Dana Gas PJSC, the Middle East’s largest regional private sector natural gas company, has signed an agreement with the Syrian Petroleum Company (SPC) to explore the potential for the redevelopment and expansion of several natural gas fields across central Syria

The fields include the Abu Rabah gas field – one of the largest gas discoveries in Syria – as well as other SPC gas fields.

Dana Gas is the first developer to sign such an agreement. Under the terms of the agreement, Dana Gas will conduct a comprehensive technical assessment of the identified fields and propose a development plan aimed at significantly increasing total gas production if the evaluation is successful and both parties reach a final agreement. The initiative aims to support the government’s ambition to significantly boost national gas production, supporting Syria’s power generation and energy recovery.

Richard Hall, CEO of Dana Gas, said, “This agreement marks an important first step in evaluating opportunities to redevelop Syria’s gas infrastructure and unlock the potential that exists within its gas sector. The fields identified under this MoU could make a real difference to domestic gas production, strengthening Syria’s energy security and supporting local communities.

“Our confidence in taking on this challenge is two-fold: first, the professionalism and technical strength of the Syrian Petroleum team and second, our own proven development and operational expertise, most recently demonstrated through the early completion of the KM250 expansion project in Iraq alongside our joint operating partner. The lessons and capabilities we developed there are directly transferable to projects such as this, where hands-on execution, technical and financial discipline, and regional understanding are key to delivery. We are grateful to our Syrian counterparts for their trust and partnership as we embark on this effort.”

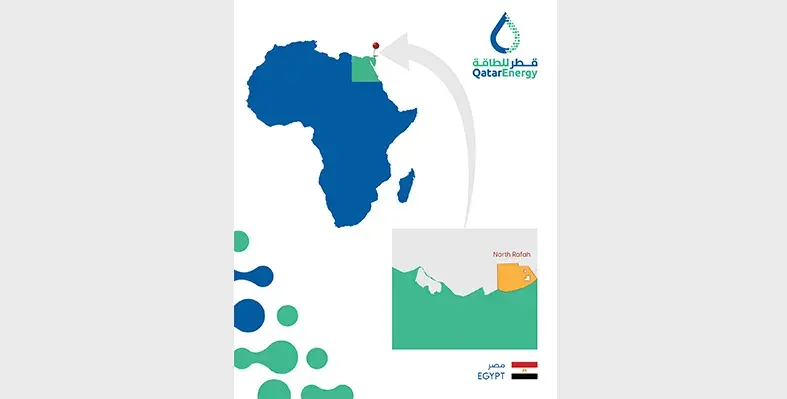

Dana Gas has exploration and production assets in Egypt, Kurdistan Region of Iraq (KRI) and UAE, with 2P reserves exceeding one billion boe and average production of 55,000 boepd in 2024. With sizeable assets in KRI and Egypt, and further plans for expansion, Dana Gas is playing an important role in the rapidly growing natural gas sector of the Middle East, North Africa and South Asia (MENASA) region.

Syria has the potential to significantly increase its oil and natural gas production. Before the civil war in 2011, it was self-sufficient in energy production, producing around 380,000-400,000 bpd of crude and 9 bcm of gas, with oil and gas sales accounting for around 20% of total revenues. However its infrastructure and refineries were damaged in the war, and the imposition of western sanctions, now partially lifted, along with the exit of oil majors from the country also took a toll on its production and refining capabilities. Crude production now stands at around 80,000-100,000 bpd.