QatarEnergy is expected to be the most active explorer in 2025, participating in 13 high impact wells, according to Westwood Energy’s latest insight on Key Wells to Watch in 2025

This reflects the expansion of QatarEnergy’s upstream portfolio in recent years. In 2024, QatarEnergy expanded its presence in Egypt with the signing of an agreement with ExxonMobil to acquire a 40% participating interest in two exploration blocks offshore Egypt, and signed an agreement with TotalEnergies to acquire additional interests in the Orange Basin, offshore Namibia. It has also made recent acquisitions in Mauritania and Lebanon.

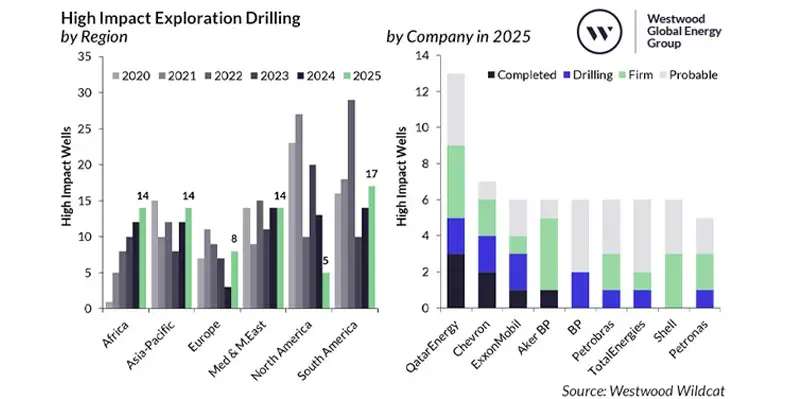

High impact exploration drilling remains stable

Westwood forecasts high impact exploration drilling globally will remain stable in 2025, with 65-75 wells expected to complete, compared to the 69 completed in 2024. 21 frontier wells are expected in 2025, up from 19 wells in 2024, 11 of which are targeting frontier basins, whilst new plays will be tested in the proven Sabah, Rio Muni, Western Black Sea, Suriname-Guyana and Cauvery basins. Emerging play wells are expected to account for around 30% of high impact wells in 2025 while high value prospects in mature and maturing plays are forecast to make up 40%. The Arabian, Campos, Gulf of Mexico, Kutei, Norwegian Sea, Santa Cruz and Santos basins will all have multiple high impact maturing/mature play prospects drilled.

Busy year for Africa

Africa should see another busy year for high impact drilling with 14 wells expected to be drilled. Eyes will be on the Orange Basin, where 7-10 wells are expected to be drilled in 2025, which will be key to determining the ultimate potential of the basin. Elsewhere in Africa, Azule Energy is expected to drill the Kianda-1 well in the outboard area of the Congo Basin, Angola, and there are potential high impact wells being drilled offshore in the Namibe, Rio Muni and Tano basins, as well as potential frontier onshore tests in the Cabora Bassa and Kavango basins.

High impact drilling in North America, on the other hand, continues to decline, with only five high impact wells currently forecast to be drilled in 2025, while South America could see 17 high impact wells, making it the most prolific region globally. They include key wells in Brazil at Andorinha in the Campos Basin, and the Bumerangue well in the Santos, which could extend the pre-salt play further south. Key wells are also expected to be drilled in Columbia and Suriname.

In the Mediterranean, Black Sea and Middle East, 14 high impact wells are expected to be drilled. Key wells to watch are Egypt’s Khendjer-1 well in the North El-Dabaa area of the Mediterranean, and the Nefertari gas discovery in the Herodotus Basin offshore Egypt. Two wells are expected offshore Cyprus, and Matsola offshore Libya is a significant well, exploring the offshore extension of the Sirte Basin. Elsewhere, high impact wells will be drilled in Kuwait, Kazakhstan and the UAE.

14 high impact wells are expected in Asia Pacific, and eight in Europe.