The next global energy transition is already under way, posing risks for some of the world’s largest energy companies, according to a recent study

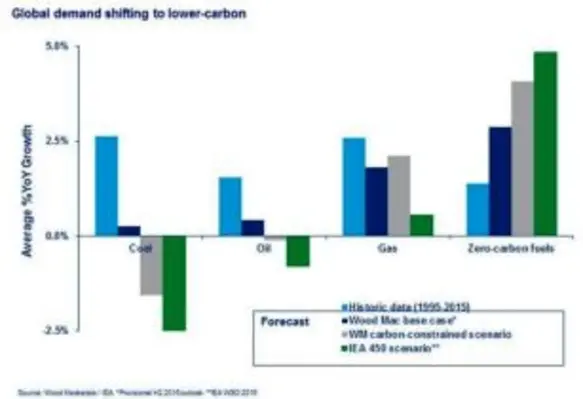

Natural gas and zero-carbon fuels will satisfy at least 60 per cent of the rise in global energy demand to 2035, and under some scenarios renewable energy could grow nearly 500 per cent in the next 20 years. Coal and oil demand could peak well before 2035. As demand for oil slows and energy growth shifts to lower carbon fuels, renewables will grow rapidly across all regions.

The three main risks for global oil majors identified in Wood Mackenzie’s latest study Fossil fuels to low-carbon: The Majors’ energy transition are – The growth in renewable energy, intensifying carbon policy and increasing low-carbon competition. The study investigates how the major oil companies are responding to growing pressure to move to a low carbon-energy environment.

Paul McConnell, research director of global trends for Wood Mackenzie, said, “As carbon policy intensifies, the oil and gas majors will face more regulatory burden and are likely to face increasing costs.

“Green financing could also mean higher cost of capital for more carbon-intensive oil assets such as oil sands, as investors shift to alternative fuels and lower-carbon technologies.”

Wood Mackenzie’s study shows that only 13 per cent of global emissions are currently covered by a price on carbon. The vast majority of the majors’ upstream operations are not yet directly impacted, with most policies primarily focused on the power and industrial sectors.

Up to 50 per cent of the explorers’ production could be hit with carbon costs over the next decade – but only if the countries and regions that currently price carbon extend their policies to the extractives sectors. These are commonly outside the scope of emissions-limiting schemes.

“While all the major oil companies put a price on carbon in their long-term planning, the big question is how much risk each has taken into account,” said McConnell. Assumptions vary greatly by geography, timeline and on price from between US$6 to US$80 a tonne.

“As costs for renewables and energy storage continue to fall, ‘subscription’-type services could open up new low-carbon growth markets.”

According to the study, the global major oil companies are under pressure to de-risk their existing business models and diversify into low-carbon energies. However, diversification into renewables will be challenging. It will be difficult to both justify allocating already scarce capital to low-returning projects and transform existing business models.

“The timing of a transition to low-carbon energy will be critical,” added McConnell. “Diversifying to renewable energy will be a balancing act. Moving too quickly could leave money on the table from the Majors' fossil fuels business. But too slowly, and they could miss their window of opportunity. The biggest risk for oil and gas companies is to do nothing, and be left exposed to investors making their own minds up.

“There is notably an emergence of three different strategies by the major oil companies – decarbonise, capitalise or grow. The Majors are testing different strategies to decarbonise and mitigate risks, to capitalise by using existing capabilities to explore opportunities in renewables and to grow a profitable and substantial renewables business.”

“Regardless of the diverging strategies, the majors are all increasing their share in gas while also aiming to push down the cost curve,” according to McConnell.

“Global carbon risks could depress oil prices for the long-term with slowing demand and an increase in costs, making it crucial for the majors to push break-evens down further. To facilitate the move to low-carbon energy policies, new skills will be needed through joint ventures or acquisitions.”

While there is strong rhetoric on diversification into renewables, a much greater proportion of capital will be needed to deliver a material shift.