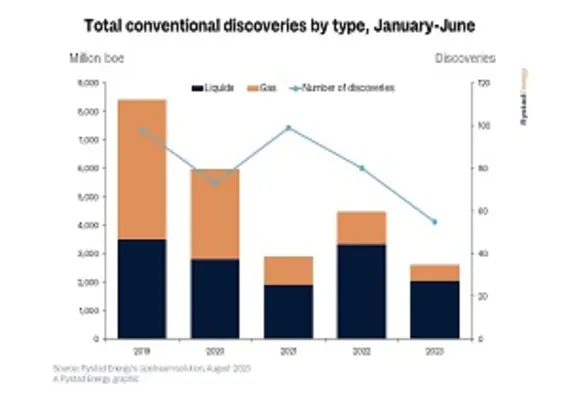

Spending on conventional oil and gas exploration is rebounding and expected to exceed US$50bn this year, the highest since 2019, according to new research from Rystad Energy

Exploration & Production

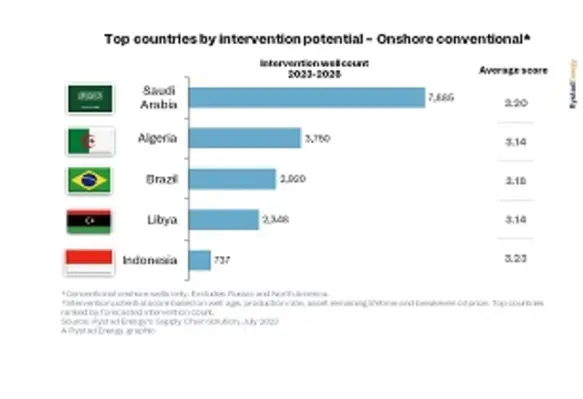

Saudi Arabia top onshore market globally for well intervention: Rystad Energy

Spending on well interventions is projected to jump by almost 20% this year to US$58bn according to research from Rystad Energy, with Saudi Arabia being the top onshore market from 2023-2028

OPEC oil output sees small dip ahead of Saudi cut

According to a recent survey by Reuters, OPECs oil output experienced a modest decline in June, with Iraq and Nigeria raising their production levels, offsetting the cutbacks made by other member countries

Petrofac awarded major EPC contract by ADNOC for new compressor plant

Petrofac, a leading international service provider to the energy industry, has been selected by ADNOC Gas Processing, the ADNOC subsidiary, to undertake a significant new engineering, procurement and construction (EPC) project at its Habshan Complex

PTT Exploration and Production expands to Oman to advance green hydrogen project

PTT Exploration and Production (PTTEP), Thailand’s national energy company, is gearing towards the development of future energy together with five world-renowned companies in a large-scale green hydrogen project in the Sultanate of Oman