Middle Eastern basins will play a pivotal role in meeting global energy demand while decarbonising, according to new research from Rystad Energy

Despite the accelerating energy transition, oil and gas will remain central to the global energy mix for the foreseeable future given the growth in energy demand. Rystad Energy estimates that by 2030, more than 75% of total demand will be met by fossil fuels, with emissions climbing as a result. This underscores the continuing importance of hydrocarbons, while also highlighting the need for oil and gas companies to build sustainable portfolios and reduce their Scope 1 and Scope 2 emissions to meet medium and long-term targets. As oil companies work to transform into integrated energy players and decarbonise their operations, it is crucial not only to achieve transition goals but also to minimise the carbon footprint of upstream activities, with the extraction of these resources accounting for more than 800mn tonnes of CO2e every year.

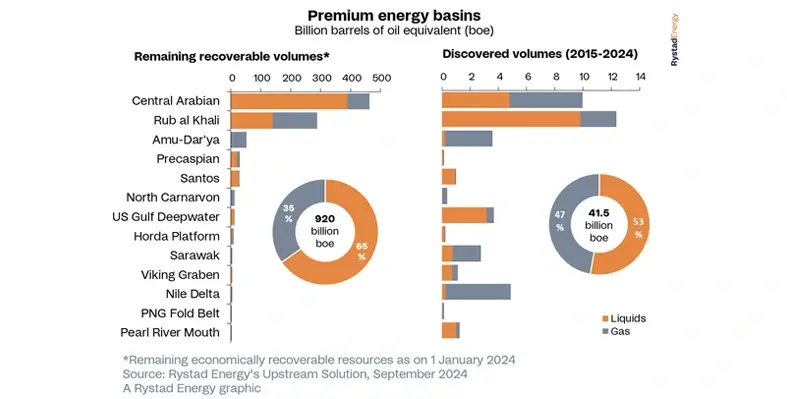

Premium energy basins (PEB) – a term coined by Rystad Energy – are particularly valuable because they are rich in hydrocarbon reserves and offer the potential for integrating low-carbon energy sources. As such, they provide an ideal platform for addressing emission challenges by combining substantial hydrocarbon volumes with opportunities for incorporating low-carbon solutions to reduce overall emissions.

“A select few basins hold the potential for upstream players to decarbonise while continuing to meet oil and gas demand. However, the race to decarbonise hinges on three crucial factors: accelerating investment, overcoming geographical challenges and modifying existing infrastructure. These changes are essential for unlocking the full potential of these basins and for upstream players to achieve their decarbonisation targets,” said Palzor Shenga, vice president, Upstream Research at Rystad Energy.The Central Arabian and Rub Al Khali basins stand out as carbon-efficient, resource-rich basins with significant potential, according to Rystad. These Middle Eastern basins are at the forefront of PEBs and play a pivotal role in global conventional discovered volumes, especially as global discoveries decline and exploration activity peaks. Separately, these basins also score highly in terms of renewable potential, with both offering more than 6.2 gigawatts (GW) combined of installed and upcoming solar capacity.

Since 2015, these basins have contributed approximately 40bn bbl of oil equivalent (boe) in newly discovered volumes, evenly divided between liquids and gas. Egypt’s Nile Delta, driven by Eni’s giant Zohr gas discovery in the Mediterranean Sea, ranks third with about 5bn boe discovered during this period, followed by the US Gulf Deepwater (3.7bn boe) and the Central Asian Amu-Darya (3.6bn boe) basins.

With a combined capital expenditure of US$638bn, the Rub Al Khali, US Gulf Deepwater and Central Arabian basins have seen the highest greenfield investments since 2000. Due to the vast volumes discovered, the unit cost of development in the two Middle Eastern basins has been under US$2 per boe. In contrast, the smaller average resource size in the exclusively offshore US Gulf Deepwater Basin has driven development costs to over US$9 per boe, with only the Viking Graben Basin (US$11 per boe) in Northwest Europe having a higher development cost. Significant investments have also been made in resource development in Brazil’s Santos Basin (US$153bn) and Australia’s North Carnarvon Basin (US$140bn).

Several PEBs offer significant potential for carbon storage, particularly in late-life or abandoned oil and gas fields, which are suitable for enhanced oil recovery or permanent storage. These basins are increasingly being utilised for carbon capture and storage due to their geological properties.

The pivotal role of Middle East energy basins

Premium energy basins hold the potential for upstream players to decarbonise while continuing to meet oil and gas demand. (Image source: Rystad Energy)