The lack of reliable methane data is one of the main challenges in curbing methane emissions, according to energy consultancy Rystad Energy

“Reducing methane emissions is generally a more low-hanging fruit than cutting emissions of carbon dioxide, and therefore has the most promising potential for the energy sector in the short and medium term – provided the emissions are detected,” said Magnus Kjemphol Lohne, senior vice president of global emissions research at Rystad Energy.

“Scarce and low-quality methane data is one of the key challenges to curb methane emissions. The trend over the past couple of years has been positive as more operators deploy on-site methane monitoring equipment and use other measurement technologies such as aviation and satellites – but even so, most reported data is still based on simple emission factors for facilities and equipment located on site. Addressing the critical hurdle of limited and unreliable methane data is vital in unlocking progress for reducing methane to near zero in the short and medium term.”

Recent developments in measurement technologies, such as satellite imagery, reveal that methane emissions are probably substantially higher than earlier anticipated. Reducing methane emissions was high on the agenda during the recent COP28 climate conference, which saw the launch of the Oil & Gas Decarbonization Charter (OGDC) – an agreement signed by 50 operators which together account for around 40% of global oil production to reach near-zero methane emissions by 2030. Several companies have also joined the Oil and Gas Methane Partnership (OGMP), while the Global Methane Pledge has welcomed new countries and secured new funding, and new regulations are set to come into force in the EU.

New research from Rystad Energy has found that more than 100 individual oil and gas fields, primarily located in the Middle East, Africa and Asia, contributed less than 1% of global production while emitting nearly 100mn tonnes of CO2 equivalent in methane emissions in 2022.

Rystad Energy’s assessment indicates that more than half of the global upstream oil and gas methane emissions stem from large venting and leakage events, with the remaining portion attributed to flaring sources, fugitive emissions from equipment, and smaller venting occurrences. The Middle East and North America together account for nearly half of worldwide methane emissions from upstream oil and gas activities, followed by Asia, Russia, and Africa. By contrast, South America and Europe have relatively moderate methane emissions.

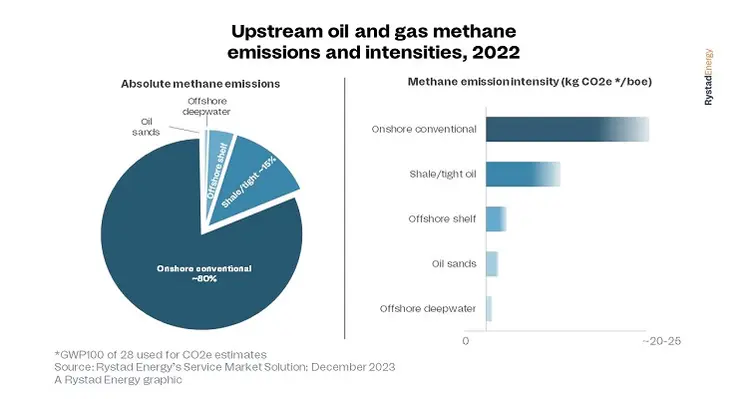

Around 80% of methane emissions from upstream activities originate from conventional onshore fields, followed by shale or tight oil developments, primarily in the US and Canada. The remaining emissions come from offshore and oil sands. The dominance of methane emissions from onshore conventional fields is related to the extensive volumes of onshore production, comprising around half of global output in 2022.

In terms of methane intensity, onshore operations on average have significantly higher levels than other supply segments, while offshore production has a lower methane footprint than the global average, especially deepwater developments.