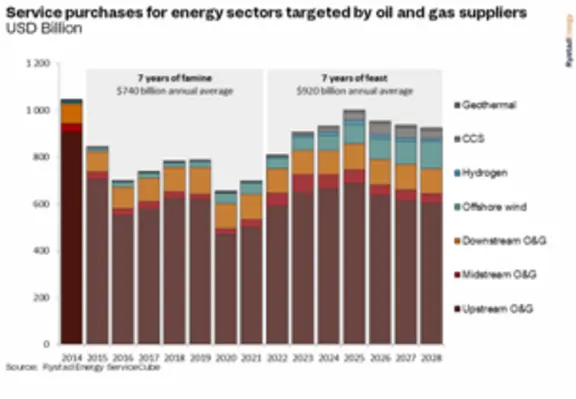

The global market for oil and gas contractors is expected to rise to a peak of US$1 trillion in 2025 and remain at high levels for several years thereafter, according to Rystad Energy

Helped by strong growth in the midstream part of the industry to liquefy, transport, and re-gasify natural gas, overall oil and gas spending is forecast to stay above US$920bn annually on average for the 2022-2028 period, according to the energy consultancy.

Despite the risk that another downturn cycle in oil and gas may occur after 2025, oilfield service suppliers should be able to branch out into other parts of the wider energy market – such as geothermal energy, hydrogen, offshore wind, and carbon capture, utilisation and storage. Together with oilfield services, this expansion into other energy areas could provide a US$1 trillion market for suppliers by 2025, which could be sustained for several years after that.

Overall utilisation is improving rapidly as suppliers are careful not to over-invest in more capacity, which has driven up prices for offshore rigs, land rigs, frac fleets, proppant, OCTG, vessels, and subsea infrastructure to levels not seen in a decade.

“All signs point towards 2022 being the start of another super cycle for the energy services sector,” said Audun Martinsen, partner and head of energy service research at Rystad Energy.

Last year was a turning point, with the post-pandemic recovery and record high gas prices and strong oil prices, allowing oil and gas companies to lift their oil and gas investments by 20%. Energy security concerns prompted petroleum producers to raise production and contract goods and services from suppliers, and the oilfield service industry was quickly sold out of fracking fleets, rigs, and casing and tubing steel. The prices that suppliers could charge surged by double-digit percentages, allowing EBITDA margins to climb.

“After the rebound in 2022 we are entering a very promising 2023, with potential for 13% growth both for oil and gas investments and 10% for low-carbon investments,” commented Rystad.