In The Spotlight

Getech Group and STRYDE deploy new targeting service in the Middle East

Getech Group plc, a leading locator of subsurface energy and mineral resources, and STRYDE, the onshore nodal seismic imaging experts, have successfully deployed their new targeting and exploration service on a number of oil and gas and geothermal exploration projects in the Middle East

Designed to help energy and natural resource companies explore faster and more effectively, while reducing exploration risk and cost, the new service provides subsurface intelligence that reduces uncertainty and guides smarter, more targeted exploration investment. It enables companies to conduct early screening and identification of high value leads and prospects, to optimise new seismic survey design, and to reduce unnecessary seismic acquisition costs by focusing only where it matters most.

On a recent regional and multiphase client project in the Middle East, Getech analysed gravity and magnetic data to map subsurface density and susceptibility contrasts, providing critical insight into the depth and extent of the petroleum system and helping pinpoint areas with the highest prospectivity. Enhanced gravity and magnetic maps, a structural interpretation, reinterpretation of legacy seismic data, detailed lead descriptions, and a comprehensive lead summary map were provided. Based on these findings, a targeted 3D seismic acquisition campaign was recommended in high-value zones. STRYDE then designed and planned the seismic programme to ensure an efficient acquisition process focused precisely where new data will deliver the greatest impact for decision-making.

“The market has long lacked a streamlined, data-driven service that connects early lead identification to the delivery of direct targets,” said Max Brouwers, chief business development officer at Getech. “We are thrilled to collaborate with another industry leader to bring this unique solution to market. Our partnership with STRYDE combines Getech’s expertise in basin evaluation and geoscience intelligence with STRYDE’s specialism in nodal seismic acquisition for high-resolution subsurface imaging, creating a powerful service that accelerates the discovery process for energy and mineral companies. By integrating multiple geophysical datasets with expert interpretation, this new service empowers customers to target smarter, spend less, and discover more.”

The new offering is now available to clients across sectors including oil and gas, CCUS, natural hydrogen, geothermal, and mining.

Drones for enhanced oil and gas operations

Are we ready to see drones in the oil and gas sector? Flyability discusses the potential applications

Any oil and gas facility faces an array of challenges – from working with flammable material to managing tight deadlines and high-pressure shutdowns. Drones are being proposed as a means to make work easier. So what can they offer the oil and gas sector?

The answer lies in safer, faster, and cheaper non-destructive testing. We’ve been seeing a steady rise in outdoor drone applications for inspections. Now, drones are advancing beyond visual inspections into non-destructive testing. This isn’t limited to the exterior of assets either – they’re flying indoors too.

The Swiss-designed Elios 3 is one example of an oil and gas drone. This remote inspection UAV was the winner of the Safety Award at the 2025 Offshore Support Journal conference in London. The Elios 3 is a confined space drone that features a protective cage and custom firmware that allows it to recognize and recover from collisions – perfect for flying indoors. The drone can be used to gather visual, LiDAR, and ultrasonic thickness measurements simultaneously, in addition to a low explosive level gas sensor calibrated for over 14 flammable gases. As it flies, the Elios 3 creates a 3D model of its surroundings that localises all of the UT measurements and points of interest captured by the camera. This means that post-flight, engineers can navigate a 3D point cloud of the asset and see where each measurement was taken, making it easy to locate defects and plan repair work.

Industry-wide change

As with any new technology, investors want to see results before committing to innovation. The numbers behind the Elios 3 offer little doubt: this technology is well-placed and ready to bring about real industry-wide change. In one case, UK-based service provider CyberHawk used the Elios 3 and its UTM probe and managed to save US$600,000 on cargo oil tank inspections. In another example, Turner Specialty Services saved 60% on pipe rack inspections measuring 2,000 feet (600 meters), completing the inspection on an oil and gas site in just 2 days.

Another reason for the growing interest in drone technology is the rate of development. As we advance towards more advanced AI and autonomous capabilities, drones are evolving too. For example, the Elios 3 has a Smart Return-to-Home feature that, when triggered by the pilot, allows it to select the fastest and safest route back to the home point. The tool works by using onboard autonomy engines to analyze the environment and plan the best route. This means that pilots can focus on gathering critical data while the drone manages its battery life and plans the home route. The manufacturer of the Elios 3, Flyability, also teases future developments that will take advantage of autonomy, such as “Resume Inspection”, where the drone will autonomously return to the point where Smart Return-to-Home was triggered to continue an inspection after batteries have been changed.

Drones are here to stay

So what does this mean for the wider industry? That drones not only have a place in the sector but are here to stay. Drone-based NDT inspections are offering improved safety, access, and reporting simultaneously. Multiple class societies have certified data collected with the Elios 3 UT, signaling industry-wide acceptance while the drone has received multiple awards commending the safety improvements it empowers. The technology is ready for the industry – it’s just a question of who will adopt it fastest.

Middle East manufacturers are leading the way in AI adoption, according to the Rockwell Automation report.

Middle East manufacturers lead in GenAI adoption

According to Rockwell Automation’s newly-issued 10th annual State of Smart Manufacturing Report, 98% of manufacturing companies in the Middle East are using or planning to use generative AI, the highest rate globally, with 96% committed to broader AI/ML technologies

The study is based on feedback from more than 1,500 manufacturing leaders globally, including representation from the oil and gas (7%), renewables and energy transition (9%) and chemicals (4%) sectors.

The study highlights that Middle East companies are leading the way in deploying AI to improve operations and meet business goals, shifting from broad digital expansion to focused strategies, to achieve measurable outcomes in efficiency, cybersecurity and sustainability.

"Middle East manufacturers are not just experimenting with smart manufacturing technologies; they are applying them to address real operational challenges," said Ediz Eren, regional vice president, Middle East, Türkiye, and Africa, Rockwell Automation. "From cyber resilience to ESG performance and workforce engagement, the data shows a shift toward outcome-driven digitalisation."

Practical use cases

Manufacturers in the region are focusing on practical use cases for AI, with 68% planning to use AI for quality control, 61% for cybersecurity, and 46% for energy management over the next 12 months, significantly above European benchmarks, and 42% applying AI/ML to monitor sustainability targets.

This is paying off in terms of ROI, with 10% of manufacturers citing GenAI as their top-returning technology, and 15% saying the same of cybersecurity platforms.

Cybersecurity has risen up the agenda for manufacturing firms, with 98% of companies having either invested in or planning to invest in cybersecurity platforms, and 44% deploying countermeasures to mitigate rising threats, the highest rate globally. Thirty-six percent now view cyber risk as their top external concern, up from 27% last year.

Technology is also reshaping the workforce, with 43% of regional respondents now prioritising upskilling, up 14% year-on-year and significantly ahead of the European average.

Libya's latest bid round has attracted international investor interest. (Image source: Energy Capital & Power)

Libya bid round attracts international investor interest

Libya’s latest upstream licensing round has already attracted more than 40 bids, according to Abdolkabir Alfakhry, Advisor to Libya’s Minister of Oil and Gas, signalling growing international interest in its largely untapped hydrocarbon potential

The bid round, launched in March, offers 22 blocks for exploration and development (11 Offshore and 11 Onshore) including areas with undeveloped discoveries estimated to contain a minimum of 2.0 Bboe in hydrocarbon resources.

The Minister, who was addressing a session sponsored by ConocoPhillips at the Invest in African Energy Forum in Paris, noted that results of the bid round are expected around November. “This will open a new environment for international companies to work in Libya.”

Libya’s assets are underexplored, particularly offshore, Alfakhry said, pointing to the country’s strategic location on the Mediterranean and its proximity to European markets as key competitive advantages.

“The bid round signals Libya’s integration into the global energy market,” he said.

Steiner Våge, president for Europe, the Middle East and Africa at ConocoPhillips, confirmed the U.S. major’s intention to deepen its engagement in Libya and across the African continent.

“Libya is a place where we can work – over the last few years, we’ve significantly increased production at the Waha concession,” said Vaage. “We want to see Libya prosper. We’d also like to transfer our knowledge, and we want to work with partners that have similar objectives – that is the starting point.”

At Libya Energy & Economic Summit 2025 earlier this year, Bashir Garea, technical advisor to the chairman of the NOC, highlighted the country’s immense oil and gas potential.

“We have 48 billion barrels of discovered but unexploited oil, with total potential estimated at 90 billion barrels, especially offshore,” he said, adding that Libya also has 122 trillion cubic feet of gas yet to be developed. “To unlock this potential, we need more investors and new technology, particularly for brownfield revitalisation.”

Oil majors including Eni Repsol, bp and OMV have recommenced exploration in Libya in recent months following a 10-year hiatus. However the recent eruption of violent clashes in Tripoli following the assassination of a powerful militia leader, shows that the current security situation is far from stable.

The energy trilemma was the focus of discussion at the session. (Image source: AIEN International Summit)

Is profitability the fourth leg of the energy trilemma?

At final session of the AIEN International Energy Summit, held in Istanbul from 10-12 June, the trilemma of energy security, affordability, and sustainability was in the spotlight

The panel also debated whether profitability should be considered the fourth leg of the trilemma.

Moderator Jay Park KC, managing partner, Park Energy Advisory Ltd asked the panel what the current priorities were of the triangle, and if we were seeing a shift to one corner.

Yelda Guven, VP Policy, EMEA, ExxonMobil Low Carbon Solutions said, “That’s the challenge – how do you make sure energy security and affordable energy can reach the growing population, but do it in a low carbon way? The industry knows how to reduce emissions but it needs support.”

Leonardo Sempertegui, general legal counsel, OPEC added, “While the perspective of security has been in everyone’s attention in recent years, it has been in the developing world for a long time. There is no way out of poverty without stable and abundant energy. At this point, thinking about reducing certain sources of energy with the objection of reaching an ‘artificial’ target – it is bringing some countries to a complicated position. What they need is development. So, this triangle has different legs in each jurisdiction.”

Carlos Bellorin, EVP Macro Research & Advisory, Welligence Energy Analytics agreed: ‘The corners of the triangle are always shifting. Security is currently a top priority to some countries due to ongoing turmoil around the world. Affordability affects everyone in the world. Sustainability hasn’t disappeared – we know a low carbon future is the way forward.’

Graham Kellas, SVP, Global Fiscal Research, Wood Mackenzie was asked how to balance sustainability in light of the growing demand for oil and gas. “10 years ago, the oil price had just crashed and there was the Paris agreement. We saw the level of total capital investment in energy supply rise in low carbon and renewables from one third to a half, while oil and gas came down. And then Covid happened and the momentum behind the sustainability bit of our triangle flipped to affordability. Then in the third phase, after February 2022 and the Russian invasion, it has turned to security. The level of investment into renewables has remained constant, but we have seen an uptick in oil and gas. Diversification is what is underplaying it, and we are not going to an end point with no fossil fuels being produced – there will always be a diverse range.”

At this point, a member of the audience asked if ‘profitability’ actually turned this into a ‘quadrilemma’.

“That’s spot on!’ said Kellas. “This is something that is sometimes lost in the conversation – the need for private companies to make a return for shareholders. There is a certain return you can make from risk-free bonds, so why would you invest in a new emerging project with all the risks attached? You can’t just tell companies that they must do “this or that” without acknowledging that shareholders need to see a return on their investment.”

Guven agreed. “This is what the public debate doesn’t cover enough! The private sector is beholden to shareholders. You have to have that return or no one will invest in the energy transition.”

Sempertegui slightly disagreed on the terminology. “I still think it is a trilemma. Profitability falls within sustainability, just not in terms of emissions. We have a system to sustain – we can’t just reverse 300-400 years of history. As long as we make policy based on facts and realities, we’re fine and going somewhere. When some actors think there is an ideology and have their own agenda, we are in a different scenario. So, I think it is a trilemma, but I appreciate these are semantics.”

ADNOC L&S will manage the transportation of up to 70% of Borouge's annual production. (Image source: ADNOC L&S)

Borouge partners with ADNOC L&S to boost petrochemicals exports

Borouge Plc and ADNOC Logistics & Services Plc have partnered to boost the production and export of petrochemicals from the UAE, as Borouge prepares to ramp up production capacity

Borouge plans to increase production capacity by 1.4 million tonnes per annum by the end of 2026 through its Borouge 4 mega project, which will make it the world’s largest single-site polyolefin complex. The 15-year US$531mn service agreement, which will drive cost savings and efficiencies as well as enhancing Borouge’s supply chain network, covers port management, container handling, and feeder container ship services for the Borouge Container Terminal in Al Ruwais Industrial City, Abu Dhabi. ADNOC L&S will manage the transportation of up to 70% of Borouge’s annual production, deploying a minimum of two dedicated container feeder ships to transport Borouge’s products from Al Ruwais to the deepwater ports of Jebel Ali in Dubai and Khalifa Port in Abu Dhabi.

Hazeem Sultan Al Suwaidi, CEO of Borouge, commented, “This agreement builds on our longstanding collaboration with ADNOC L&S, a partnership that has been instrumental in meeting the evolving needs of our customers in high-growth markets. It brings significant benefits to Borouge; driving substantial operational cost savings and enhancing our Logistics Variable Cost (LVC), as well as complementing our existing rail operations and expanding the flexibility of our supply chain network. With the rapid increase in our production capacity, we are advancing our capabilities in delivering differentiated products and solutions efficiently, while keeping pace with rising global demand."

Captain Abdulkareem Al Masabi, CEO of ADNOC L&S, added, “This comprehensive container terminal agreement marks a major milestone in our successful partnership with Borouge, delivering on ADNOC L&S’ strategy to provide seamless, end-to-end logistics solutions that power the UAE’s industrial growth and export ambitions. By leveraging our extensive maritime and logistics expertise, we are ensuring that Borouge’s world-class petrochemical products reach global markets efficiently and competitively.”

The new function simplifies the process of selecting pumps. (Image source: Armstrong Fluid Technology)

Armstrong Fluid Technology introduces Integrated Designer function

Armstrong Fluid Technology, a leading manufacturer of intelligent flow equipment, has introduced the Integrated Designer to simplify the process of selecting and sizing pumps and accessories from a single interface

Available within its ADEPT selection platform, the Integrated Designer is Tailored to meet the demands of fast-paced and sustainability-driven markets such as the Middle East, and enables the seamless creation of comprehensive equipment schedules and system layouts with pre-configured solutions.

Using the supplied values for system flow and pressure, as well as flow redundancy and flow turn-down, the Integrated Designer recommends the optimum pump size plus the number of pumps and suggests alternative combinations.

“With the Middle East’s growing emphasis on smart building technologies and green infrastructure, this tool is a game-changer for mechanical engineers and system designers,” said Zeljko Terzic, global offering manager for Pumps, Armstrong Fluid Technology.

“Users can get optimised selections in just a few clicks and avoid the extra work of manual calculations. The Integrated Designer gives professionals the ability to deliver better designs, faster and with more confidence.” he added.

Key features of the Integrated Designer tool include:

• Integrated selection and system design in one workflow

• Real-time system performance estimates

• One-click export of equipment schedules and submittal packages

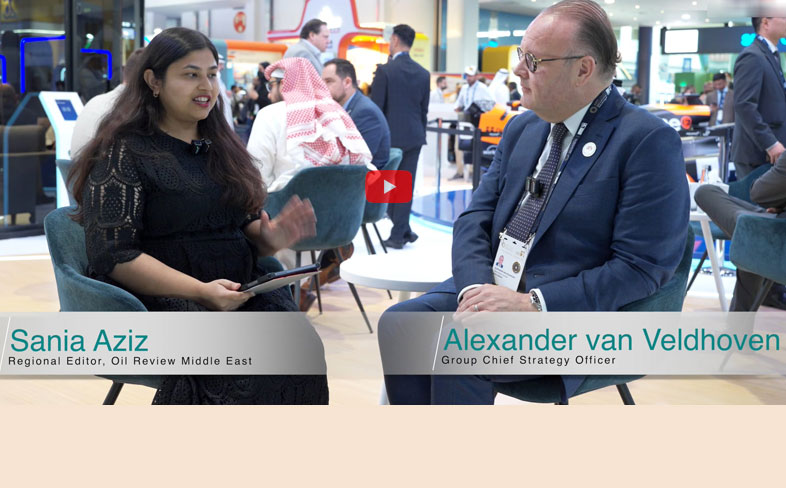

SAFEEN Group webinar addresses future of offshore operations

Oil Review Middle East hosted a very well-attended webinar on 20 November on the future of offshore operations, in association with SAFEEN Group, part of AD Ports Group

The webinar explored the latest trends and challenges in the rapidly evolving world of offshore operations, focusing on groundbreaking innovations that are driving sustainable and efficient practices. In particular, it highlighted SAFEEN Green – a revolutionary unmanned surface vessel (USV), setting new benchmarks for sustainable and efficient maritime operations.

Erik Tonne, MD and head of Market Analysis at Clarksons, gave an overview of the offshore market, highlighting that current oil price levels are supportive for offshore developments, and global offshore capex is increasing strongly. The Middle East region will see significant capex increase over the coming years, with the need for rigs and vessels likely to remain high. Offshore wind is also seeing increased spending. Global rig activity is growing, while the subsea EPC backlog has never been higher, with regional EPC contracts seeing very high activity. Tonne forecast that demand for subsea vessels and other support vessels will continue to increase.

Tareq Abdulla Al Marzooqi, CEO SAFEEN Subsea, AD Ports Group, introduced SAFEEN Subsea, a joint venture with NMDC, which offers reliable and innovative survey, subsea and offshore solutions to support major offshore and EPC projects across the region. He highlighted the company’s commitment to sustainability, internationalisation and local content, and how it is a hub for innovations and new ideas, taking conceptual designs and converting them to commercial projects. A key project is SAFEEN Green, which offers an optimised inspection and survey solution.

Tareq Al Marzooqi and Ronald J Kraft, CTO, Sovereign Global Solutions ME and RC Dock Engineering BV. outlined the benefits and capabilities of SAFEEN Green as compared with commercial vessels, in terms of safety, efficiency, profitability and sustainability. It is 30-40% more efficient through the use of advanced technologies, provides a safer working environment given it is operated 24/7 remotely from a control centre, and offers swappable payload capacity. Vessels are containerised and can be transported easily to other regions. In terms of fuel consumption, the vessel is environment-friendly and highly competitive, reducing emissions by 90% compared with conventional vessels, with the ability to operate on 100% biofuel.

As for future plans, SAFEEN Green 2.0 is under development, which will be capable of carrying two inspection work-class ROVs simultaneously. A priority will be to collect data to create functional AI models for vessels and operations, with the first agent-controlled payload systems in prospect by around 2027.

To view the webinar, go to https://alaincharles.zoom.us/rec/share/mNHjZhAhQzn1sPzmFWZCgrq7_SckfLRcSb4w81I7aVlokO9sgHM_zVeOqgN3DgJS.bO4OIRqNeFP09SPu?startTime=1732095689000

CCS at a turning point: DNV

Carbon capture and storage capacity is forecast to quadruple by 2030, and the Middle East has ‘significant CCS ambition’, according to a new report from DNV

Cumulative investment in carbon capture and storage (CCS) is expected to reach US$80bn over the next five years, according to DNV’s Energy Transition Outlook: CCS to 2050 report.

Up to now, growth has been limited and largely associated with pilot projects, but a sharp increase in capacity in the project pipeline indicates that CCS is at a turning point. CCS will grow from 41 MtCO2/yr captured and stored today to 1,300 MtCO2/yr in 2050, which will be 6% of global emissions, DNV forecasts.

The immediate rise in capacity is being driven by short-term scale up in North America and Europe, with natural gas processing still the main application for the technology. Europe is moving projects forward amidst tightening emissions regulations and developers are advancing in the US, taking advantage of the established 45Q tax credit. Hard to abate industries such as steel and cement production are forecast to be the main driver of growth from 2030 onwards, accounting for 41% of annual CO2 captured by mid-century. Maritime onboard capture is expected to scale from the 2040s in parts of the global shipping fleet.

As the technologies mature and scale, the average costs will drop by an average of 40% by 2050.

Ditlev Engel, CEO, Energy Systems at DNV said “Carbon capture and storage technologies are a necessity for ensuring that CO2 emitted by fossil-fuel combustion is stopped from reaching the atmosphere and for keeping the goals of the Paris Agreement alive. DNV’s first Energy Transition Outlook: CCS to 2050 report clearly shows that we are at a turning point in the development of this crucial technology.

“The biggest barrier to the very much needed acceleration of CCS deployment is policy uncertainty. Policy shifts, not technology or costs, have been responsible for many CCS project failures. However, policy support for CCS is firming across most world regions.”

Recent turmoil and budgetary pressure in the global economy pose risks to CCS deployment, potentially shifting priorities and removing necessary finance needed.

Jamie Burrows, Global Segment Lead CCUS, Energy Systems at DNV said “CCS is entering a pivotal decade and the scale of ambition and investment must increase dramatically. It remains essential for hard-to-decarbonise sectors like cement, steel, chemicals, and maritime transport. But as DNV’s report shows, delays in reducing carbon dioxide emissions will place an even greater burden on carbon dioxide removal technologies. To stay within climate targets, we must accelerate the deployment of all carbon management solutions -from industrial capture to nature-based removal - starting today."

Middle East developments

DNV notes that the Middle East is home to three operational CCS projects and six under construction. Operating facilities include the Al Reyadah steel plant in the UAE, Qatar's Ras Laffan LNG Facility, and Saudi Arabia's Uthmaniyah gas processing plant.

The world’s largest CO2 utilisation facility, United Jubail Petrochemical, is also in Saudi Arabia. The facility converts 0.5 MtCO2/yr into feedstock for chemical processes.

The main focus of regional CCS development has evolved from EOR to decarbonising energy and the production of low-carbon fuels. The UAE's Long Term Strategy highlights CCS as crucial for industrial sector decarbonisation, targeting 43.5 MtCO2/yr capacity by 2050. ADNOC aims for 10 MtCO2/yr captured by 2030 and net-zero operations by 2045. ADNOC's Habshan and Ghasha Concession projects, each with capacity of 1.5 MtCO2/yr, are currently under construction.

Saudi Arabia aims to capture and store 44 MtCO2/ yr by 2035 and launched a domestic carbon crediting scheme in 2024. A CCS hub is under construction at Jubail, which will store 9 MtCO2/yr by 2027 from natural gas processing and industrial sources in an onshore saline aquifer.

Oman aims to utilise its pipeline infrastructure for hydrogen and CO2 transport in new CCS and EOR projects.

Direct air capture (DAC) projects are emerging in Saudi Arabia, the UAE, and Oman, often combined with CO2 mineralisation or sustainable aviation fuel production.