In The Spotlight

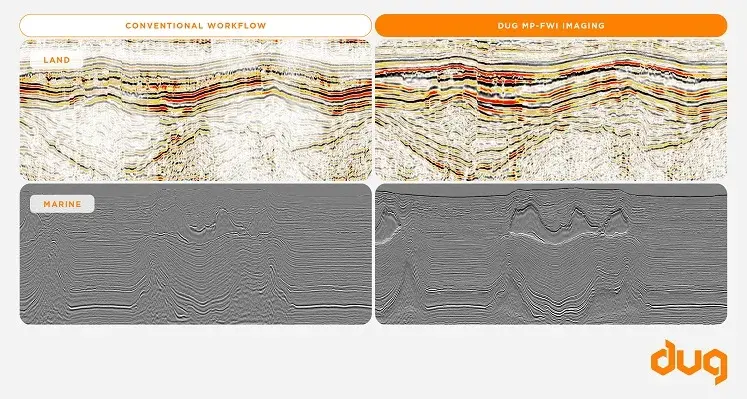

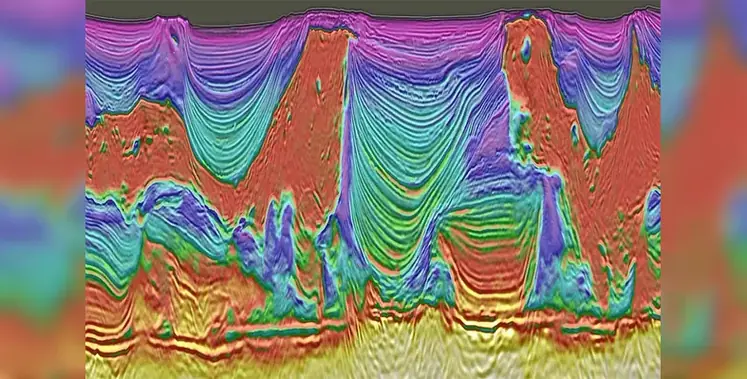

Seismic imaging example from the Laconia Phase I 12Hz E-TLFWI dataset in the US Gulf. (image courtesy of Viridien Earth Data).

Viridien, an advanced technology and digital solutions company, is collaborating with NVIDIA to transform seismic imaging workflows

The collaboration will combine NVIDIA HPC platforms and Viridien’s expertise in subsurface imaging technologies and HPC and Cloud solutions. It will optimise Viridien’s seismic imaging algorithms on NVIDIA accelerated computing platforms, integrating advanced techniques such as tensor cores and mixed-precision computing, to deliver continued improvements in system performance, imaging accuracy, and operational efficiency for energy and geoscience clients worldwide.

John Josephakis, VP of HPC and Supercomputing, NVIDIA, said, “By combining NVIDIA accelerated computing platforms and AI with Viridien’s expertise in seismic imaging and HPC, together we are enabling subsurface teams to deliver sharper, more reliable images faster and more cost-effectively. Better imaging reduces uncertainty, improves prospect screening and well placement decisions, and ultimately lowers the cost of exploration by cutting dry hole risk and minimising the time and compute required to reach decision-grade results.”

Anil Vattalai, SVP, HPC & Cloud Solutions, Viridien, added, “We are delighted to work with NVIDIA to accelerate the evolution of HPC for seismic imaging. Viridien is the industry leader in subsurface imaging based on our pioneering expertise in industrial and customised end-to-end HPC and over fifteen years of experience in optimising complex scientific workflows on GPU accelerators. This agreement underscores our commitment to continuously improving our full HPC stack (hardware, software, and algorithms) to deliver advanced HPC and cloud solutions that empower our clients to achieve greater performance and higher-quality outcomes more efficiently.”

ADNOC companies have announced strong 2025 results, reflecting growth across the value chain from upstream development to logistics and distribution, as well as international expansion, capital discipline and the harnessing of new technologies

ADNOC Drilling recorded the strongest performance in its history, reflecting continued growth across integrated drilling and oilfield services (“OFS”), and driven by sustained rig utilisation, strong operational execution across the fleet, resilient long-term contracts and accelerated adoption of AI-powered technologies. Revenue was up 22% to US$$4.9bn year on year, with net profit up 11% to US$1.45bn.

Oilfield Services (OFS) revenues grew particularly strongly, by 80%, to US$1.46bn, on the back of increased activity volume, driven by higher IDS activity and additional discrete services, coupled with the growing year-on-year contribution from unconventional business. OFS is a core pillar of the company’s growth strategy, with the UAE and wider GCC representing some of the most attractive and strategically important markets for integrated energy services.

Abdulla Ateya Al Messabi, ADNOC Drilling CEO said, “2025 was a defining year for ADNOC Drilling. Our record-breaking results were delivered by our people, whose discipline, innovation and commitment to operational excellence and safety underpin every milestone we achieve. Our resilience as a business, built on strong systems, disciplined operations and the ability to adapt at pace, continues to reinforce our competitive strength.

“Through execution excellence, technology led efficiency and a disciplined approach to capital allocation and operations, we continue our transformation into the region’s most advanced energy services company. By expanding across the GCC, pioneering AI driven operations and setting new benchmarks in sustainability, we are unlocking value and helping power the UAE’s energy future. This is just the beginning of a new era of growth, innovation and impact.”

The company comments that the forward outlook remains strong, with growth in 2026 expected to be driven by accelerated IDS deployment, incremental OFS scope awards, and continued AI-driven efficiency gains, as well as further progress in ADNOC’s long-term upstream and unconventional development plans. Sustained development in both unconventional and conventional drilling is expected, the latter including six new island rigs scheduled for delivery between 2026 and 2028. This is complemented by ongoing expansion in OFS and attractive regional growth avenues. ADNOC Drilling aims to deploy approximately 70 IDS rigs by the end of 2026, reinforcing its operational scale and future OFS earnings visibility.

ADNOC Gas meanwhile recorded income of US$5.2bn, a 3% increase compared to 2024, despite a 14% drop in the oil price. This was primarily driven by the strength of its domestic gas business where its EBITDA was up 10% on sales volume growth of 4% year-on-year (YoY) and improved commercial terms.

Capital expenditure at US$3.6bn increased by a staggering 98% in 2025 as several major projects progressed. These included phase one of the RGD project, which expands domestic gas processing capacity and increases production of export-traded liquids from new, richer gas supplies. Work is also advancing on the ADNOC Estidama gas-pipeline project, which aims to enhance access for industrial and utility customers in the Northern Emirates.

Looking ahead, ADNOC Gas expects to capture continued domestic demand growth beyond 2026, supported by strategic infrastructure investments, including the ADNOC Estidama gas pipeline project, which will expand access to the Northern Emirates and reinforce the UAE’s long term objective of achieving gas self sufficiency. The Final Investment Decision (FID) for phases two and three of the Rich Gas Development (RGD) project is anticipated in the first quarter of 2026. This expansion, benefiting from the growth of ADNOC’s upstream operations, is one of the critical projects to enable ADNOC Gas by 2029 to expand its overall capacity by 30%.

Fatema Al Nuaimi, chief executive officer of ADNOC Gas, said, “2025 was a defining year for ADNOC Gas. We delivered record earnings while investing in growth, demonstrating that our business is resilient, scalable, and globally relevant. As demand for reliable delivery of gas continues to expand, ADNOC Gas is strategically positioned to serve both the UAE and international markets with confidence and discipline.”

ADNOC Logistics & Services saw revenues rise 41% YoY to US$5,016mn and net profit up 14% YoY to US$863mn, driven by favourable market demand, strong operational execution and the continued expansion across the company’s core and growth segments.

Integrated Logistics, the largest segment within ADNOC L&S saw revenues rising 11% YoY to US$2,529mn, driven by robust market demand and sustained momentum across key business lines. The shipping sector, despite challenging market conditions, saw revenue increase by 122% to US$2,125mn, reflecting the successful integration of Navig8, followed by the rapid integration of its 32 vessel fleet and the adoption of advanced commercial and digital capabilities. The acquisition of Navig8 added commercial scale, strengthened ADNOC L&S’ revenue profile, and improved access to global energy and commodities flows.

Captain Abdulkareem Al Masabi, CEO of ADNOC L&S, said, “2025 was a pivotal year for ADNOC L&S. We further enhanced our customer centricity, achieved record financial results and created significant value for our shareholders. ADNOC L&S grew across all segments, diversified into new verticals and accelerated its international expansion. With the acquisition of Navig8, we elevated ADNOC L&S from a regional powerhouse to global sector leadership.”

ADNOC Distribution also put in a strong performance in 2025.

PC Oman Ventures Ltd (PCOVL), a subsidiary of PETRONAS, has signed a Concession Agreement with the Government of the Sultanate of Oman and OQ Exploration and Production Batinah Offshore LLC (OQEP) for the exploration of oil and gas in Block 18

Block 18 is a large offshore exploration area located in Northeast Oman, spanning more than 21,000 sq km and offering significant frontier exploration potential across diverse geological settings, from shallow to ultra-deep water. Under the concession agreement, PCOVL will become operator of Block 18 in partnership with OQEP.

PCOVL has been active in the Sultanate of Oman since 2018 and currently holds a participating interest in Block 61. This collaboration builds on the Memorandum of Understanding (MoU) signed between PETRONAS and OQEP in October 2025, strengthening the strategic partnership between both companies and reinforcing PETRONAS’ long-term presence in the Sultanate of Oman.

The partnership supports PETRONAS’ aspiration to enhance its competitive upstream portfolio by aligning its offshore exploration capability with OQEP’s regional expertise, laying the foundation for a mutually beneficial venture.

"Building on our technical strengths and successes, PETRONAS continues to expand its exploration activities into new frontiers. Through our innovative exploration approaches and OQEP’s basin expertise, we aim to jointly unlock the potential of Block 18, contributing to Oman’s long-term energy security. The addition of Block 18 aligns with our commitment to disciplined portfolio expansion, providing strategic optionality across our international portfolio," said Mohd Redhani Abdul Rahman, vice president of International Assets, PETRONAS.

The strategic partnership agreement sets out the framework for NOC and MOL to exchange information and jointly explore potential areas of cooperation. (Image source: Adobe Stock)

Hungary’s MOL Group has signed a memorandum of understanding (MoU) with Libya’s National Oil Corporation (NOC) for cooperation in hydrocarbons exploration, technological innovation and crude trading, as international interest in Libya hots up

The strategic partnership agreement sets out the framework for NOC and MOL to exchange information and jointly explore potential areas of cooperation. These include hydrocarbon exploration and production, technological and field development innovations, oilfield services opportunities in Libya, crude supply and trading activities.

"We recognise Libya’s oil and gas industry as a pillar of strength and expertise. I am sure that this new agreement will act as a catalyst for further expanding our international portfolio, creating clear mutual value for both companies and reinforcing the resilience of our region. From the perspective of security of supply and energy sovereignty, particularly for landlocked countries, diversification of sources is of crucial importance. Our cooperation also goes beyond business, as we have agreed to rebuild our educational, scientific, and university ties in order to learn as much as possible from each other. Such partnerships can also help Europe to find its own path to competitiveness, rather than switching between different forms of energy dependency,” – said Zsolt Hernádi, chairman and CEO of the MOL Group.

The agreement comes as MOL is looking to expand its international portfolio to maintain its strategy target of at least 90,000 barrels of oil equivalent/day production level over the next five years, recently signing cooperation agreements with the national oil company of Kazakhstan (KazMunayGas), the national oil company of Azerbaijan (SOCAR), and the national oil company of Türkiye (Turkish Petroleum). The company has oil and gas exploration and production assets in nine countries, with production in eight countries: in Croatia, Azerbaijan, Iraq, Kazakhstan, Russia, Pakistan, Egypt, and Hungary.

The agreement also reflects the hotting up of international interest in Libya. Chevron recently signed an MoU with NOC to evaluate exploration and development opportunities, while TotalEnergies has signed an agreement extending the Libya Waha Concessions up to 2050, paving the way for further investments. TGS has a global provider of energy data and intelligence, has just signed a Letter of Intent (LOI) with North Africa Geophysical Company, (NAGECO),a subsidiary of the NOC to advance high-quality subsurface data, supporting Libya’s upstream development through modern, fit-for-purpose data and technology solutions. Libya’s latest upstream licensing round launched in March 2025, the first in 18 years, has attracted more than 40 bids, signalling growing international interest in Libya’s largely untapped hydrocarbon potential.

As danger looms over the globally strategic Strait of Hormuz set off by intense geopolitical turbulence from US and Israel's missile strikes in Iran, Independent Commodity Intelligence Services experts are predicting a sharp surge in Brent crude, surpassing 8% in early Asian trade on 2 March

The prices briefly exceeded US$82 per barrel before easing back above US$78, while WTI traded around US$72. Shipping activity across the Strait of Hormuz has come to a standstill, adversely affecting the Gulf oil and LNG exports. Halt in the movement of LNG tankers since 28 February has disrupted around 120 bcm per year of supply from Qatar and the UAE. To add perspective, this volume is substantial enough to match the gas Europe has lost from Russia since 2021.

The tensions have sharply reflected on the global petrochemical markets as well, with China recording over 6% rise in methanol futures, reacting to supply concerns from Iran, the world’s second largest methanol producer. According to ICIS analysts, the current uncertainties are likely to prevail long enough to overhaul market expectations and pricing behaviour. Brent can potentially reach as much as US$100 per barrel if the closure persists, although renewed US Iran talks could limit further gains.

The missile attacks, which reportedly killed Iran’s Supreme Leader Ayatollah Ali Khamenei, came amid recent nuclear negotiations in Geneva, adding to already elevated crude prices and heightening uncertainty across global energy and chemical markets.

Aramco, Honeywell and King Abdullah University of Science and Technology (KAUST) are collaborating to scale up the development of Crude-to-Chemicals (CTC) technology in a bid to maximise the value of crude oil and reduce costs associated with CTC conversion

The new CTC pathway will entail converting crude oil directly into light olefins and other high-demand chemicals, resulting in improved fuel efficiency, carbon utilisation, and process economics—allowing for more efficient and cost-effective production at scale.

The collaboration aligns with Saudi Arabia’s Vision 2030 by helping to advance economic diversification, build national research and technology capabilities, and strengthen the Kingdom’s position in the global chemicals market, combining academia and industry expertise to accelerate technology development and national capabilities.

Dr. Ali A. Al-Meshari, Aramco senior vice president of technology oversight & coordination, said, “This collaboration with Honeywell UOP and KAUST furthers Aramco's efforts to drive innovation and shape the future of petrochemicals. By harnessing the power of cutting-edge technologies, we aim to enhance energy efficiency and unlock increased value from every barrel of crude. This novel Crude-to-Chemicals process is aligned with our vision of supporting the global transition towards cleaner, high-performance chemical production. Moreover, this initiative demonstrates our focus on contributing to the growth of a vibrant ecosystem, where the deployment of innovative technologies can create lasting value for our stakeholders, our communities, and the environment.”

Rajesh Gattupalli, Honeywell UOP president, added, “This agreement marks a defining moment in our strategic collaboration with Aramco and KAUST – and in the global evolution of Crude-to-Chemicals technology. With Honeywell UOP’s deep expertise in catalytic process design and commercial scale-up, we’re well positioned to drive this innovation forward.”

Yokogawa Electric Corporation has launched OpreX Pressure Transmitter EJX S Series as the successor to its core EJX A lineup of differential pressure and pressure transmitters in its OpreX field instruments family

Building on Yokogawa's proven silicon resonant sensor technology, the EJX S Series offers enhancements in accuracy, long-term stability, and durability that ensure stable plant operations and improve maintenance efficiency. Yokogawa will continue to add new models with enhanced capabilities to the EJX S lineup, according to market needs.

Main features of the OpreX pressure transmitter EJX S Series

1. Improved performance and reliability that contribute to stable plant operation

Leveraging Yokogawa’s silicon resonant sensor technology, the EJX S Series features improved accuracy, long-term stability, and rangeability.

Main specifications:

- Accuracy: ±0.025% (with optional specification code /HAC)

- Long-term stability: ±0.1% per 20 years

- Rangeability: Up to 400:1

- Support for the HART and PROFINET communication protocols

With an IP68 dustproof and waterproof rating, compliance with SIL2 requirements, and enhanced noise immunity, the EJX S Series is even more reliable and robust. In addition, a new colour backlit graphic display significantly improves visibility of process variables and device status information.

2. Streamlined specifications that reduce maintenance and operating costs

Compliance with a variety of explosion-proof standards, support for dual power connections, and advanced diagnostic functions are all provided as standard features with the EJX S Series, allowing these devices to cover a wider range of applications and reducing the need for the ordering of products with specific model and suffix codes. Furthermore, a modular design allows parts replacement and maintenance work to be carried out easily and efficiently. Together, these characteristics help to improve maintenance efficiency and reduce inventory costs.

In addition, the LCD colour display supports NAMUR NE107-compliant alert indications, enabling intuitive recognition of device status even from a distance. This facilitates faster on-site inspections.

3. Reduction of environmental impact through product design

The OpreX Pressure Transmitter EJX S Series pressure transmitters were designed to reduce environmental impact over the entire product lifecycle. CO2 emissions have been significantly reduced during the production process, helping customers reduce their Scope 3 emissions. Furthermore, the adoption of a modular design that allows for easy disassembly and disposal contributes to the optimization of customers' maintenance parts and inventory, as well as a reduction in environmental impact after use.

Major target markets are oil & gas, LNG, downstream, chemicals, power, renewable energy, food & pharma, pulp & paper, iron & steel, mining & metal, water & wastewater.

Major applications are measurement of liquid level, flow rate, pressure, etc. of liquid, gas, and steam in tanks and pipes.

OpreX is the comprehensive brand for Yokogawa's industrial automation and control business. OpreX Measurement delivers highly reliable technology for the implementation of value-enhancing operational technology and information technology integration.

Oil and gas operations in the Middle East span harsh deserts, sprawling refineries and high-risk offshore environments. (Image source: Adobe Stock)

In the oil and gas industry, where every second counts and every decision impacts profitability and safety, robust security is not just a luxury – it's a necessity

From protecting critical assets to safeguarding human lives, security systems must meet the highest standards of reliability and performance.

Pelco, a leader in video security, is uniquely positioned to address the challenges faced by oil and gas companies in the Middle East, offering a fresh perspective on how to optimise security systems seamlessly. With our upcoming online event, we invite you to explore how Pelco can help tackle worker safety, asset protection and operational efficiency in this complex industry.

Addressing oil and gas challenges head-on

Oil and gas operations in the Middle East span harsh deserts, sprawling refineries and high-risk offshore environments. Physical, environmental and digital threats are converging, and security systems must evolve to meet these overlapping demands. Our upcoming online event will focus on three critical areas where Pelco's expertise can make a difference:

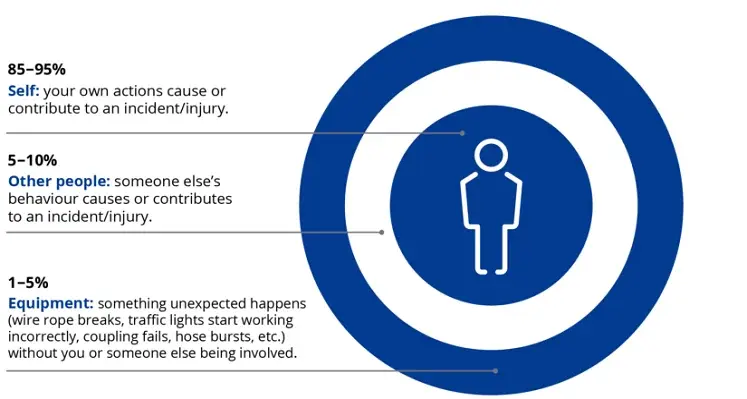

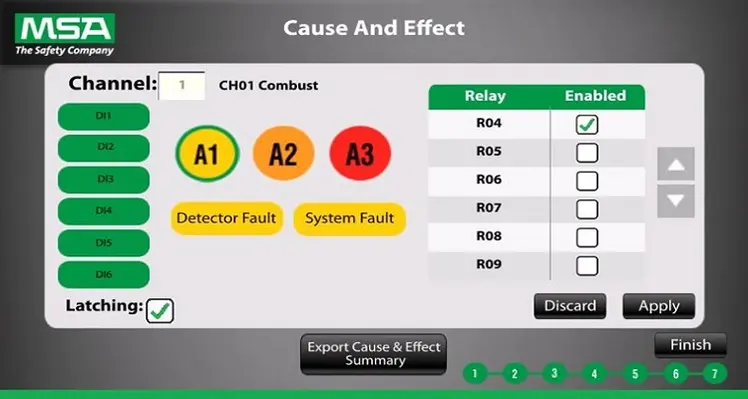

1. Improve worker safety and HSE compliance

Ensuring worker safety is both a moral responsibility and a regulatory imperative. Health, Safety and Environmental (HSE) compliance is a top priority for oil and gas operations. Pelco's advanced portfolio is designed to help you meet these standards.

Edge-based analytics and intelligent video security can be valuable tools in supporting site safety. These systems can help detect safety incidents, such as slips or falls, especially in areas where oily surfaces, heat or dust create additional hazards. When incidents occur in remote areas, automated detection can prompt faster intervention, thereby closing the gap between the event and the response.

Personal Protective Equipment (PPE) compliance is another key safety concern. High temperatures in the Middle East can lead to discomfort, and in some cases, workers may be tempted to remove protective gear, such as hard hats or vests, for temporary relief. In this case, AI-enabled video analytics can help identify instances of non-compliance, enabling safety teams to address the issue before it becomes a liability.

Zone-based behavioural analytics can help detect when someone enters a restricted or hazardous area or remains in a dangerous zone longer than necessary. For example, loitering detection near flare stacks or storage tanks can support situational awareness and proactive incident mitigation.

2. Improve security and asset protection

From refineries in the desert to offshore rigs in corrosive marine environments, your assets operate under pressure, so your security systems must withstand these harsh conditions. In areas where explosive gases or dust particles may be present, even basic equipment can pose risks. That’s why choosing video solutions built for hazardous environments is critical.

ExSite Enhanced cameras, featuring 316L stainless steel construction and certifications such as ATEX and IECEx, are designed for use in hazardous atmospheres. Whether it’s observing pipeline manifolds, wellheads or chemical storage areas, these systems deliver dependable performance in high-risk environments. In corrosive coastal locations, such as LNG terminals or offshore rigs, Pelco’s anti-corrosion models withstand salt spray, humidity and chemical exposure without compromising visibility.

For perimeter defence, long-range Silent Sentinel cameras give security teams early warning of approaching threats, detecting vehicles, vessels or drones from kilometres away in fog, darkness or dust. These systems are especially valuable for remote desert pipelines or unstaffed offshore installations, where rapid detection is critical to prevent disruptions.

3. Minimise downtime and maximise uptime

Every minute of downtime impacts revenue. For oil and gas operations, the cost of unplanned outages is measured in millions of dollars. With Pelco, your video security can become an operational asset.

Radiometric thermal cameras can detect overheating in transformers, compressors and electrical panels, allowing teams to take action before equipment failure occurs. At the same time, Pelco’s camera image health analytics help ensure your video infrastructure is always performing at its best. Our cameras automatically detect issues such as lens obstructions, misalignment or tampering, reducing the need for manual inspections and helping ensure your security coverage is always clear, optimised and ready when it matters most.

Join us to discover the Pelco advantage

We invite you to join our upcoming online event, where industry leaders and Pelco experts will dive deeper into these challenges and solutions. Together, we'll explore how Pelco can be the missing ingredient to supercharge your security and drive operational excellence in the Middle East oil and gas sector.

Don't miss this opportunity to gain actionable insights and position your operations for success. Register now and discover how Pelco can transform your approach to security.

Progress has been reported in developing action plans to reduce methane emissions and end routine flaring. (Image source: Adobe Stock)

Coinciding with COP30, significant progress has been reported in driving forward the aims of the Oil & Gas Decarbonization Charter (OGDC) launched at COP28

The Oil & Gas Decarbonization Charter (OGDC), a global coalition of leading energy companies championed by the CEOs of ADNOC, Aramco, and TotalEnergies and supported by the Oil and Gas Climate Initiative (OGCI), highlights expanded reporting coverage, strengthened action plans for emissions reduction and enhanced collaboration to accelerate industry decarbonisation in its 2025 Status Report: Implementing Action.

The Charter now brings together 55 signatories operating across more than 100 countries, representing around 40% of global oil production. Signatories invested approximately US$32bn in low-carbon solutions including renewables, carbon capture, hydrogen and low-carbon fuels in 2024.

This year, for the first time, the companies shared emissions data based on the OGCI Reporting Framework, laying the foundation for consistent reporting across 55 companies. 50 of the 55 signatories submitted data for this year’s report, covering 98% of OGDC operated production, most of which has received third-party assurance.

Forty-two signatories have now set interim Scope 1 and 2 emissions reductions ambitions for 2030, and 36 have developed corresponding action plans, reflecting tangible progress since the Charter’s 2024 Baseline Report, with six more companies sharing interim ambitions and seven more developing corresponding action plans on methane and flaring.

Extensive collaboration programme

An extensive collaboration programme is underway, with a focus on methane, flaring and reporting. TotalEnergies for example is sharing its AUSEA technology with several national oil companies to strengthen methane detection and measurement. Peer-to-peer exchanges, regional partnerships and technical workshops have strengthened capacities, while engagement with OGCI, the United Nations Environment Programme, the World Bank and many others, are helping scale practical solutions. At the company level, OGDC is helping to embed tailored, industry-specific training programmes.

Dr Sultan Ahmed Al Jaber, managing director, Group CEO of ADNOC, COP28 president and OGDC CEO Champion, said, “Two years ago, at COP28 we came together to create the world’s first truly industry-wide coalition to decarbonise at scale. Together, we are turning the Charter’s words into action by delivering tangible progress, scaling innovation and reporting transparently against our shared commitments.”

Patrick Pouyanné, chairman and CEO of TotalEnergies and OGDC CEO Champion, added, “OGDC is about action and collective delivery. This year we moved from baseline to implementation, with almost all signatories reporting data that covers 98% of operated production and more companies setting 2030 targets backed by plans. This reflects that progress starts with what we measure and a shared reality that this is a journey where we advance faster together. Our focus now is clear. We must cut methane, end routine flaring and report progress consistently. We invite all IOCs and NOCs to join and show measurable results by the next COP.”

Bjørn Otto Sverdrup, head of the OGDC Secretariat, said, “With OGDC, we have established a platform for companies willing to take action and collaborate across North, South, East, West, to share best practices and accelerate decarbonisation – particularly towards reducing methane and zero flaring by 2030.”

“We are encouraged by the progress made, and we look forward to the work ahead.”

At COP30, TotalEnergies announced a US$100mn commitment to Climate Investments Venture Strategy funds, which supports technologies that cut emissions across the oil and gas value chain. Climate Investments (CI) is an OGDC Partner.