Mohamed Malak, Fishbones

-

ADIPEC 2024 - Exclusive Interview with Dileep Divakaran, SLB

-

ADIPEC 2024 - Exclusive Interview with Eric Kjol, SLB

-

ADIPEC 2024 - Exclusive Interview with Dmitry Shubenok & Aleksandr Dolgikh, North Side

-

ADIPEC 2024 - Exclusive Interview with Adam Stephenson, AkzoNobel

-

ADIPEC 2024 - Exclusive Interview with Frazer Young, Oil States

-

ADIPEC 2024 - Exclusive Interview with Peter Foith, CS Combustion Solutions GmbH

-

Exclusive interview with Maurits van Tol

-

Rockwell Automation interview with Sebastien Grau

-

Rockwell Automation interview with Michael Sweet

-

ADIPEC 2023 - Exclusive interview with Wissam Chehabi, Fishbones

-

Rockwell Automation interview with Kalypso’s Rodrigo Alves & Knowledge Lens’ Ganesh Iyer

Dana Gas has reported success in the initial stages of its US$100mn investment programme to increase Egypt’s gas production

The US$100mn investment programme, which involves the drilling of 11 new wells, is expected to significantly increase Dana Gas’s long-term production in Egypt and add approximately 80 bcf in recoverable gas reserves over the course of the two-year plan.

The company has received encouraging initial results from the ‘Begonia-2’ appraisal well, the first appraisal well within the Begonia development area in Egypt’s onshore Nile delta and the first of eleven appraisal and exploration wells planned under the investment programme. The well is estimated to contain nine billion cubic feet (bcf) of gas as an initial estimate, which is subject to increase. Begonia-2 will produce an additional five million cubic feet per day. The well is located in the "New El-Manzala" concession and is operated by the El-Wastani Petroleum Company (Wasco).

The company has also begun to re-complete several wells in other geological layers, which are expected to add more reserves and enhance production. Work is currently underway on the Balsam-3 well, where estimated reserves are 4 bcf, with an anticipated additional production of 3 million cubic feet of gas per day. The successful recompletion of Balsam-3 is expected to reduce the risk associated with drilling exploration wells in the area and further enhance output.

Richard Hall, CEO, Dana Gas, said, “We have been developing and producing gas in Egypt for over a decade, and the signing of the concession area consolidation agreement with the Egyptian Natural Gas Holding Company (EGAS) late last year has allowed us to acquire additional areas under improved financial terms, enabling us to launch this new phase.

“The success of drilling this well opens vast prospects for gas production in the 'Begonia' area and presents promising future opportunities for expansion and growth. It will also extend the operational life of our assets in Egypt. We are fully committed to making every effort to ensure the success of the programme and its efficient and timely execution. Dana Gas reaffirms its strong commitment to reinvesting the payments it receives from the Egyptian government into executing this ambitious programme and supporting future development projects in the country.”

The industry must continue to take a proactive and agile approach to talent readiness. (Image source: Adobe Stock)

Alex Spencer, chief operating officer, OPITO, looks at how we can ensure the creation of a workforce that is skilled and prepared for the energy transition

2030 is the year Saudi Arabia is aiming for 50% of its electricity to come from renewable sources, and by when the UAE plans to triple its share of renewable energy, while increasing installed clean energy capacity in the total energy mix to 30% – to name only a few ambitions in the region. In this process of transitioning to more sustainable forms of energy, tens, even hundreds, of thousands, of energy jobs are to be created and adapted. In just a few months, we’ll need to have secured the fresh talent pipeline that will play a large part in making 2030 possible.

As university degrees take roughly 34 months and most courses only enrol every September, we have just a few months to attract students to a career in energy infrastructure, so that they can apply for the September 2026 intake. For those interested in an apprenticeship, we have a little more time.

The need for a STEM degree, and for specialist qualifications or certifications, was highlighted as a key barrier to working in the energy industry, according to OPITO’s report: My Energy Future. However, respondents were equally encouraged by the industry’s potential to offer good pay, career development opportunities, and job security. Over the coming months, these are the factors that we should highlight with enthusiasm to secure that fresh influx of talent.

Once we get this right, we will have solved one of two pressing workforce challenges. However, not only do we need this increase in people, but these people need to be readily up to the task ahead. Here lies the industry’s next challenge – the readiness gap.

Is the workforce ready?

Fast forward to 2030, let’s imagine we’ve succeeded in creating a workforce with the right foundational skills. How prepared are they to step into these emerging energy roles? Whether it’s the need for more on-the-job experience or for the right set of qualifications to step onto the job site safely to begin with, this is the energy industry’s readiness gap.

Of course, we expect that many of the new jobs that are to be created will be filled by oil and gas workers. Often their skills could meet up to 80% of the new brief whatever part of the energy industry they step into. But it’s that final 20% – that final push to readiness – that is so often overlooked when we talk about the skills gap.

Part of the challenge is that the diversification of industry means there are many different and new job roles to consider – and this differs for every country in the Middle East region at different stages in their energy transition journey. From solar and green hydrogen scale up to the new demands of data centres and the intersection of AI across industry, how do we build a workforce that is ready and mobile across the region with the capability to flex their expertise to meet evolving needs?

Enhancing workforce readiness

One relatively straightforward answer to this conundrum is to establish industry standards that ensure employees and contractors can always work safely and competently, regardless of the type of energy infrastructure they are assigned to.

Whether you’re maintaining a motor on an offshore oil platform or at the top of an offshore wind turbine, many of the safety requirements and electromechanical skills are the same if not similar. Products that were first developed for oil and gas – helideck operation, emergency response, confined spaces, rigging and lifting, working at height, safety induction etc. – are all transferable to emerging technologies such as green hydrogen, carbon capture, and many more.

One of the ways we’re addressing the readiness gap at OPITO is by developing introductory courses on business sustainability, carbon capture, and hydrogen aimed at technical apprentices. Learners gain an understanding in the role of hydrogen and carbon capture in supporting the transition to clean energy, the technology’s characteristics and categories, and the required health, safety, and regulatory frameworks for working with them.

Increasing the fidelity and flexibility of training

With little time left on the clock, we are working closely with industry stakeholders including developers, operators, regulators, and contractors to establish training and assessment frameworks for emerging energy transition technologies. This is complimented by a global network of industry forums where we regularly receive feedback on how the skills and readiness gap is evolving.

For instance, one interesting development that has come out of those conversations is how core safety training like the International Minimum Industry Safety Training (IMIST) standard can be delivered in a way that better reflects regional needs in the Middle East. IMIST introduces new entrants to key safety concepts and encourages a strong sense of personal responsibility, something increasingly important as diverse mixes of project teams come together for complex operations. Because the programme has been designed to be flexible, employers are exploring how to tailor it to local operating conditions by embedding it into their own in-house training, helping ensure teams are equipped to manage risks specific to their environments.

As with the skills gap, the readiness gap looks different in each region, so while global standards are necessary, so too is the need for flexibility to meet individual country and company needs. In the Middle East, the development focus is on ensuring the workforce is trained to the minimum safety standard, while investigating region specific requirements such as safe driving on the worksite.

For example, OPITO advanced on its safe driving at work standard to develop desert-specific standards for both light and heavy vehicles.

Safe, skilled and ready for the task ahead

Addressing the workforce skills gap is a major energy industry priority to 2030, but we only have a few months left to influence the size and shape of the talent pipeline. To ensure that the pipeline is ready to make an impact from day one, the industry must continue to take a proactive and agile approach to talent readiness. While there are still many unknowns, global standards that can be adapted to address regional priorities will ensure that our future workforce not only has the knowledge and expertise – but are also competent, confident, and safe in its real-life application.

Abu Dhabi-based petrochemicals company Borouge is collaborating with Honeywell to conduct a proof of concept for AI-powered autonomous operations, which is set to deliver the petrochemical industry’s first AI-driven control room designed for full-scale, real-time operation

The initiative aims to deploy the proof-of-concept technologies to enhance Borouge’s operations across its Ruwais facilities in the UAE. Autonomous operations will enable Borouge to optimise production, reduce energy use, and enhance safety while reducing costs at what will be the single largest petrochemical site in the world. Both companies will leverage their expertise in process technology and autonomous control capabilities to identify new opportunities to deploy Agentic AI solutions and advanced machine learning algorithms.

The project is a key component of Borouge's companywide AIDT programme, which is projected to generate US$575mn in value this year. In 2024, Borouge’s portfolio of over 200 AIDT initiatives—spanning operations, health and safety, sales, sustainability, and product innovation—generated $573mn in value

Borouge has already installed the world’s largest Real-Time Optimisation (RTO) system across three large-scale ethane crackers and 20 furnaces. The initiative analyses over 2,500 parameters per minute, enabling instant data-driven decisions, significantly enhancing productivity, optimising energy consumption and reducing emissions. The unique system minimises ethane dumping and optimises resource use, in line with Borouge's commitment to sustainable growth and operational excellence.

Borouge has invested in its state-of-the-art Innovation Centre located in Abu Dhabi and is now using advanced AI-powered tools to accelerate innovation, enabling the company to bring new grades of advanced polymers to market quicker. In collaboration with ADNOC AI Lab, Borouge has completed its first “Polymer Optimisation” programme, achieving a 97% accuracy, enabling Borouge to reduce its development timeline from months to weeks.

Hazeem Sultan Al Suwaidi, chief executive officer of Borouge, said, “Borouge's AI, Digitalisation, and Technology (AIDT) transformation programme is setting new standards in operations, innovation and business performance. By collaborating with global AI leaders such as Honeywell, we are accelerating growth, driving efficiency, and enhancing shareholder value. This project further strengthens Borouge’s competitive edge as we continue to deliver on our ambitious AIDT roadmap.”

George Bou Mitri, president of Honeywell Industrial Automation, Middle East, Turkey, Africa, Central Asia, said, “By integrating AI and automation technologies into core operations, we are helping unlock new levels of efficiency, safety, and performance. This agreement shows how advanced technologies, applied with purpose, can reshape industrial operations at scale.”

Flow control specialist Oxford Flow has started commercial trials of its ES stemless control valve with ADNOC

The ES valve is proven through third-party testing to eliminate fugitive emissions. With no stem or external actuator, its compact design removes common failure points, reduces maintenance requirements and enables a significantly smaller footprint. This makes it simpler to install and service, more reliable in extreme environments, and well suited to high-performance applications across upstream and downstream operations - supporting operators to cut emissions without compromising on efficiency or durability.

The ES valves are currently being piloted both onshore and offshore at key production fields Upper Zakum and Das Island, the aim being to demonstrate the valve’s ability to eliminate fugitive emissions while supporting ADNOC’s ambitious decarbonisation targets.

This pilot marks a significant step in Oxford Flow’s expansion in the Middle East and reinforces the company’s aim to partner with operators committed to real-world deployment of decarbonisation technologies. Working alongside ADNOC in live field conditions provides a powerful opportunity to demonstrate the commercial and environmental benefits of next-generation valve technology at scale.

Neil Poxon, CEO at Oxford Flow, said, “Leaking valves are a major, often overlooked, source of emissions. By replacing them, operators can make fast, material progress in decarbonising both onshore and offshore systems. It’s a significant step forward to now see ADNOC piloting the ES valve in live operations.”

With the growing focus on reducing emissions, Oxford Flow’s valve technology is already in use in a number of markets including North America.

Oil Review Middle East hosted a very well-attended webinar on 20 November on the future of offshore operations, in association with SAFEEN Group, part of AD Ports Group

The webinar explored the latest trends and challenges in the rapidly evolving world of offshore operations, focusing on groundbreaking innovations that are driving sustainable and efficient practices. In particular, it highlighted SAFEEN Green – a revolutionary unmanned surface vessel (USV), setting new benchmarks for sustainable and efficient maritime operations.

Erik Tonne, MD and head of Market Analysis at Clarksons, gave an overview of the offshore market, highlighting that current oil price levels are supportive for offshore developments, and global offshore capex is increasing strongly. The Middle East region will see significant capex increase over the coming years, with the need for rigs and vessels likely to remain high. Offshore wind is also seeing increased spending. Global rig activity is growing, while the subsea EPC backlog has never been higher, with regional EPC contracts seeing very high activity. Tonne forecast that demand for subsea vessels and other support vessels will continue to increase.

Tareq Abdulla Al Marzooqi, CEO SAFEEN Subsea, AD Ports Group, introduced SAFEEN Subsea, a joint venture with NMDC, which offers reliable and innovative survey, subsea and offshore solutions to support major offshore and EPC projects across the region. He highlighted the company’s commitment to sustainability, internationalisation and local content, and how it is a hub for innovations and new ideas, taking conceptual designs and converting them to commercial projects. A key project is SAFEEN Green, which offers an optimised inspection and survey solution.

Tareq Al Marzooqi and Ronald J Kraft, CTO, Sovereign Global Solutions ME and RC Dock Engineering BV. outlined the benefits and capabilities of SAFEEN Green as compared with commercial vessels, in terms of safety, efficiency, profitability and sustainability. It is 30-40% more efficient through the use of advanced technologies, provides a safer working environment given it is operated 24/7 remotely from a control centre, and offers swappable payload capacity. Vessels are containerised and can be transported easily to other regions. In terms of fuel consumption, the vessel is environment-friendly and highly competitive, reducing emissions by 90% compared with conventional vessels, with the ability to operate on 100% biofuel.

As for future plans, SAFEEN Green 2.0 is under development, which will be capable of carrying two inspection work-class ROVs simultaneously. A priority will be to collect data to create functional AI models for vessels and operations, with the first agent-controlled payload systems in prospect by around 2027.

To view the webinar, go to https://alaincharles.zoom.us/rec/share/mNHjZhAhQzn1sPzmFWZCgrq7_SckfLRcSb4w81I7aVlokO9sgHM_zVeOqgN3DgJS.bO4OIRqNeFP09SPu?startTime=1732095689000

Oil and gas companies are playing a leading role in the development of carbon capture, utilisation, and storage (CCUS) according to a new report from GlobalData

CCUS is widely gaining credence as an important energy transition strategy, given its potential to decarbonise hard-to-abate sectors such as cement, steel, refining, and thermal power generation.

As of 2024, more than 70% of the operational and planned CCUS facilities were associated with energy assets, according to the GlobalData’s Strategic Intelligence report, “Carbon Capture and Storage", indicating a growing commitment by the energy sector to reduce its emissions intensity through innovation in carbon capture and storage technologies. The global energy sector accounted for more than 50 commercial-scale carbon capture projects as of 2024, representing a cumulative carbon capture capacity of approximately 45 million tonnes per annum (MTPA). If all the proposed projects come to fruition, the global carbon capture capacity in the energy sector could rise to nearly 316 MTPA by 2030.

Leading oil and gas players such as ExxonMobil, Occidental Petroleum, and Equinor have taken early initiatives in CCUS, supported by engineering and service companies like Technip Energies, Mitsubishi Heavy Industries (MHI), and SLB. These firms are leveraging their expertise in industrial-scale project delivery to develop and execute carbon capture strategies across upstream and downstream operations. For example, Shell Catalysts & Technologies has signed an agreement with Technip Energies to deliver a post-combustion amine-based carbon catpure solution using Shell's CANSOLV CO2 capture system, designed to make carbon capture more investable, scalable and accessible for industrial sectors and helping hard-to-abate industries to decarbonise.

According to GlobalData’s report, there are 17 carbon capture projects in advanced stages of development that are expected to begin operations later this year. Additionally, around 460 capture projects are under development globally across diverse industries, which will lead to significant capacity growth through 2030.

Middle East CCUS leadership

The Middle East is emerging as a major region for CCUS development. The UAE’s ADNOC operates Al Reyadah, the world’s first commercial scale operation to capture and store CO2 from the steel industry, with a capacity of 800,000 tonnes a year. Further projects are planned and underway such as Habshan, which will have a capture and storage capacity of 1.5MTPA and is set for completion in 2026. CO2 will be injected and placed for permanent storage in ADNOC Onshore’s Bab Far North Field, southwest of Abu Dhabi. ADNOC aims to capture and store 10MTPA of CO2 by 2030. Meanwhile while Aramco has a target of 14 MTPA by 2035, and is developing a major 9MTPA carbon capture hub at Jubail with SLB and Linde, set to be one of the largest in the world.

Ravindra Puranik, Oil and Gas analyst at GlobalData, commented, “Unlike consumer-driven clean energy trends, CCUS adoption is largely influenced by regulatory and economic frameworks, with limited visibility to end users. Policies such as the EU Emissions Trading System (ETS), Canada’s carbon pricing mechanism, and the US 45Q tax credit have been instrumental in unlocking commercial opportunities for CCUS. These frameworks have helped offset the high capital and operational costs of CCUS deployment, particularly in energy-intensive industries, and are driving the emergence of large-scale projects globally.”

Puranik noted however that CCUS still faces a range of challenges that threaten to hamper its scale-up, such as high upfront costs, the lack of fully developed CO₂ transport and storage infrastructure, and limited commercial applications for captured CO₂. Retrofitting existing facilities often adds further complexity, making project economics difficult without consistent policy support.

“Additionally, regulatory uncertainty around permitting processes, cross-border CO₂ transport, and long-term liability for stored carbon continues to pose risks for investors. Public scepticism also persists, with some critics viewing CCUS as a strategy to extend the life of fossil fuels rather than as a legitimate tool for emissions reduction. The absence of standardisation and the fragmented nature of the CCUS value chain further limit the ability to implement integrated, scalable solutions.”