In the most recent edition of Westwood’s World Downstream Maintenance Market Forecast 2018-2022, Douglas Westwood have highlighted significant price pressure during the oil price downturn has heavily impacted the downstream maintenance market

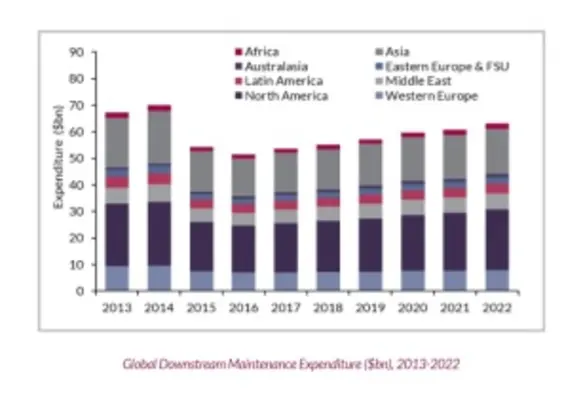

Global downstream maintenance spend bottomed out in 2016, after falling 26 per cent compared to 2014 levels. Westwood believes that the downstream maintenance market is at the beginning of a recovery cycle, with global expenditure forecast to rise by 4 per cent compared to 2016, reaching US$54bn.

Growth in the market is expected to be sustained over 2018-2022, with global expenditure forecast to rise at a 3.5 per cent CAGR over the next five years. Petrochemical facilities will account for the largest proportion of downstream maintenance expenditure over 2018-2022, with a market share of 42 per cent.

The asset services sector is forecast to account for 72 per cent of downstream maintenance expenditure over the next five years, with asset integrity representing the remaining 28 per cent of the market.

The report contains service line analysis for the downstream asset services and asset integrity markets, split out by service line, facility type, and region. Comprehensive regional analysis is also provided for Africa, Asia, Middle East, Australasia, Eastern Europe & FSU, Latin America, North America, and Western Europe. The report is intended for equipment providers, operations and maintenance contractors, and facility operators.

With a large installed base, petrochemical facilities will continue to account for the largest proportion of expenditure over 2018-2022, despite having a lower maintenance cost per facility relative to refineries. The share of expenditure allocated to LNG facilities is set to increase through to 2022. Large and ageing facilities are expected to support increased maintenance expenditure in order to sustain production levels and reduce downtime.