The oil and gas industry reported a quarter-on-quarter (QoQ) decline of 16% in disclosed contract volume in Q4 2023 according to a GlobalData report – but contract value increased marginally, thanks to major Middle East contracts

GlobalData’s latest report, "Oil and Gas Industry Contracts Review by Sector, Region, Terrain, Planned and Awarded Contracts and Top Contractors and Issuers, Q4 2023," reveals that disclosed contract volume declined from 1,401 in Q3 2023 to 1,172 in Q4 2023, while the overall contract value marginally increased from US$46bn in Q3 2023 to US$48bn in Q4 2023. ADNOC, Aramco and Kuwait Petroleum represented three of the top five contract issuers, according to the report.

ADNOC contracts pivotal

Pritam Kad, Oil and Gas analyst at GlobalData, commented, “The significant contract value in the quarter was largely driven by Tecnimont, Saipem, and NPCC's significant contracts with ADNOC totalling US$8.7bn and US$8.2bn, respectively, for the Hail and Ghasha Development Project in Abu Dhabi, the UAE. These contracts were pivotal in elevating the oil and gas contracts landscape, potentially boosting opportunities for further growth and collaboration in the region.”

With the ADNOC contracts, Tecnimont will oversee the construction of an onshore processing plant, including gas processing units, sulphur recovery sections, utilities, offsites, and export pipelines. While Saipem and NPCC will handle the Engineering, Procurement, and Construction (EPC) of drilling centres, processing plants, and various offshore structures on artificial islands for the Hail and Ghasha Development Project.

In the petrochemical sector the Middle East again featured strongly in terms of notable contracts, such as SGC eTEC E&C’s EPC contract from Sipchem and Tasnee for the expansion of an ethylene cracker plant in Al-Jubail, Saudi Arabia.

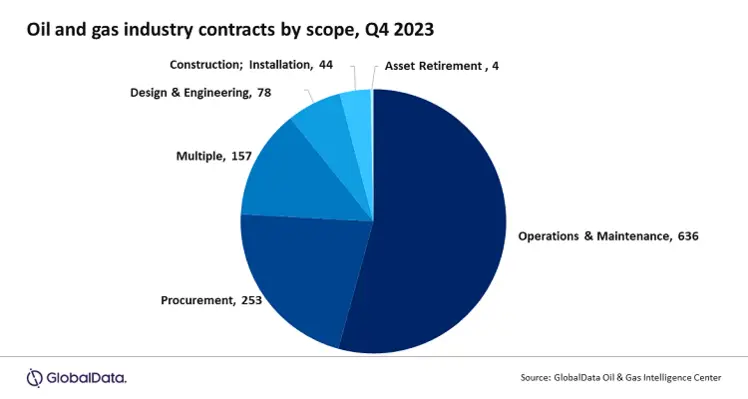

Operations and Maintenance (O&M) represented 54% of the total contracts in Q4 2023, followed by procurement scope with 22%, and contracts with multiple scopes, such as construction, design and engineering, installation, O&M, and procurement, which accounted for 13%.

Kad concluded, “Despite facing challenges in the market environment, the oil and gas industry has demonstrated resilience. This is evident from the slight increase in total contract value, despite a significant drop in disclosed contract volume. Looking ahead, it is imperative for the industry to prioritise strategic investments and forge partnerships to navigate uncertainties and foster sustainable growth.”