Spending on conventional oil and gas exploration is rebounding and expected to exceed US$50bn this year, the highest since 2019, according to new research from Rystad Energy

However, despite this, discovered volumes are falling to new lows.

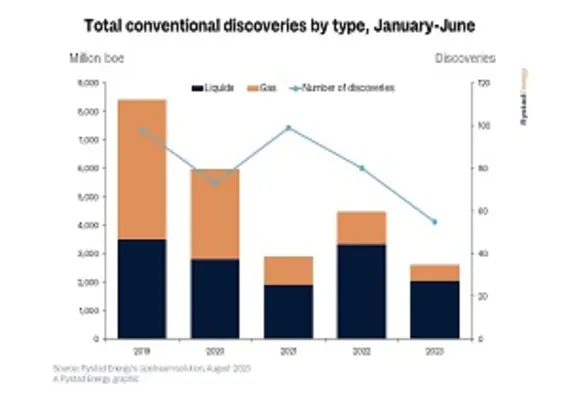

Rystad estimates show that discoveries in the first half of 2023 have averaged 47 million boe, lower than the 56 million boe per discovery for the same period in 2022. Explorers found 2.6bn barrels of oil equivalent (boe), 42% lower than the first half of 2022 total of 4.5bn boe. Fifty-five discoveries have been made, compared to 80 in the first six months of last year.

The exploration and production (E&P) industry is in a transitionary period, with many companies exercising increased caution and shifting their strategies to target more profitable and geologically better-understood regions. This strategic shift and the failure of several critical high-potential wells are contributing to the sharp drop.

Exploration companies are prioritising the offshore sector, with a view to capitalising on underexplored or frontier areas to unlock new volumes through high-risk, higher-cost offshore developments. The offshore industry accounted for around 95% of exploration spending this year to date, but only around two-thirds of discovered volumes.

“Upstream companies are facing a period of uncertainty. They are eager to capitalise on the increased demand for fossil fuels and find additional resources, but recent results have been lackluster. If exploration efforts continue to yield unimpressive results for the remainder of the year, 2023 could be a record-breaker for the wrong reasons,” said Aatisha Mahajan, vice president of upstream research at Rystad Energy.

The six majors – ExxonMobil, BP, Shell, TotalEnergies, Eni and Chevron – continue to play a critical role in global exploration, with a prominent share of exploration spending and global conventional discovered volumes. The six companies are expected to spend around US$7bn this year on exploration, around 10% higher than in 2022.

Exploration activity will likely gain momentum in the second half of 2023, Rystad comments, with crucial exploration wells planned to be drilled. The majors will contribute around 14% of total global exploration spending in the coming months. More than half of the projected exploration spending in 2023 will come from NOCs and NOCs with international portfolios (INOC).