The three oilfield services (OFS) majors – SLB, Halliburton and Baker Hughes – all posted robust results for this year’s first quarter and saw steady growth year-on-year, with the Middle East being a key region for all three

According to analysis from Rystad Energy, SLB, Baker Hughes and Halliburton are on course for strong financial performances in the coming quarters after they all posted a strong set of results for the first three months of the year. All three posted improved topline numbers, margins and cash flow in the first quarter as against the comparable period a year earlier.

Following a similar strategy to many exploration and production (E&P) operators, the trio have also focused on returns to shareholders and increasing dividends. With energy security being a priority for most countries and supply chains remaining capacity constrained on many fronts, Rystad Energy believes market fundaments necessary for OFS players to boost their financial performance will remain strong for the rest of the year.

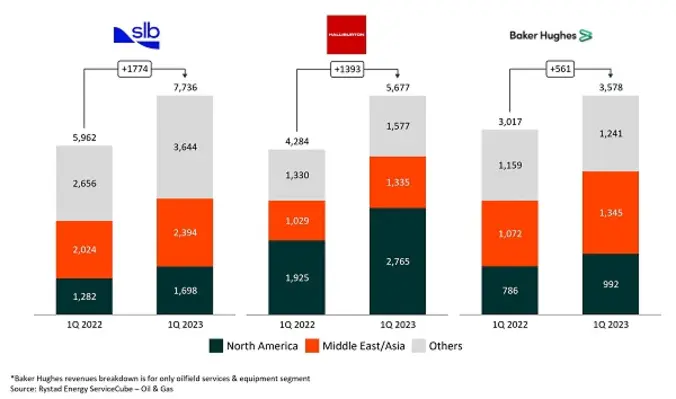

SLB saw first-quarter revenues increase by close to 30% YoY, fuelled by growth in the well construction and production systems segments. Halliburton posted more than 30% YoY growth in the first quarter, supported mainly by the completion and production unit, while Baker Hughes saw revenues surging 18.2% YoY in 2023 on the back of higher volumes across both the oilfield services and equipment (OFSE) and industrial and energy technology (IET) business segments.

Regionally, the three companies reported growth in revenues stemming from across the globe as demand for drilling activity rose. A key region for the three players was the Middle East, with Baker Hughes’ OFSE segment bringing in 23% higher revenue in the Middle East and Asia. For Halliburton, growth in the Middle East came from Saudi Arabia where all product lines saw improved activity, further supported by improved well construction services and increased project management activity across the region. SLB also posted double-digit growth from the region as drilling, intervention and evaluation activity picked up in Saudi Arabia, the UAE, Qatar and Oman, including weather-impacted simulation activity in Saudi Arabia.

Revenues of the major OFS trio by reported geography (US$mn)

The Middle East is already set to exceed all the other regions this year in terms of the offshore upstream sector, driven by massive projects in Saudi Arabia, Qatar and the UAE, Rystad noted. Around US$33bn is set to go on offshore investments in the Middle East in 2023, a near doubling of the US$17bn seen just two years ago. Huge demand for oilfield services in the region is pushing up prices in the supply chain due to capacity constraints, with a 30% YoY increase in demand for jackup rigs.

The Middle East is already set to exceed all the other regions this year in terms of the offshore upstream sector, driven by massive projects in Saudi Arabia, Qatar and the UAE, Rystad noted. Around US$33bn is set to go on offshore investments in the Middle East in 2023, a near doubling of the US$17bn seen just two years ago. Huge demand for oilfield services in the region is pushing up prices in the supply chain due to capacity constraints, with a 30% YoY increase in demand for jackup rigs.

All three continued to expand their footprint in the low-carbon energy sector. SLB’s new energy division reported an increase in participation in the carbon capture and storage (CCS) market, with the company now involved in more than 30 projects globally. Baker Hughes entered two alliances during the first quarter of 2023 aimed at solidifying its presence in the low-carbon energy sector. With its existing presence in the geothermal market, Halliburton strengthened its core business by entering a joint venture for emissions management software with Siguler Guff, and introduced three new clean energy companies to its Halliburton Labs offshoot.