The oil and gas industry’s overall disclosed contract value witnessed a quarter-on-quarter (QoQ) decrease of 26% in Q3 2023, according to the latest report from GlobalData, although the Middle East performed well, dominating the main contracts awarded

The report, "Oil and Gas Industry Contracts Analytics by Sector, Region, Planned and Awarded Contracts and Top Contractors, Q3 2023,” reveals that the overall contract value decreased from US$57.4bn in Q2 2023 to US$42.6bn in Q3 2023. At the same time, the contract volume also saw a drop from 1,425 in Q2 2023 to 1,128 in Q3 2023.

However, the Middle East performed strongly in terms of contracts awarded in this quarter. QatarEnergy was the leading issuer in Q3 2023, followed by Aramco, ADNOC, Eni and Equinor. Main contractors were HD Hyundai, National Marine Dredging Co, Saipem, Tecnicas Reunidas and Larsen & Toubro.

Some of the notable contracts during the quarter include HD Hyundai Heavy Industries’ agreement worth QAR14.2 billion (US$3.9bn) with QatarEnergy for the construction of 17 ultra-modern Liquefied Natural Gas (LNG) carriers, as part of the North Field LNG expansion and Golden Pass LNG export projects as well as long-term fleet replacement requirements in Qatar; and National Petroleum Construction Co (NPCC) and Tecnicas Reunidas consortium’s AED13.1bn (US$3.6bn) contract from ADNOC Gas for the expansion of gas processing infrastructure at the Habshan complex in Abu Dhabi, United Arab Emirates.

McDermott International’s major contract ranging between US$750mn - US$1.5bn from Qatargas Operating Company (Qatargas) for the Engineering, Procurement, Construction, and Installation (EPCI) services for the North Field Production Sustainability (NFPS) COMP1 - offshore fuel gas pipeline and subsea cables project in Qatar, is the other major contract in the quarter.

Pritam Kad, Oil and Gas analyst at GlobalData, commented, “The ongoing geopolitical tensions and the unpredictable fluctuations in crude oil prices are significantly dampening the overall sentiment within the oil and gas sector. This is translating into a notable slowdown in projects/contracts activity reflecting a cautious approach among key stakeholders.”

The upstream sector reported the highest number of contracts with 858 contracts during Q3 2023.

The offshore segment recorded 587 contracts, including contracts for the construction and charter of drilling rigs, FPSO, Anchor Handling Tug Supply (AHTS), Platform Supply Vessel (PSV), LNG, Very Large Crude Carriers (VLCC) and Very Large Gas Carriers (VLGC), provision of digitalisation solutions to enhance subsea intervention and commissioning services, provision of Remotely Operated Vehicles (ROVs), and top drive, wellhead, subsea equipment and services and EPC works.

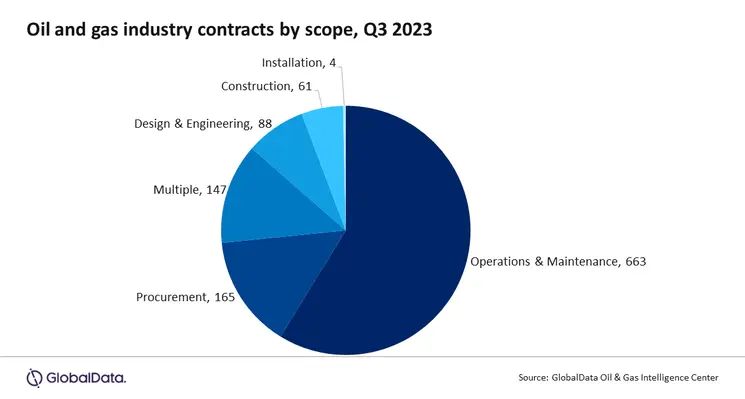

Operations and Maintenance (O&M) represented 59% of the total contracts in Q3 2023, followed by procurement scope with 15%, and contracts with multiple scopes, such as construction, design and engineering, installation, O&M, and procurement, which accounted for 13%.