The Middle East (including Algeria, Egypt and Libya) holds almost half of global gas reserves, mostly untapped, yet the volume of LNG imports into the region is rapidly rising as domestic demand exceeds piped gas supply, says economist Moin Siddiqi

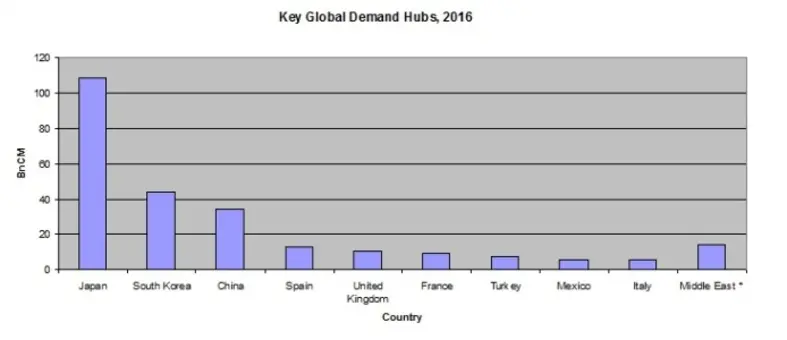

In the past three years, LNG imports in the Middle East have surged 380 per cent against relatively saturated markets in other key energy demand hubs (notably Japan and South Korea), according to the Gulf Intelligence LNG Whitepaper (March 2017). Regional LNG buyers are Egypt, Jordan, Kuwait, Bahrain and the UAE.

“The Middle East needs a comprehensive and robust infrastructure network to build a world-standard gas hub and meet demand across the region,” said Hatem Al-Mosa, CEO, Sharjah National Oil Company. The IEA expects Middle East gas demand to nearly double by 2040. Last year, natural gas consumption in the region was 603.6 bcm – equivalent to 17 per cent of the global total, according to BP figures.

The Oxford Institute of Energy Studies notes that Middle East LNG off-take rose from 5 bcm in 2014 to 24 bcm in 2016. Apicorp, the Saudi-based investment bank, estimates that Middle East countries need to invest US$10.3bn in LNG-importing facilities over the medium-term to cope with booming demand. London-based Energy Aspects consultancy predicts Middle East LNG imports reaching 13.4mn tonnes/year in 2018.

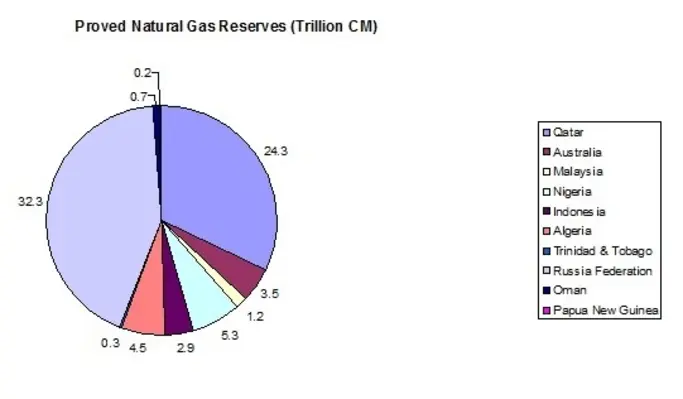

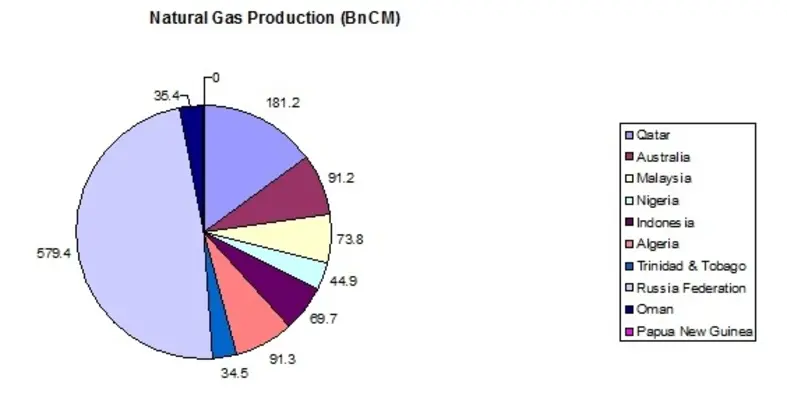

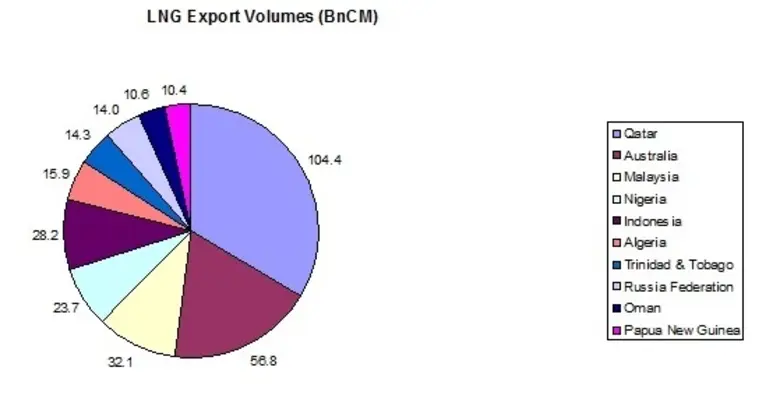

In 2016, the Middle East was the world’s largest exporting region, shipping 138.4 bcm of LNG – equivalent to two-fifths of global exports (BP figures). Qatar, with a liquefaction nameplate capacity of 105 bcm, comprised about one-third of global LNG trade. Recently, Qatar Petroleum announced plans to increase natural gas production dramatically from its huge Persian Gulf ‘North Field’ which, if followed through, could boost Qatar’s nominal LNG capacity in future years.

Other LNG exporters in 2016 were Algeria (15.9 bcm), Oman (10.6 bcm), and the UAE (7.4 bcm). Yemen LNG, with a capacity of 9.1 bcm, went off-line in April 2015 due to the country’s civil war; Total (the operator) closed the plant. Thus far, the largest regional consumers (Iran and Saudi Arabia) have no plans for either building LNG production or importing facilities, though they possess vast proved gas reserves of 33.5 trillion cm and 8.4 trillion cm respectively.

This is an extract from an exclusive article by economist Moin Siddiqi which will appear in Issue 6 of Oil Review Middle East, due for publication in September.

*Source - BP Statistical Review of World Energy