Demand is likely to determine the trajectory of the oil industry over the next few years, and global oil undersupply is unlikely, says Ben Wilby, senior analyst – Onshore Energy Services, Westwood Energy

The last few months have been significant for those in the OPEC+ group. Perhaps the most significant was Saudi Aramco’s announcement on 30 January that the Saudi Ministry of Energy had ordered the NOC to maintain its Maximum Sustainable Capacity at 12mn bpd rather than increase it to 13mn bpd by 2027 as previously planned. This news reflects concerns within the Saudi government over the necessity of a high-Capex 1mn bpd MSC addition, giving supply growth elsewhere, especially from the Americas. As a result, in March 2024 Aramco stated that total Capex over 2024-2028 would be reduced by US$40bn due to project deferrals and reductions in infill drilling.

2024 year to date has seen Brent oil prices average US$81.2/bbl, broadly in line with the 2023 average of $82.5/bbl. Despite significant global turmoil in 2023, the global oil supply/demand balance remains the primary driver for oil prices. In 2023, abundant non-OPEC+ supply, especially from the US, where growth of 8% was well above expectations at the start of the year, was countered by continued OPEC+ cuts. In addition, Saudi Arabia and Russia announced voluntary production cuts in 2023, pledging a combined voluntary output reduction of 1.5mn bpd. In 2024, this output reduction has been joined by six other OPEC members, leading to a total voluntary cut of 2.2mn bpd, which has now been extended through 2Q 2024.

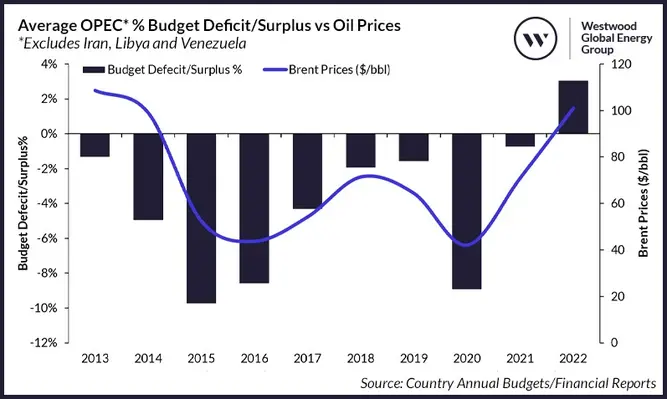

The length and impact of these output restrictions in 2024 will largely depend on demand, an area that is growing increasingly partisan. While there are differing projections of this, OPEC+’s decision to continue its output reduction policy is likely to be the primary driver stopping oil supply from outweighing demand in 2024. The likelihood is that OPEC+ will stick to its output restriction policy to ensure that oil prices remain above Saudi’s fiscal breakeven point of US$80/bbl. The economies of most members are still tied intrinsically to oil prices, including key Gulf States such as Saudi Arabia and Kuwait, who posted budget surplus’ in 2022 when oil prices averaged US$100.3/bbl after nearly a decade of budget deficits.

The IMF estimated Saudi Arabia’s breakeven for 2024 to be US$80/bbl and has many members of OPEC+ at or above this level, including Algeria (US$145/bbl), Iraq (US$98/bbl) and Kazakhstan (US$99/bbl). As a result, unless there is a catastrophic drop in demand, OPEC+ is likely to continue with its current policies and has limited options to change course.

Taking the mid-point in demand between the IEA and OPEC, Westwood estimates that demand outstripped supply by 600,000 bpd in 2023. For 2024, this is expected to shrink to 0.1kbpd, despite OPEC+’s actions, as continued quick barrels from the US are joined by structural increases in supply from countries such as Brazil and Guyana. In total, Westwood expects to see an additional 1.2mmbpd of liquids supply coming into the market from non-OPEC sources in 2024, undercutting the actions of OPEC+ to reduce production.

Beyond 2024

Beyond 2024, the picture is more complex, as the growth rate in oil demand will underpin the actions of OPEC+ and non-OPEC member countries. Westwood anticipates significant drilling activity of over 38,500 wells per year to translate into an additional 4mn bpd from non-OPEC sources (including Brazil), with output declines in many countries outweighed by production additions elsewhere. The majority of this increase will be related to long-term structural barrel increases, such as the deepwater projects in Brazil and Guyana. These two countries alone have 2.6mnb pd of new FPSO oil capacity already sanctioned, including five FPSOs at Petrobras' Buzios development and two FPSOs at ExxonMobil's Stabroek block offshore Guyana. The global picture indicates a total of 8mn bpd of additional FPS liquids capacity is expected by 2030, of which 4.2mn bpd are already sanctioned. Allied to this are new onshore drilling campaigns in countries such as Uganda, continued strong levels of development drilling in Canada and the US, and fixed platform additions in Qatar.

OPEC members also represent a major supply influx, given the significant investment many of them are making. Countries such as the UAE are moving forward with expansion plans and should hit their target of 5mn bpd by 2027. Even countries likely to struggle to hit their targets, such as Iraq and Nigeria, are expected to see an uplift in production given projects sanctioned or due to be sanctioned. Saudi Arabia is not excluded from this either, despite the delay of its plan to reach 13mn bpd MSC by 2027, which has seen planned output increases at Manifa and Safaniya deferred. The outlook for Saudi Arabia also points to a major supply increase – especially compared to liquids production of 11mn bpd recorded in 2023, with crude production of just 9.6mn bpd – well below its structural capacity potential. Major new fixed platform installation campaigns at fields such as Abu Safa and Zuluf are expected to continue, despite the announcement, while a new onshore drilling rig construction campaign is underway to help boost onshore activity levels. Non-crude liquids will see a major boost due to the start-up of onshore activity. The Jafurah project alone is anticipated to add 625,000 bpd of condensate and NGLs by 2030. At the same time, assuming the output cuts come to an end, crude production will increase.

Overall, the picture for 2024 appears complex, with much of OPEC+'s production restriction efforts dependent on demand, given the flood of supply coming from non-OPEC+ sources. Beyond 2024, what is abundantly clear is that supply is in no danger of a shortfall. As a result, demand is likely to determine the trajectory of the oil industry over the next few years, with OPEC+ likely to continue output restrictions to maintain pricing at least above US$70/bbl if required. Saudi Arabia's decision not to pursue 13mn bpd of production means that the market is likely to be more delicately poised than previously expected. Despite this, the additional capacity increases expected in Latin America, combined with quick barrels from the US, mean that any supply shortfall is unlikely to last long.

Data is derived from Westwood’s Wells & Production Outlook 2023-2030, a series of four regional reports covering onshore and offshore drilling and production outlooks for Africa & Europe, the Americas, Asia Pacific and the Middle East.