Carbon capture, utilisation and storage (CCUS) will ramp up strongly over the next decade, but development in the Middle East and some other regions is hampered by a lack of policy, regulatory frameworks and funding, according to a recent report from Wood Mackenzie

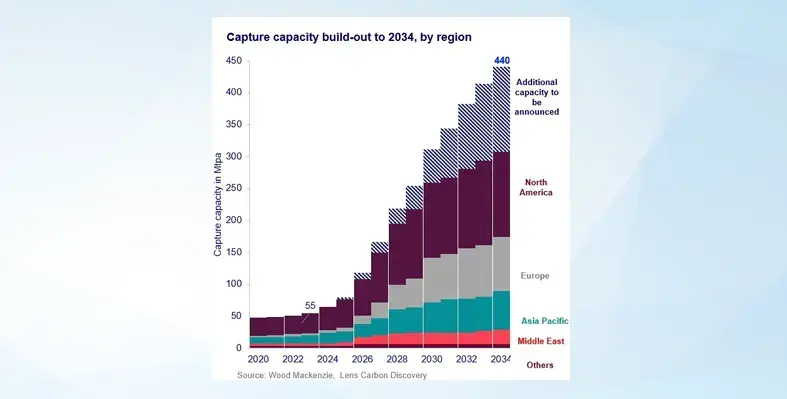

By 2034, global carbon capture capacity will reach 440 Mtpa and storage capacity will reach 664 Mtpa, requiring US$196bn in total investment, according to the report “CCUS: 10-year market forecast”, with around 70% of the investment forecast to be in North America and Europe. The USA leads in funding, followed by the UK and Canada.

“This is a huge ramp-up from where the industry is today. Government funding plays a critical role in driving the first wave of CCUS investments,” said Hetal Gandhi, APAC CCUS lead with Wood Mackenzie. “We see governments offering capex grants, opex subsidies, tax incentives and contracts for differences for CCUS. While no single mechanism has been used predominantly and each country devises novel methods to incentivise investments, nearly US$80bn is directly committed to CCUS across five key countries.”

Shortfall in supply forecast

Despite the forecasted increase in projects, Wood Mackenzie forecasts a shortfall in supply. Industries will need up to 640 Mtpa of carbon capture capacity by 2034 as they look to decarbonise, but the projects expected to come into operation fall around 200 Mtpa short of that.

“Of the projects already announced and expected to go ahead in the development pipeline, 71% are in North America and in Europe,” said Gandhi. “Government incentives such as the US Inflation Reduction Act (IRA), UK business models, Canada’s Investment Tax Credit and the Netherlands SDE++ scheme are moving projects towards final investment decision (FID). We also expect a further boost to European projects due to the recently announced EU Industrial Carbon Management Strategy.

“The lack of CCUS announcements in APAC’s largest emitting countries – China and India – is causing the region to have substantially lower capacity than needed under Wood Mackenzie’s base case. Key sectors like power and chemicals will see a large gap between demand potential and actual supply until 2034. We expect APAC’s capture pipeline will mature through additional announcements later in the decade.”

In APAC, while regulatory momentum is strong in Australia, Japan, South Korea and Indonesia, government incentives are needed to accelerate CCUS development. In contrast, development in China, India, Latin America, the Middle East and Africa is limited by a lack of firm policy, regulatory frameworks and funding support.

Cross-border transport of CO2 and liability risk remain key areas to watch out in the medium term, says Wood Mackenzie.