OPEC+ members have extended the voluntary adjustments of 1.65 million bpd announced in April 2023 until the end of December 2026

The organisation has extended the additional voluntary adjustments of 2.2 million bpd announced in November 2023 until the end of March 2025, delaying the phase out from September 2025 to September 2026.

New compensation schedules for overproducing countries will be submitted by the end of December 2024.“Oil markets have been anxiously awaiting this OPEC+ meeting since the US election results made clear a Trump 2.0 presidency was on the horizon. Trump’s tariff-forward stance toward China and persisting weak demand provided the group with all of the encouragement needed to extend production cuts until the first quarter of 2025. The overall signal to the market is constructive and will likely prevent any price downsides in the short term. The announcement makes crystal clear that the group is worried about both a potential supply glut and a lack of compliance with production targets among member countries,” said Mukesh Sahdev, global head of commodity markets, Rystad Energy.

The latest OPEC+ announcement hints that compliance among members is a concern, Rystad says. The organisation, however, has maintained that monthly changes can be paused or reversed at any time.

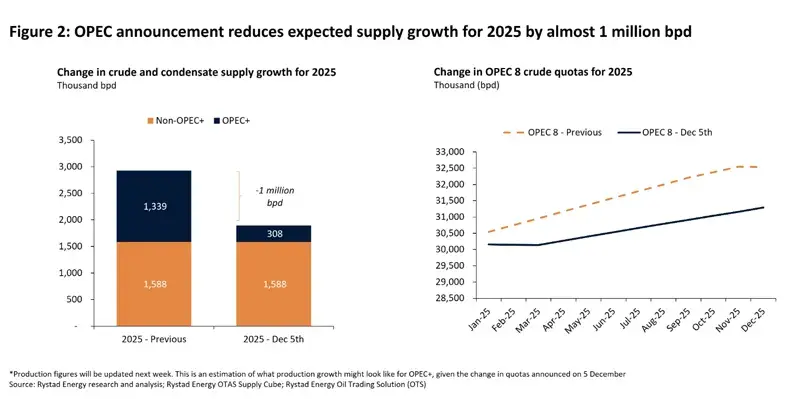

With the latest announcement, the production profile and oil balances clearly indicate an acknowledgment of the emerging supply glut without the extension in 2025.

The phase out of cuts shift from 12 months to 18 months is constructive for the crude balances for 2025, with a swing from average 0.7 million bpd surplus to average 0.3 million bpd deficit.

The confirmation that the UAE’s new baseline (300,000 bpd higher) will only start in April 2025 and will be gradually phased in over an 18-month period establishes the country's firm commitment towards OPEC+, Rystad says.

Rystad believes that the non-OPEC+ supply has not posed much of a concern for OPEC+.