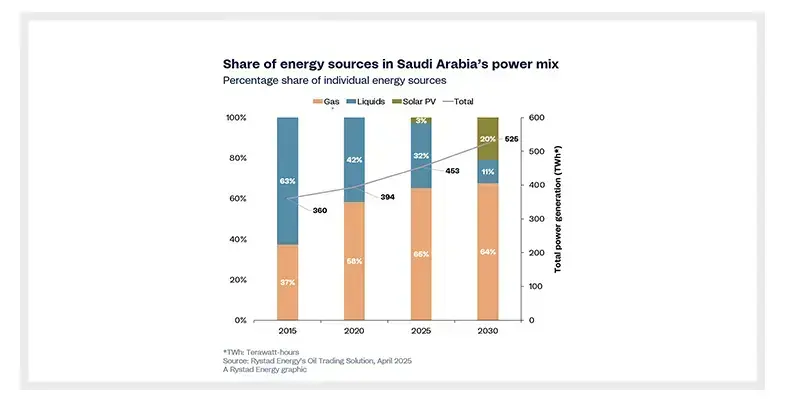

Gas is set to increasingly displace oil used for power generation and industrial facilities in Saudi Arabia thanks to the giant Jafurah unconventional gas project, according to Rystad Energy analysis

By tapping into unconventional gas, Saudi Arabia could displace up to 350,000 bpd of crude burn by 2030, according to Rystad. The increased gas supply would not only curb domestic crude use but also free up more oil and refined products for export, strengthening the country’s position in global energy markets. This shift comes at a critical time, as oil product demand in Saudi Arabia is projected to rise by approximately 100,000 bpd between now and 2030, largely driven by increasing consumption of gasoline and diesel.

The Jafurah unconventional gas field, the largest liquid-rich shale gas play in the Middle East, contains an estimated 200 trillion standard cubic feet (scf) of natural gas. The Jafurah project, set to start production this year, is a key component of Saudi Arabia’s Vision 2030, which seeks to boost gas production by 60% from 2021 levels while diversifying the nation’s energy mix. The project will see more than US$100bn in investment in the next decade, positioning Saudi Arabia as the world’s third-largest shale gas producer.

“Saudi Arabia is stepping up investment in natural gas as a cleaner, lower-carbon alternative to oil and coal. This strategic pivot, alongside the OPEC+ decision to cap Aramco’s oil production at 12 million barrels per day by 2027, is designed to support price stability while increasing domestic gas consumption. Output is projected to climb to 13 billion cubic feet per day (Bcfd) by 2030, setting the stage for a major expansion in gas supply. This will allow the nation to redirect more crude for export, reinforcing its influence in the global energy landscape. As the initiative advances, the success of this shift will depend on robust midstream infrastructure, downstream integration and deeper-zone drilling campaigns,” said Pankaj Srivastava, senior vice president, Commodities Markets – Oil.

On the domestic front, the economics of fuel switching continue to favour gas over crude for power generation, resulting in operational costs that are six to eight times lower per kilowatt-hour. These cost advantages underpin Saudi Arabia’s strategy to replace crude with gas in its power mix, enabling the Kingdom to redirect more crude toward export markets and strengthen fiscal returns, says Rystad.