Companies which won oil and gas exploration contracts in Iraq’s latest round of auctions will have to keep costs low to realise “competitive” returns, according to GlobalData, a leading data and analytics company

Iraq’s auction of 11 blocks saw a lacklustre response as most major energy companies stayed away, with only Italy’s Eni submitting an offer. Only 6 of the 11 blocks were finally awarded in the auction which ended on 26 April.

GlobalData’s report said that a lack of time to evaluate bids was cited as a reason for the muted response.

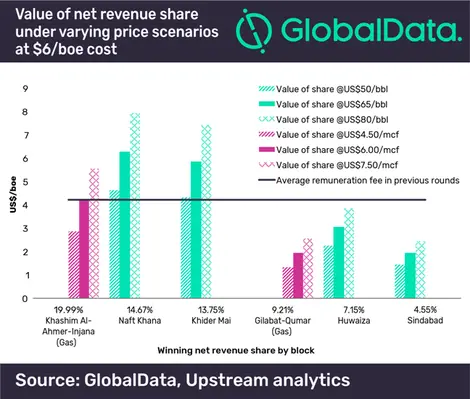

Under Iraq’s new model for contracts, contractors will pay a 25 per cent royalty on gross production, recover costs and share the remainder with the government according to the net revenue bid.

“If the lower royalty allows contractors to recover their costs more quickly, this should improve rates of return, but the key aspect determining profitability will be the value of the net revenue share,” Will Scargill, Oil & Gas analyst at GlobalData, said.

“In order to achieve competitive margins, operators will need to drive down costs below the average, a task which may prove challenging at smaller developments, or hope for higher oil prices,” Scargill added.