Spending on well interventions is projected to jump by almost 20% this year to US$58bn according to research from Rystad Energy, with Saudi Arabia being the top onshore market from 2023-2028

According to Rystad Energy, this is just the start of a surge in the coming years as the focus on efficiency intensifies.

The intervention rate – how many oil and gas wells go through the intervention process – is forecast to reach 17% in 2027. This would total about 260,000 wells globally.

More than US$11bn of the total expenditure will be directed to the wireline & perforating segment, while together, intervention units and oilfield chemicals sectors will represent 35%. The sum of the investments in coiled tubing, water management, and intervention tools is expected to surpass US$20bn by end 2023.

To boost production rather than drill new wells, operators are more likely to undertake intervention into mature assets that have been producing for more than five years, with relatively high production rates which are starting to show signs of decline. Onshore interventions in Asia, South America, and Africa will lead the 9% growth in activities related to intervention during 2024. North America is projected to account for 64% of the total oil and gas wells ready for intervention in 2027, whereas Asia and South America will reach their maximum in 2026, with respectively 41,413 and 9,703 wells.

“As oil demand picks up in the second half of this year, operators will look to ramp up production from existing fields, and well interventions will be a vital piece of the puzzle. As a quick, efficient, and cost-effective method of maximising existing resources, interventions are going to be a hot topic in the years to come,” said Jenny Feng, supply chain analyst at Rystad Energy.

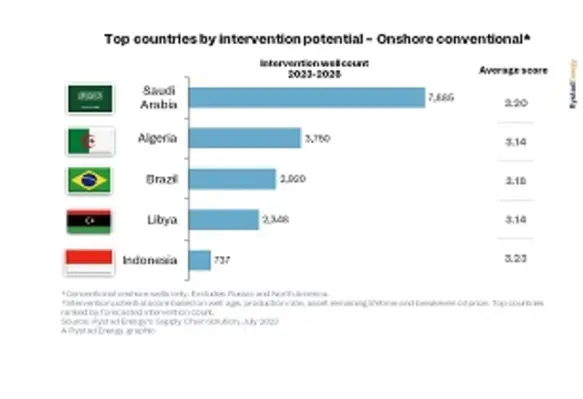

Saudi Arabia and Algeria are the top two onshore markets, adding up to more than 11,000 wells with exceptional intervention opportunities from 2023 until 2028. Brazil, a country traditionally attractive for offshore explorations, represents almost 17% of the total top five intervention count, followed by Libya and Indonesia.

In terms of offshore markets, Norway and Australia are top, with 36% and 25%, respectively.