Fadi Al-Shihabi, sustainability solutions lead, KPMG Middle East, discusses how decarbonisation is transforming the lubricant oil industry and accelerating the Middle East’s journey to net zero

The lubricant (lube) oil sector is under growing pressure to minimise its environmental footprint as industries worldwide confront the realities of climate change. A rapidly growing industry in the UAE, it is currently estimated at 166.27mn litres, and is expected to reach a staggering 202.68mn litres by 2030. In the Middle East, where the current lubricant market is estimated at 2.94 billion litres and expected to reach 3.31bn litres by 2030, similar trends are evident in Saudi Arabia, Oman, and Qatar.

From the automotive industry to power generation, the lubricant oil sector is a widely growing area. It plays a critical role in keeping engines, machinery, and industrial systems operating efficiently, but its traditional production, packaging, and end-of-life management contribute significantly to greenhouse gas (GHG) emissions.

According to the International Energy Agency (IEA), oil and gas operations, including extraction, processing, and refining, account for approximately 5.1 Gt CO2e annually, or about 15% of global energy sector emissions. To remain on track for net-zero by 2050, these emissions must fall by over 60% by 2030.

The UAE has set itself enormous emissions targets – the UAE Net Zero by 2050 strategic initiative aims to achieve net-zero emissions by 2050 – with stakeholders in key sectors, including energy, implementing projects to decarbonise in line with their needs and growth requirements. Saudi Arabia’s Circular Carbon Economy framework and Oman’s Net Zero 2050 pledge echo similar decarbonisation ambitions.

The deployment and use of clean energy solutions is one of the UAE’s main pillars to address climate change and reduce GHG emissions. The country began financing clean energy projects more than 15 years ago and has invested over US$40bn in the sector to date. The Middle East region as a whole is set to receive over US$75bn in investments for renewable energy projects by 2030, according to a report released by the Energy Industries Council (EIC). Ahead of the COP28 summit in the UAE in 2023, more than 60 top executives from the oil and gas, cement, aluminium and other heavy industries agreed to cut their emissions to meet their climate obligations.

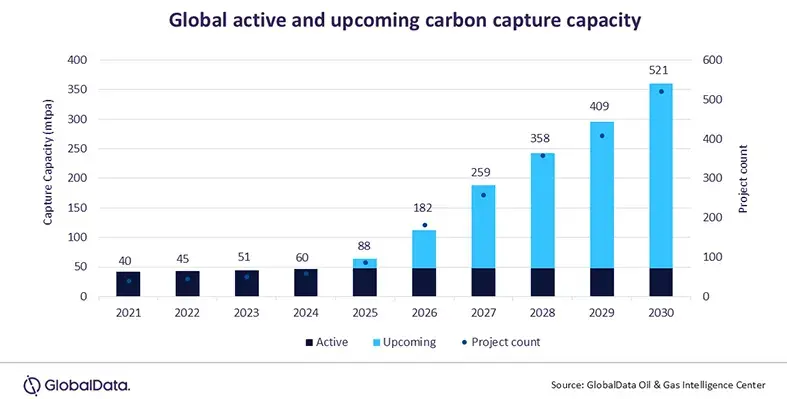

Within the lubricants sector, electrifying process heat, cutting methane leaks, and using low-emissions hydrogen, particularly in energy-intensive refining steps like hydrotreating and hydroisomerisation, are vital for efficiency improvements. These innovations are critical as it is estimated that a single liter of lubricant can generate over 3.5 kg CO₂e. Refineries across the GCC are piloting hydrogen and CCUS technologies to curb emissions in lubricant production.

Innovation powering the lubricants industry

The journey of lube oil begins with crude oil extraction, followed by vacuum distillation to separate heavier fractions suitable for base oil production. These base oils undergo further refining processes such as hydrotreating, hydroisomerisation, dewaxing and other processes, enhancing their viscosity, stability, and longevity.

Recent innovations in catalyst technology and feedstock selection are driving both product quality improvements and emissions reduction. Producers are also blending biomass-derived feedstocks with conventional inputs to create lower-carbon base oils. These bio-based oils perform similarly to fossil-based ones but have less carbon footprint and can be processed using existing infrastructure. Scientists are also exploring entirely renewable base oils.

However, innovation doesn’t stop at production. Digital monitoring tools help reduce lubricant waste during use. For example, Finnish company Lassila & Tikanoja installed real-time oil monitoring across its hydraulic systems and reduced oil use by 13,400 litres over four years, saving around 10 tonnes of CO₂e annually. They also cut lubricant-related emissions by up to 80% through smarter maintenance without affecting performance.

Packaging and handling

When it comes to packaging, manufacturers are increasingly optimising designs by reducing material use and enhancing handling and distribution. While traditional rigid plastics and metals have historically provided the necessary protection, they also present significant challenges in terms of disposal and GHG emissions.

Consequently, the lubricant industry is undergoing a transition toward low-carbon packaging alternatives that can maintain safety and performance while addressing environmental concerns. Lightweighting and design optimisation reduce raw material demand, shipping weight, and CO2 emissions per litre delivered, without compromising safety or performance.

TotalEnergies has been at the forefront with the integration of 50% post-consumer recycled (PCR) HDPE in its premium lube oil bottles, launched in France and Belgium since September 2023. These bottles retain the same weight, design, and performance while significantly reducing the carbon footprint.

Lowering cradle-to-grave emissions

Beyond production and packaging, extending lubricant life is key to decarbonisation. Modern additives have enabled lubricant change intervals to increase from 5,000 km in legacy vehicles to upwards of 30,000 km in modern engines.

Bio-based or biomass-balanced additives further support environmental goals by reducing the emissions linked to additive manufacture and enhancing overall oil performance. The result is less frequent oil manufacture, transport, and disposal.

As the UAE accelerates its journey towards decarbonisation, these steps will be crucial in ensuring the responsible end-of-life management of lube oils. Technological advancements and environmentally friendly formulations will create new growth avenues and set a new benchmark in the UAE’s industrial revolution. As neighbouring countries pursue similar ambitions, regional collaboration in innovation and policy will be key to transforming the Middle East lubricant landscape.