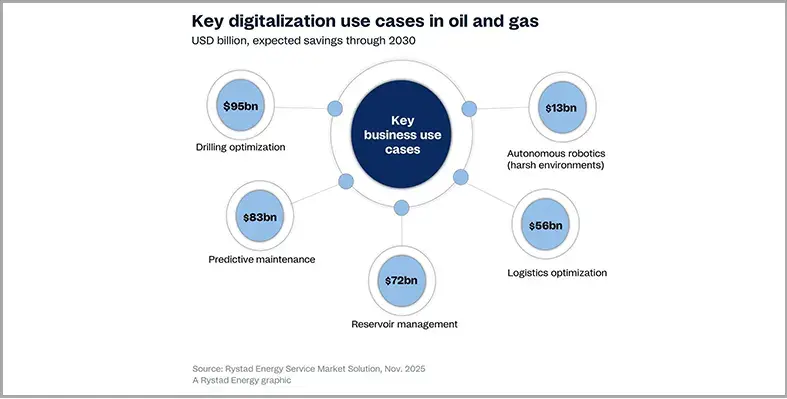

The oil and gas industry could save more than US$320bn in the next five years by further digitalising operations in five key areas, according to Rystad Energy research

The five key areas highlighted are drilling optimisation, autonomous robotics, predictive maintenance, reservoir management, and logistics optimisation.

The oilfield services (OFS) business ecosystem is expected to undergo a significant transformation as continued merger and acquisition (M&A) activity, new business partnerships with technology firms, and greater software integration drive digital-first business strategies for key OFS players.

“We estimate that US$320bn is a modest figure, as broader digital adoption across other business domains could generate even greater value. To realise this, executives will need to deliberately prioritise digital transformation by fostering a less risk-averse business culture,” said Binny Bagga, senior vice president, Supply Chain.

Rystad notes that digital revenue streams offer more stable, resilient growth trajectories that are less exposed to the volatility of upstream capex. SLB expects its digital division’s margin to reach 35% on a full-year basis in 2025, while Viridien’s digital, data and environment (DDE) segment generated US$787mn, growing 17% and delivering adjusted earnings before interest, taxes, depreciation and amortisation (EBITDA) of US$458mn last year.

“The investment community is increasingly valuing energy-technology narratives, with service companies that clearly articulate technology-driven and recurring-revenue strategies often commanding higher valuation multiples than those tied solely to equipment cycles. However, such premium valuations hinge on demonstrated scalability. Emphasising digitalisation is a direct pathway to creating lasting shareholder value,” Bagga said.

Nevertheless, widespread adoption of digital oilfields faces significant barriers, including substantial upfront costs for hardware, software, ongoing maintenance and cybersecurity, which impact smaller firms or those operating with legacy infrastructure in particular. To mitigate these challenges, mid-tier companies are selectively enhancing their offerings with targeted digital capabilities, while smaller niche players and specialised software vendors focus on delivering modular, custom solutions.

A marked trend in digital investment is the growing use of partnerships with technology firms, which complements internal capability building and acquisitions in the digital space. These have increased significantly, with the most significant growth observed in the past two years among leading companies such as SLB, Halliburton, NOV and Baker Hughes. This pattern highlights a clear industry shift toward digital transformation, with large suppliers actively accelerating their collaborations with technology partners in recent years.

Digitalisation could save oil & gas industry more than US$320bn: Rystad Energy

The oil and gas industry could save more than US$320bn in the next five years by further digitalising operations in five key areas. (Image source: Rystad Energy)