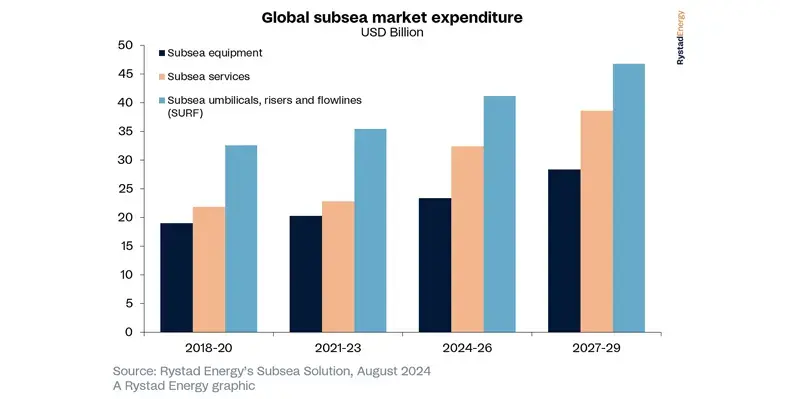

The subsea market is set to experience a significant inflow of capital from 2024-2027, with total spending set to exceed US$42bn at a CAGR of 10% over this period, according to Rystad Energy

The growth is driven by investment in deep and ultra-deep projects and includes players involved in production and processing systems such as subsea umbilical risers and flowlines (SURF), trees, wellheads, manifolds and other components.

Driven by rising operator expenditure on equipment and installation services, investment activity has been particularly robust in regions such as South America and Europe, where major projects are making significant progress and attracting new investment. Brazil, with its vast pre-salt reserves, is driving strong demand for subsea equipment and SURF, with anticipated expenditure set to surge 18% to US$6bn in 2024. Meanwhile, in Europe, Norway is experiencing a resurgence in activity, fuelled by favourable market conditions and technological advancements.

Deepwater developments are set to dominate the sector, accounting for 45% of the market from 2024 to 2028. Significant greenfield projects include Barracuda Revitalization in Brazil, Johan Castberg and Breidablikk in Norway and Golfinho in Mozambique. Key brownfield initiatives include Balder Future, Gullfaks South and Schiehallion in Norway and the UK.

Ultra-deepwater projects, driven by major floating production, storage and offloading (FPSO) initiatives in Brazil and Guyana, are projected to capture 35% of the market, led by South America.

In 2024, ExxonMobil's expanded operations, with a focus on Guyana, are expected to significantly boost subsea tree installations, while in the SURF sector, global installations are anticipated to reach 3,500 km in 2024., with Brazil expected to account for 22% of this total, followed by the USA and Angola.

Looking ahead, TechnipFMC, OneSubsea and Aker Solutions are expected to lead the way in the supply of subsea trees. In terms of operators, Petrobras remains a dominant operator, particularly in South America, where it has heavily invested in pre-salt developments. In Europe, Equinor and Aker BP have extensive subsea portfolios, with significant tieback projects on the Norwegian Continental Shelf, while in the USA, Shell and BP lead with substantial investments in deepwater and ultra-deepwater exploration and production. TotalEnergies holds a strong position in Africa, especially in Angola and Nigeria.

The subsea sector is also expanding beyond traditional oil and gas applications, Rystad notes. The push for carbon capture and storage (CCS) is creating new opportunities for suppliers and spurring research and development in this emerging market. Consequently, suppliers are leading the way in developing more efficient subsea production systems, which are set to see broader adoption.

“The subsea market has rebounded robustly from the impacts of Covid-19, which caused a significant 20% drop in expenditure in 2020. By 2021, the industry began to recover, with spending increasing by 5% to reach US$23bn. Looking ahead, we anticipate steady growth in the subsea sector, fuelled by advancements in deepwater exploration and carbon capture and storage (CCS). This recovery highlights the industry’s resilience and suggests a promising trajectory of consistent progress,” said Sanwari Mahajan, analyst, supply chain research, Rystad Energy.