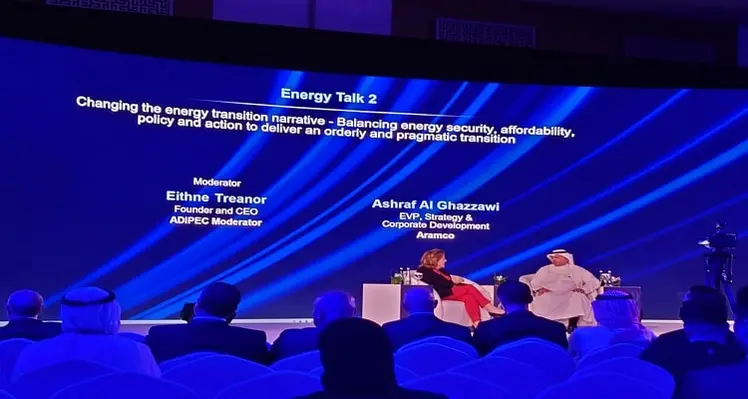

In an Energy Talk at ADIPEC 2023, Ashraf Al Ghazzawi, EVP, strategy & corporate development at Saudi Aramco, discussed the challenges of achieving a realistic energy transition, Saudi Aramco’s decarbonisation efforts and the investments in technology required to reach net zero by 2050

“The transition is anything but straightforward," Al Ghazzawi began. "First, you have to appreciate the scale and the magnitude of the global energy system of around 270bn barrels of oil equivalent, which energises a US$100 trillion global economy. If you fast forward to 2050, the global economy is going to double to US$200 trillion with give or take two billion additional energy consumers, so the scale and the magnitude of the challenge at hand is anything but straightforward. Any plan on energy transition will have to acknowledge the complexity of the magnitude, but also understand that our assumptions and premises have to be underpinned with realistic expectations, realistic solutions and realistic paths towards that transition.”

Speaking about Aramco’s own emissions reduction and decarbonisation efforts, he said, “First and foremost, we're tackling one area that we're pretty comfortable with, which is emissions reduction, where we're the industry leader. Our efforts in emissions reduction date back to the 1970s with the construction of the Master Gas System, the single most significant step we have made towards reducing emissions from our gas operations and oil processing. We have, for the past two decades, focused on minimising flaring and methane emissions from our operations. If there's one thing that I think we need to pass on to our peers, it is that we proved it can be done, with enough focus and enough resource allocation.

“Apart from emissions reduction, we're looking at an investing in many new areas. We've already invested in renewable energy. We've partnered with PIF and ACWA power for a development of 40 gigawatts by the year 2030. We're also investing in carbon capture and sequestration with two global partners, Schlumberger and Linde, to develop a 9mn tonnes per annum CCS project, one of the largest, if not the largest, in the world. We're also investing in in nature-based solutions. The company is intending to plant 650mn mangroves by the year 2035. So we're looking at various solutions towards towards meeting our net zero ambitions.”

But oil and gas remains key. “The two tier investment has always been our philosophy, and we've never advocated to migrate away from conventional energy. We're going to grow our oil and gas production, while we invest and grow our renewable energy and alternative energy sources.”

Speaking about the investment needed to get to net zero, he said, “Clearly there is a significant amount of investment that is needed. The figure that people are now talking about is an additional US$4 trillion that has to be invested in the energy system to take it into a net zero by 2050. If you look at carbon capture and sequestration alone, that has to grow by almost 100 times from today's levels for us to reach net zero by 2050. More specifically, in Aramco, we're doing multiple things in terms of investments in new technologies, and we're focusing on two technologies that in my view, hold a lot of promise in the hard to abate sectors, particularly hydrogen and CCS.

“In carbon capture and sequestration, we've talked about the investment that we're making now to sequester 9mn tonnes per annum, but we're not stopping there. We're taking that investment further to reach around 11mn tonnes per annum by the year 2030. And then hydrogen, like many of our peers in the industry, we're following closely the development of hydrogen. We have plans to produce 2mn tonnes of hydrogen by 2030. That's around 100mn tonnes of blue ammonia.

“Where we are probably ahead of many of our partners and peers, is we’re not only talking about planning and designing the production, we’ve actually tested the whole supply chain of hydrogen production. In 2020, we sent a blue ammonia shipment to Japan, one to Sabic in 2022, and we’ve delivered a shipment of 25,000 tonnes to our Korean partners. This is an effort to understand the value chain and supply chain of hydrogen, to allow us to become a prominent player in hydrogen by 2030.”

Concluding, he said, “Aramco will continue to do its part to provide the energy needs for the world today. But we'll also be spending a significant amount of money and developing technologies and innovative solutions to create the clean energy that is needed for the world tomorrow.”

Collaboration is key, he added. “I don't think there's any other way. And we're hoping that venues such as ADIPEC will create the platform for collaboration and dialogue, at least amongst all the important stakeholders. Energy transition is not going to happen through policymakers alone, it's not going to happen through the financial sector alone and it certainly isn’t going to happen with the energy sector alone. It depends on favourable policies and investments and the right focus. It has to be a collaborative effort.”