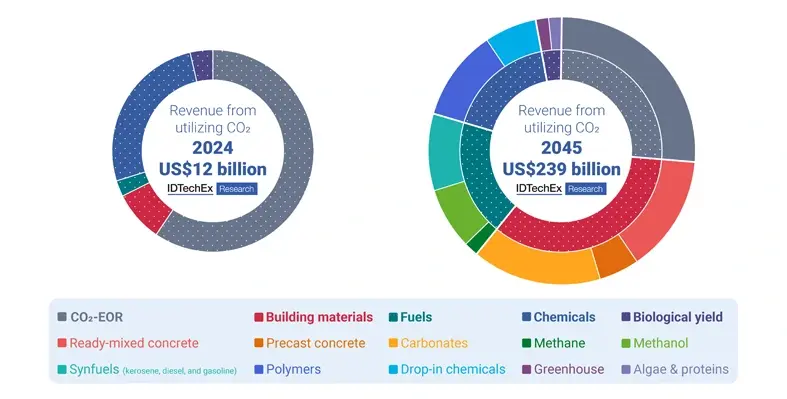

Eve Pope, technology analyst at IDTechEx assesses developments in CO2 utilisation, with the market forecast to grow to US$240bn by 2045

Carbon capture technologies capable of removing CO2 from industrial emissions have been around for more than 50 years, but widescale deployment of CCUS (carbon capture, utilisation, and storage) has been too slow for global net-zero ambitions. While governments are beginning to implement carbon pricing mechanisms or tax credits to motivate permanent storage of CO2 deep underground, a profitable business model exists beyond CO2 sequestration via emerging CO2 utilisation applications. According to the new IDTechEx research report, Carbon Dioxide Utilization 2025-2045: Technologies, Market Forecasts, and Players, sales from CO2 utilisation will directly generate US$240bn in revenue in 2045.

Carbon dioxide utilisation technologies recycle captured CO2. The new carbon-containing products can be sold to generate financial benefits while offering a reduction in carbon footprint. The leading destination of captured carbon dioxide today is enhanced oil recovery. However, there are many emerging areas of CO2 recycling, including CO2-derived concrete, CO2-derived fuels (methane, methanol, kerosene, diesel, and gasoline), CO2-derived chemicals, and CO2 yield boosting applications (crop greenhouses, algae, and proteins).

Profitable production

Profitable production of CO2-derived polymers has been around for decades. The total annual production capacity of polycarbonate resin using CO2 utilisation technology has now reached about 1 million tonnes. Other essential plastics, such as polyethylene and PET, are starting to be made from CO2 via thermochemical and biological conversion routes, with LanzaTech leading microbial innovation in this space. Drop-in chemicals such as CO2-derived ethanol and aromatics are also being commercialised.

While potentially all carbon-containing chemicals could utilise carbon dioxide in production, those requiring non-reductive pathways are the most promising due to a smaller energy demand and lack of dependency on low-carbon hydrogen production. The IDTechEx report explores synthesis routes for chemical companies to use waste CO2 as a green feedstock, displacing petrochemical products.

Decarbonising the aviation and shipping sectors

To date, alternative fuels have not achieved price parity with fossil fuels, inhibiting market uptake. However, increased market penetration of CO2-derived fuels is expected to come from regulations already being put in place, such as fuel-blend mandates for long-haul transportation. As green hydrogen electrolyzer capacity scales up worldwide, production of e-fuels from carbon dioxide using power-to-x technology will also increase. These fuels are expected to play a role in decarbonising shipping and aviation as full electrification of the aviation and maritime sectors is currently unfeasible.

Several CO2-derived fuels are already being commercially produced with many more commercial facilities expected over the next decade. The start of 2024 saw Mitsui and Celanese’s joint venture Fairway Methanol become operational, joining plants from Carbon Recycling International in producing over 100,000 tonnes per year of methanol made from captured CO2. Other hydrocarbon fuels such as kerosene, diesel, and gasoline, which can be made via methanol or syngas intermediates, are also being ramped up. For example, Infinium’s Corpus Facility opened its doors this year, expected to produce thousands of tonnes per annum of CO2-derived e-fuels.

CO2-derived concrete

CO2 utilisation can lower the carbon footprint of ready-mixed concrete, precast concrete, and carbonate aggregates/supplementary cementitious materials through CO2 mineralisation reactions. Players already utilising over 10,000 tonnes of carbon dioxide each year in carbonates include O.C.O Technology and Greencore.

When CO2 is permanently stored in concrete, performance is improved, and less cement is needed. Growth of CO2-derived building materials will be driven by new certifications, superior materials performance, and the ability to achieve price parity through waste disposal fees and the sale of carbon credits.