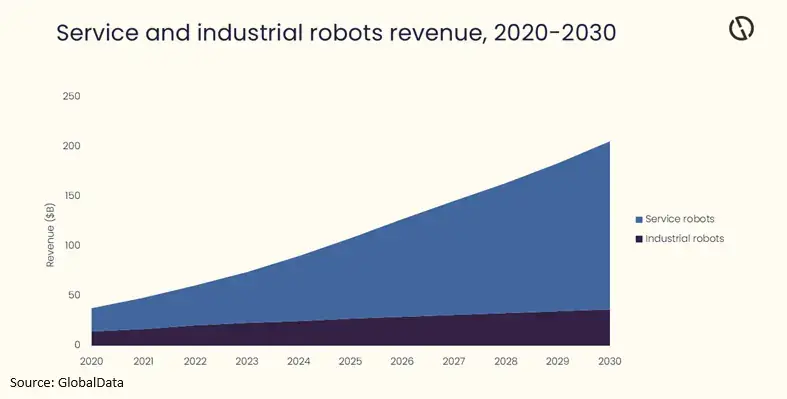

The global oil and gas robotics market is forecast to hit US$205.5bn in 2030. (Image source: GlobalData)

The global oil and gas robotics market is forecast to grow from US$90.2bn in 2024 to US$205.5bn in 2030, according to data analytics and consulting company GlobalData

Robotics is rapidly transforming oil and gas operations as advances in artificial intelligence (AI) and cloud computing unlock the next phase of industrial automation. Previously focused on repetitive industrial tasks, robots can now operate autonomously, collaborate, and access cloud-based data in real time. AI enables advanced decision-making, navigation in complex environments, and reduced reliance on human intervention.

Despite progress in humanoid robotics, task-specific robots remain dominant. GlobalData’s Strategic Intelligence report, “Robotics in Oil and Gas,” highlights how robotics is increasingly being adopted across the oil and gas value chain to improve safety, efficiency, and asset integrity.

Operators such as Equinor deploy subsea autonomous vehicles, including Hydrone-R, for extended underwater inspections, while Shell uses Cyberhawk drones and Sensabot robots for aerial and ground-based inspection of flare stacks, tanks, and pipelines. BP and Chevron have trialled Spot quadruped robots to autonomously survey facilities and collect visual, thermal, and methane data, reducing personnel exposure to hazardous environments. While ADNOC deploys more than 65 robotics applications across its operations.

Ravindra Puranik, Oil and Gas Analyst at GlobalData, comments: “Autonomous robotic systems are being introduced across hazardous, remote, and offshore environments to perform inspection, surveillance, and monitoring tasks without continuous human control.”

These platforms deliver higher operational efficiency through faster inspection cycles, consistent task execution, and repeatable, high-quality data capture, independent of operator skill or availability.

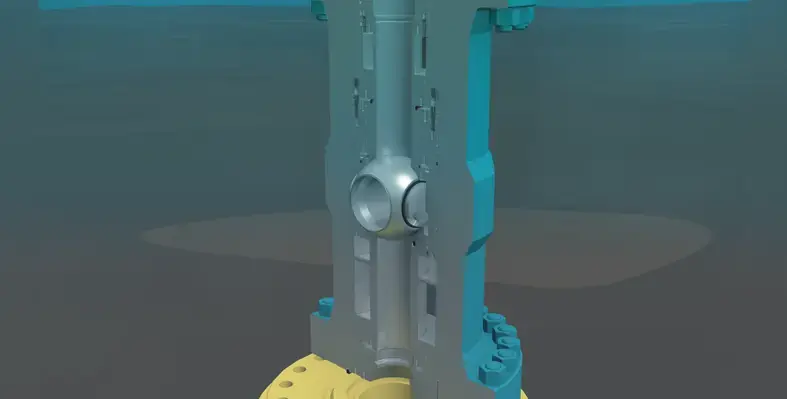

GlobalData notes that offshore and subsea operations remain a major focus area for robotics deployment. Remotely operated vehicles (ROVs) continue to support real-time subsea inspection, maintenance, and intervention, while autonomous underwater vehicles enable long-duration seabed surveys and pipeline monitoring with reduced reliance on surface vessels.

Puranik concludes: “While challenges remain, the integration of robotics with digital twins, edge intelligence, and predictive analytics is accelerating. As these technologies mature, robotics will move beyond supporting roles to become indispensable operational assets, across the oil and gas industry.”