Demand from the Gulf Cooperation Council (GCC) countries is forecast to boost MENA land rig demand by almost 50% from 2023-2027, according to the latest edition of Westwood Global Energy Group’s World Land Drilling Rig Market Forecast.

The GCC is expected to remain a hotspot for drilling activity, underpinned by the need to meet local production demand and government targets.

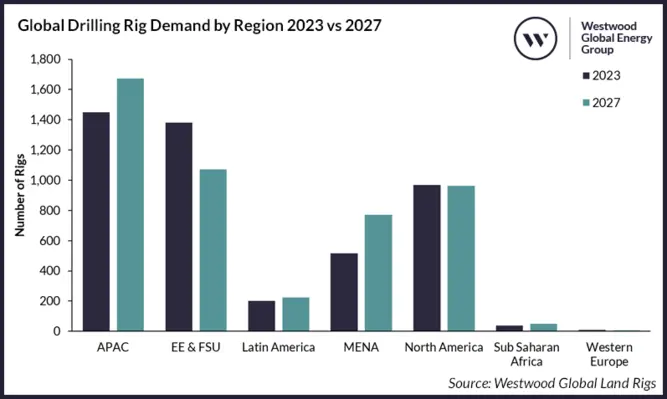

Westwood reports that the land drilling rig market continues to recover from the lows seen in 2020 and 2021, with demand for rigs totalling an estimated 4,559 in 2023, an increase of 4% on 2022 and 32% on the low point of 2020. Driven by an average of 51,125 wells drilled per year, Westwood forecasts that global land drilling rig demand will average 4,718 units between 2023 and 2027. This is a 6% improvement on the hindcast average of 48,000 wells drilled annually and a 14% increase in rig demand, which averaged 4,151 between 2018 and 2022.

The demand outlook is, however, relatively mixed on a regional level. China is forecast to lead demand, accounting for 28% of the global total, boosted by a drive to increase domestic production, which is expected to lead to an increase in drilling deeper wells in shale gas plays and increase activity at mature oilfields. Demand from the Gulf Cooperation Council (GCC) countries is forecast to see demand in the Middle East and North Africa (MENA) region grow by almost 50%. Elsewhere, the continued development of the Vaca Muerta Shale Basin in Argentina is supporting increased demand in Latin America, despite declines in many other countries in the region.

This positive is counterbalanced by a relatively flat outlook for the US, where strict capital discipline and increasingly technical well management programmes are reducing the number of wells being drilled. Given the impact of Western sanctions due to the ongoing conflict with Ukraine, a negative outlook is forecast for Russia.

As of November 2023, the global capable rig fleet is estimated to be over 9,000 rigs, well above the estimated demand over the forecast. As a result, despite the generally positive outlook, utilisation is expected to average 52% over the forecast, reflecting the continued oversupply in the market. Though the overall market is expected to remain oversupplied through 2027, demand for high horsepower rigs (2,000+ HP), which accounts for less than 1,400 of the total capable rig fleet, is expected to be strong in places such as China and the GCC countries. Should high-spec rig construction, or rig moves from other areas, not keep pace with demand, there is some potential that these regions will be undersupplied with high-spec rigs in the later years of the forecast.

Sustained oil prices have supported an increase in global drilling activities in 2023. Provided oil prices continue to trade above $75/bbl as Westwood expects, a positive outlook remains on the horizon for rig contractors, especially those with high-spec rigs as E&Ps continue to drill more complex wells and aim to maximise the value from each well drilled. Regional disparities will remain for rig demand, with China and countries in the GCC expected to remain hotspots.