OPEC+ has agreed to pause oil production hikes for the first quarter of 2026 as it slows down its push to regain market share amid fears of a looming supply glut as well as geopolitical uncertainty around Russia/Ukraine peace negotiations and US/Venezuela tensions

The eight OPEC+ countries – namely Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman – have been raising oil output month by month since April this year, but will pause production increments in January, February and March 2026 “due to seasonality”, according to an OPEC statement.

The statement said the countries will adopt a cautious approach and retain full flexibility to continue pausing or reverse the additional voluntary production adjustments, reiterating that the 1.65 million barrels per day may be returned in part or in full subject to evolving market conditions and in a gradual manner. The countries will continue to closely monitor and assess market conditions.

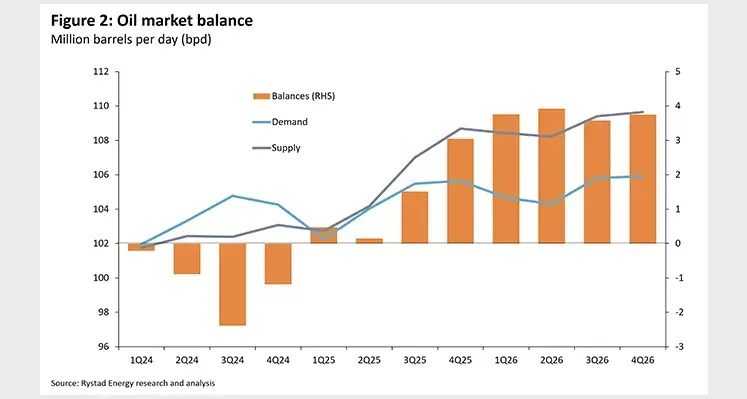

Jorge Leon, head of geopolitical analysis at Rystad Energy commented, “The message from the group is clear: stability outweighs ambition at a time when the market outlook is deteriorating rapidly. Global balances are shifting toward a significant oversupply next year, with Rystad Energy estimating a surplus of 3.75mn bpd of liquids in 2026, one of the largest projected gluts in recent years. Against this backdrop, any additional barrels from OPEC+ would risk deepening the price decline that is already visible across the forward curves.

“For producers that are heavily reliant on oil revenues, holding back supply now is becoming less of an option and more of a necessity.”

Preserving optionality, rather than committing to a new production path, allows OPEC+ to react quickly if conditions worsen or if geopolitical events unexpectedly tighten supply, Leon noted.

“The alliance must balance its desire to regain market share while stabilising prices with the realities of political fragmentation, both within the group and across the global stage. The latest decision underscores how difficult that balance has become. OPEC+ is trying to manage a market moving toward oversupply while navigating geopolitical shocks that could arrive without warning.

“The result is a strategy rooted in caution, one that leaves room for rapid adjustment but also highlights the complex, fragile nature of the alliance’s current position.”

The delay in setting individual production quotas is a “clear indication of unresolved tensions”, he added.

Oil prices rose slightly on 1 December following the OPEC+ decision, with Brent standing at just over US$63, while Ukrainian drone attacks on Russian tankers have exacerbated concerns over supply disruptions.

OPEC+ pauses oil output increases

Global balances are shifting to oversupply next year. (Image source: Rystad Energy Research & Analysis)