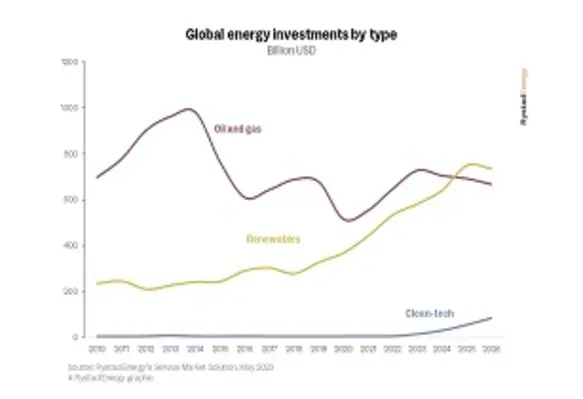

Global energy reliability concerns are triggering a temporary surge in oil and gas investments, according to Rystad Energy

The energy consultancy warns service companies should capitalise on this now before the focus returns to the energy transition. After Russia invaded Ukraine, expected investments in fossil fuels in 2022 and 2023 surged by US$140bn, Rystad Energy research shows. Before the war, the two-year total was projected at US$945bn, but as the war sparked shortages and high prices, expected spending has jumped to almost US$1.1 trillion.

Of the US$140bn growth, shale production accounted for an additional US$80bn increase, as activity climbed 30%, and pricing for oilfield services jumped nearly 50%. Offshore production accounted for US$40bn in growth, while other onshore activities expanded by an additional US$20bn.

“Service companies should make the most of this upturn now, while keeping one eye firmly on the future. The energy transition is not slowing down; huge waves of investments in renewables and clean tech are on the horizon. So, to ensure their long-term success, service companies should adapt their offerings now to capitalise fully on the inevitable green revolution,” said Audun Martinsen, head of supply chain research at Rystad Energy.

Energy security concerns have unlocked significant additional investments in oil and gas, boosting spending forecasts. The first wave of extra spending over the past 15 months mainly went to oil and gas, while low-carbon industries faced a slowdown due to high inflation and shortages in the supply chain. But low-carbon spending will bounce back, as energy security is not only about securing oil and gas here and now but also about securing cleaner energy for the future, Rystad predicts.

The US Inflation Reduction Act and the recently announced Critical Raw Mineral and Technology Acts in the European Union will strengthen investment in the renewable and clean-tech sectors. Solar, wind, carbon capture, hydrogen, and batteries are all markets that will benefit from supportive policies to accelerate low-carbon deployment and build up local supply chains.

“Gaining control of the supply chain is crucial for countries and regions to become less dependent on global value chains,” said Martinsen.