US President Trump’s visit to the Middle East has the potential for significantly impacting oil markets, according to energy consultancy Rystad Energy

Brent oil is hovering around US$65/bbl, buoyed by progress made on US-China trade negotiations, which have also eroded some demand side pessimism. In the Middle East, supply side factors will take centre stage, with possible rollbacks of restrictions on Iranian crude exports.

Rystad Energy believes that OPEC+ will continue to add supply to the market while supply elsewhere is reduced due to US sanctions and tariffs.

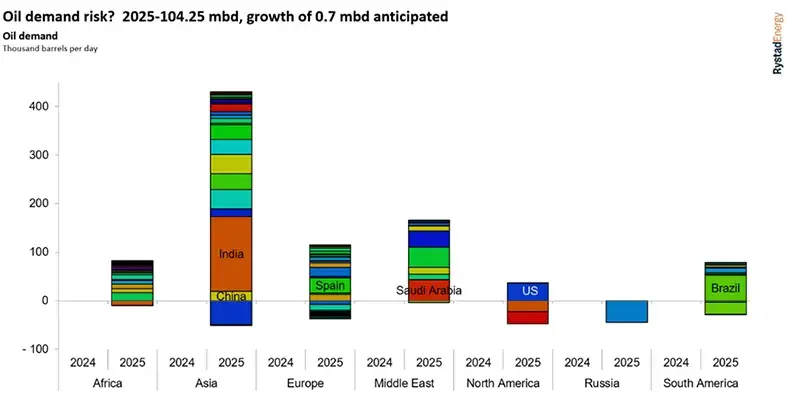

The energy consultancy has reduced its oil demand growth prediction from 1.1mn bpd to 0.7mn bpd on the basis that there will still be some lasting impact on trade flows from the tariffs, even if there are rollbacks. Growth would be led by Asia, and a need for stock build-up ahead of the summer and for geopolitical security could be additional growth factors.

On the supply side, Rystad Energy estimates that the core OPEC eight members’ reversal of planned cuts is due to the declining contributions of OPEC+ members such as Iran, Venezuela and Mexico, owing to sanctions and tariffs. Declining supply from other members is also balancing out the OPEC+ unwind without causing a price slide. On the non-OPEC+ side, the expectation of US crude production in 2025 has been revised downwards to approximately 0.3mn bpd, while new projects in Brazil have the potential to add around 0.4mn bpd in 2025 and 2026.

Overall, Rystad Energy analysis signals upside in oil prices and refinery margins towards the summer.

Mukesh Sahdev, senior vice president, global head oil commodity markets – oil at Rystad Energy commented, “President Trump’s Middle Eastern tour is timed very well, as it is just ahead of Memorial Day weekend, when prices at the pump will play a key role in driving demand. Preventing any oil price spikes in the summer will likely remain central to the president’s agenda.

“Refinery crude demand is on a growth curve between May and August, signalling a more bullish oil price environment.

“With non-OPEC+ producers around the world not growing their production and entering seasonal maintenance, the OPEC+ decision to add extra barrels in May and June fits well into that agenda. This becomes even more important as potential US-China trade resolution erodes demand concerns and GDP risk.

"The big unknown for the market is how US actions related to Iran, Russia and Venezuela will result in supply disruptions or additions. The US could take advantage of softening prices to fill the strategic petroleum reserve (SPR) with Middle East barrels. Will President Trump find middle ground while in the Middle East? Overall, the core OPEC ‘eight’ wield the greatest influence on the oil market’s future trajectory.”