Oil prices have risen following Saudi Arabia’s announcement that it will cut oil production by one million bpd in July, with the possibility that this could be extended

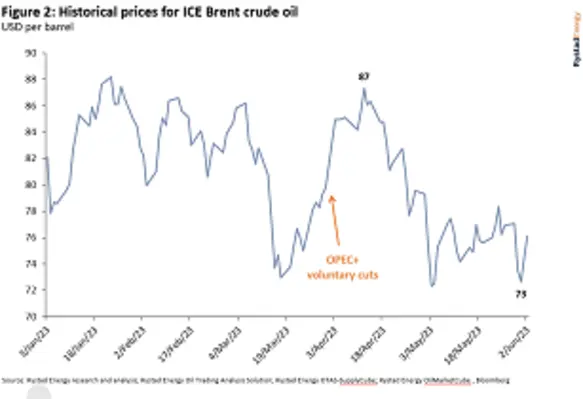

Despite cuts implemented by OPEC + in April, the macroeconomic situation led to the oil price dropping to its lowest level since the invasion of Ukraine, which had sent oil prices soaring. Brent crude oil rose to around US$77 a barrel on Monday 5 June following the news of the Saudi production cut, which was announced by the Saudi Energy Minister, Prince Abdulaziz bin Salman, following the OPEC and OPEC+ meetings in Vienna.

“We will do whatever is necessary to bring stability to this market,” Prince Abdulaziz said. The IMF estimates that the Kingdom needs an oil price of at least US$80 to fund its ambitious mega project plans.

Other members of the Opec+ group agreed to maintain the current production cuts in a bid to bolster flagging prices. Opec+ agreed to drop production targets by a further 1.4mn bpd from 2024 to 38.7mn bpd, with some members, notably Russia, Nigeria and Angola, shouldering significant production cuts. The UAE, however, will receive an extra 200,000 bpd allocation.

“This move will add limited short-term upside price pressure in the coming weeks, according to our projections,” commented Jorge Leon, senor vice president at Rystad Energy.

“The long-term price development will hinge on macroeconomic sentiment and the possible extension of the voluntary Saudi Arabian production cut beyond July. The pure possibility of the Saudi production cut extending beyond July will limit downside price pressure for the rest of 2023.”

Jim Burkhard, vice president and head of Research for Oil Markets, Energy and Mobility, S&P Global Commodity Insights commented, “S&P Global Commodity Insights estimates the cut will lower Saudi Arabia’s crude oil production from 9.9 mn bpd in June to 8.9mn bpd in July. The latest Saudi cut is unilateral, whereas the one announced before this in April was in coordination with several countries. Before that, in 2021, Saudi Arabia did cut on a unilateral basis as it has done on occasion in the past.

“The oil market faces headwinds from an uneven re-opening of China’s economy, US banking problems, high interest rates, and strong oil production growth outside of OPEC+ including from the United States, Canada, Brazil, Norway and Guyana. In terms of world oil demand and supply fundamentals, the cut will likely expand a previously expected supply deficit in the third quarter of this year. Prices have been weak lately and the impact of this cut remains to be seen.”

To read more about the cuts implemented in April, click here.