The U.S. has issued new sanctions intended to hit Iran's oil exports, including what the State Department said were the first U.S. measures targeting a Chinese "teapot refinery" (small independent refiner) processing Iranian crude

This latest round of sanctions, signalling a growing determination to pressurise Iran into a new nuclear deal, could have consequences far beyond Iran itself, says Rystad, with the potential to reshape geopolitics, disrupt the global economy and send shockwaves through energy markets.

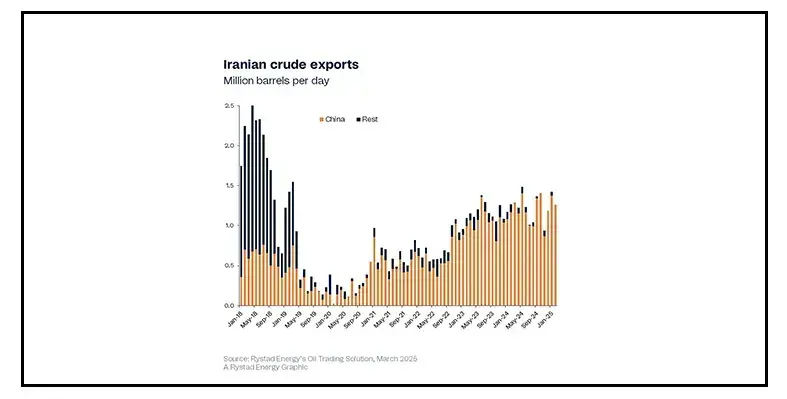

Escalating pressure could drive oil prices higher, conflicting with US President Donald Trump's goal of lowering energy costs to fight inflation. Rystad Energy’s data on oil trade flows shows that almost all Iranian crude exports make their way to China, so achieving effective maximum pressure would require cooperation from the Chinese government.

“Targeting a Chinese buyer may also signal pressure on China, the largest importer of Iranian oil, to reduce or cease its purchases. This is the fourth round of sanctions, and the pressure is intensifying with each one. Just days before, the US had revoked a sanction waiver that allowed Iraq to purchase electricity from Iran, further tightening the economic squeeze on Tehran,” said Jorge León, head of Geopolitical Analysis at Rystad Energy.

Rystad Energy analysis suggests that, if Iran remains unresponsive, the US could introduce further sanctions. In addition, the recent drop in oil prices, partly due to the decision by OPEC+ to increase production, might create a favourable environment for the US to impose stricter sanctions on Iran.

“With oil prices hovering around US$70 per barrel, the current market conditions could give the US a strategic edge. OPEC+ may be ramping up production in anticipation of potential US sanctions, helping to offset a loss of up to 1.5mn barrels per day of Iranian exports without destabilising global oil prices,” added León.

Escalating U.S./Iran tensions could hit energy markets: Rystad Energy

The majority of Iran's oil exports go to China, in the face of US sanctions. (Image source: Rystad Energy)