UTEC's products are specifically designed to integrate seamlessly with the regional grid. (Image source: UTEC)

Reliability begins with proximity. At UTEC, we are not just closer to our clients, but we are closer to the future Saudi Arabia is building.

Introduction

Saudi Arabia’s power transformation is no longer a vision; it’s happening fast. As the Kingdom advances toward a diversified and tech-driven economy, localised manufacturing is emerging as a vital enabler. At UTEC, we see it as a strategic imperative rather than just considering it a regulatory requirement. This approach enables national resilience, increased reliance on indigenous manufacturing capabilities, and supports accelerated infrastructure growth.

Today, I want to touch upon the current landscape of localisation in Saudi Arabia and its impact on the Transmission and Distribution (T&D) sector. Being a Saudi company, I would also be highlighting UTEC's role and contributions to the Kingdom’s ongoing economic transformation.

Why local manufacturing is a strategic advantage

The recent chaos, including supply chain backlogs and transport delays, has made our industry realise our excessive dependence on imported technologies. Localisation is fundamentally about regaining control. It reduces our dependence on overseas producers, shields us from global disruptions, and keeps our infrastructure plans on track.

As the CEO of a T&D equipment company, I have witnessed the impact of global supply chain disruptions on critical infrastructure timelines. The recent crises in Western markets have made us aware of the risks of over-reliance on equipment built and manufactured overseas. The events emphasised the point that the development of local capabilities is not only strategically beneficial but also a necessity.

Manufacturing power system technologies in the Kingdom, particularly critical equipment such as transformers and switchgear, are highly valuable. It enables us to complete projects more quickly, serve local stakeholders more effectively, and easily tailor our equipment to meet Saudi Arabia's grid and environmental requirements.

In my view, building an industrial base within the Kingdom is essential. Positioning economic value within our own borders not only strengthens our economy but also holds onto critical knowledge and drives innovation. With domestic demand growing, having robust capacity for production puts UTEC and Saudi Arabia more broadly well placed to enter international markets.

UTEC's commitment to local manufacturing and national growth

As Saudi Arabia advances its localisation agenda and strengthens its power infrastructure, UTEC stands as a long-term contributor to this vision. Our locally rooted operations, product expertise, and close alignment with national goals uniquely position us to support the Kingdom’s transformation in the transmission and distribution sector.

Saudi made

Over the last two decades, UTEC has been producing distribution transformers, unit substations, and medium-voltage switchgear in the Kingdom. Our operations are 100% Saudi-based, and our products are specifically designed to integrate seamlessly with the regional grid.

Engineering for local needs

Transformers and switchgear are not standardised products; they must be tailored to the working conditions of every project, the national standards for every targeted market, through local engineering expertise supported with global expertise and close liaison with clients, UTEC ensures that every system we supply is aligned with site conditions, regulatory compliance, and long-term performance expectations.

Reliable local support

Our domestic manufacturing model is also enhanced by after-sales service and lifecycle support, both of which are essential to ensuring long-term reliability. Customers know they can count on our professionals and technical experts to fix issues quickly and effectively when they inevitably arise. This level of responsiveness isn't typically available with overseas suppliers or off-the-shelf components.

Supporting the Kingdom’s vision

Our alignment with national objectives supporting the localisation efforts of the Ministry of Energy and the SEC's grid modernisation initiative ensures that solutions provided by UTEC meet evolving technical and operational standards, thereby future-proofing the Kingdom's infrastructure.

Empowering scalable power for national development

As Saudi Arabia launches some of the world's most ambitious industrial and infrastructure growth projects, including giga-cities and renewable energy initiatives, power systems must expand more rapidly than ever before.

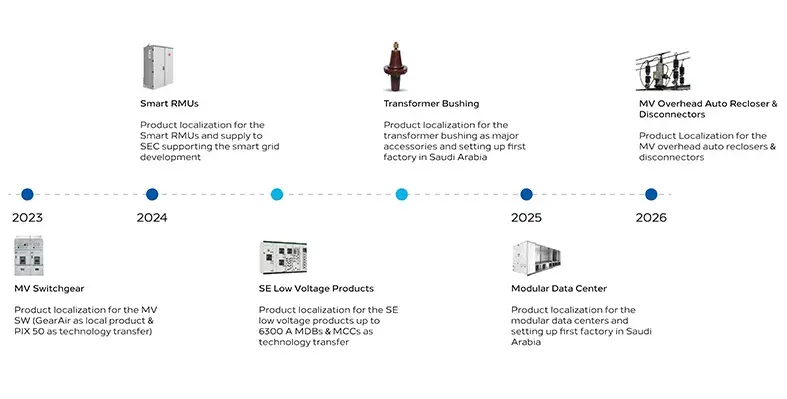

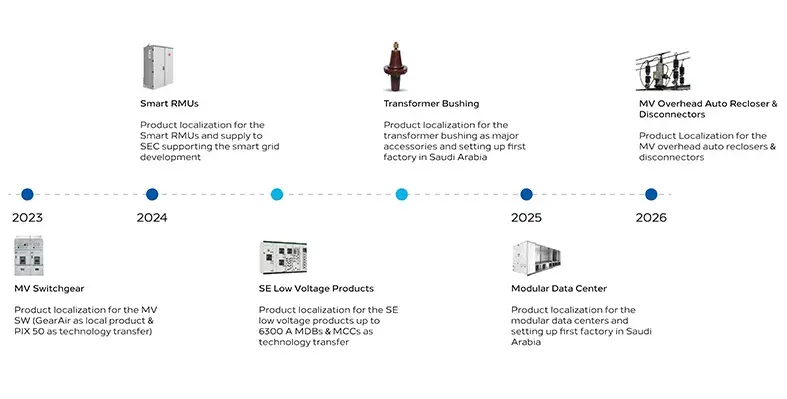

With UTEC, we are working to turn this development into a reality. By manufacturing essential power equipment domestically, such as transformer bushings, as well as establishing the first factory in Saudi Arabia, we aim to alleviate project bottlenecks, minimise procurement risks, and accelerate project schedules.

We facilitate innovative projects, such as NEOM and the Red Sea Project, as well as industrial clusters, with expedited and superior-quality solutions that meet rigorous design, safety, and performance requirements.

In addition, with the Kingdom's increasing diversification of its energy mix through the addition of solar, wind, and hydrogen, the design of equipment needs to be more responsive and flexible. With a presence in the region, we are attuned to such evolution, enabling us to co-create with our partners and seamlessly adapt to changing systems and technical requirements.

Building human capital and technology capability

I believe localisation is not only the local manufacturing of goods, but also the enabling of local talent to create, innovate, and drive the future. It is for this reason that, at UTEC, we have ensured the engagement of local engineers, technicians, and managers in every aspect of our operations. Manpower localisation has also added value in cooperation with Saudi universities for internship programmes, followed by hiring.

It is critical to invest in daily training programmes, experiential technical courses, and continuous knowledge sharing. For me, factories are not simply manufacturing plants but also learning establishments that drive the kingdom’s industrial growth and sustained wealth.

Aligned with national vision—and going beyond

Saudi Arabia’s push for local manufacturing is not just a policy, but a clear national priority included in Vision 2030 and supported by frameworks such as the Local Content and Government Procurement Authority. At UTEC, we are proud to be at the forefront of this effort, not only achieving localisation targets but also exceeding them.

With every transformer and switchgear that we produce locally, we are enhancing the Kingdom's strategic direction. UTEC is creating economic value and helping the country move closer to energy independence. Our commitment goes beyond meeting local content mandates; we strive for excellence in local manufacturing within the power sector.

Beyond the Saudi market, our products are currently serving industries and utilities in more than 23 countries including the UK, Qatar, South America, and Kuwait. Transformers manufactured locally by UTEC are sought across diverse markets of the Middle East, Africa, and Europe. We are also making footprints in Asian economies. Our strong global presence is proof that Saudi Made is not just marked but has become a symbol of quality and innovation.

Conclusion: The future is local and built to last

Saudi Arabia is on an ambitious path towards a cleaner, brighter, and more sustainable energy future. Bringing the vision to life needs more than importing foreign solutions; it demands local commitment, capacity, and capability.

We at UTEC are proud to be a long-standing partner in the Kingdom's vision for energy. We pledge to provide high-quality and dependable power solutions, including transformers, switchgear, and associated electrical equipment, all of which are locally manufactured in Saudi Arabia. Our vision is not limited to serving the local market; we aim to contribute to making the Kingdom a regional hub for energy production and export.

With our partners, we are not just manufacturing equipment, but also fostering trust, and resilience, and laying the foundation for long-term self-sufficiency.

About Author:

Wael Gad, CEO, UTEC

Wael Gad is the CEO and Board Member of Bawan Engineering Group, a subsidiary of Bawan Holding, a public listed KSA company. Bawan Engineering Group consists of several companies operating in the manufacturing and services of Electrical & Digitization equipment (Transformers, Substations, Switchgears, e-Houses, Battery Energy Storage Systems (BESS) and Data Centers). Bawan Engineering Group sells its products in more than 20 countries across the world under the brand UTEC. Wael has more than 30 years of diversified experience across Europe, the Middle East and Africa, leading several multinationals and regional organizations. Wael serves as a board Member of several companies in Saudi & Egypt, he also served as an advisory board director and as a Business Development and governance Advisor with several organizations. Previously Wael was the CEO of Philips Lighting in Saudi, the General Manager of Microsoft MMD in Saudi & Yemen and he also held several C-level assignments for Electrolux across EMEA.