A slowdown in global rig demand, a pickup in rig attrition, and falling dayrates are predicted for 2025, according to new research from Westwood Energy

2024 was another strong year for the offshore drilling rig market with high utilisation and dayrates, but 2025 is likely to be a year of declining demand and dayrates – as part of a market correction in a continued upcycle rather than the beginning of another downturn, the energy consultancy says. The three main rig types – jackups, semisubs and drillships – are already experiencing weakening demand and declining dayrates. Inflationary pressures across the sector are the driving force of the market correction expected in 2025. Rising projects costs are one of the main contributing factors, along with delays caused by supply chain challenges, resulting in long lead-times for parts and equipment. Offshore rig demand is expected to grow in areas such as Latin America, Africa and India, while demand remains depressed in the North Sea and the US Gulf of Mexico shallow-water shelf. South America will continue to lead global floating rig demand, and the Middle East will remain the dominant driver of jackup demand, according to Westwood.

Decline in offshore rig demand

The drop in offshore rig demand will lead to an increase in rig attrition, particularly in the semisub segment. Rig contractors will focus cuts on units least likely to be in demand. Consolidation among rig contractors should also provide the opportunity to streamline fleets and retire any units unlikely to be used.

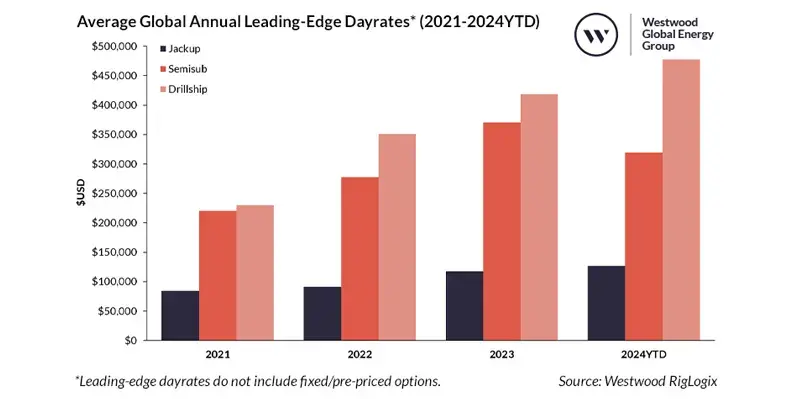

As bidding becomes more competitive, dayrates are increasingly under pressure. More incentives could be offered, such as lower mobilisation fees and discounted minor upgrades. Inflation, leading to higher labour, service and parts costs, means rig contractors will not be able to discount their dayrates as much as before. Meanwhile, dayrates for the highest-capability units will continue to command the highest rates, as these units also face the least availability in the near-to-medium term.

“The aforementioned attrition and Westwood’s expectation for few deliveries next year will tighten the available rig supply even further,” said Cinnamon Edralin, Americas Research Director at Westwood Energy. “Once operators begin to jump on the lower dayrate offers, thereby reducing near-term availability, then dayrates will bottom out and start to rise once again. With drilling demand generally being pushed into 2026-27 instead of cancelled, this sets the stage for 2025 to be a year of declining demand and dayrates as part of a market correction in a continued upcycle rather than the beginning of another downturn.”