Recent uprisings in the Middle East and North Africa provide an opportunity for the region to lay the foundation for a socially inclusive growth agenda.

But in the near term, oil-importing countries face multiple pressures stemming from higher crude prices and disruptions to economic activity, the IMF said in its latest assessment of the region.

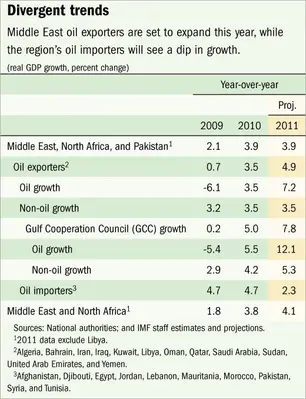

The IMF's Regional Economic Outlook for the Middle East and Central Asia, released recently, projects growth in the Middle East and North Africa region at 3.9 per cent in 2011, unchanged from 2010.

The economies of oil-exporting countries - Algeria, Bahrain, Iran, Iraq, Kuwait, Oman, Qatar, Saudi Arabia, Sudan, the United Arab Emirates, and Yemen - are expected to expand by 4.9 per cent (projections exclude Libya), owing largely to higher oil prices and oil production.

By contrast, growth among the region's oil importers - Afghanistan, Djibouti, Egypt, Jordan, Lebanon, Mauritania, Morocco, Pakistan, Syria, and Tunisia - is set to slow to a mere 2.3 per cent (see table).

Changed outlook for 2011

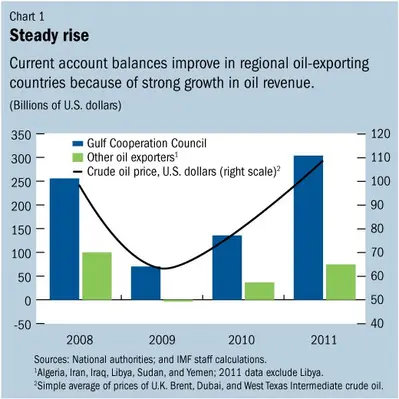

Both the surge in global commodity prices and the widespread social unrest in the region have changed the outlook for 2011. Higher oil prices have further strengthened the external and fiscal positions of oil exporters, while oil importers have seen their import bill rising and domestic pressures mounting in the face of higher food and fuel prices.

The unrest has caused short-term disruptions to economic activity in a number of countries. More generally, developments have dented investor confidence and weighed on tourism and foreign direct investment throughout the Middle East and North Africa.

"The immediate challenge facing many countries in the Middle East is to maintain social cohesion and macroeconomic stability in the face of multiple pressures," Masood Ahmed, Director of the IMF's Middle East and Central Asia Department, told a press conference in Dubai.

To mitigate the impact of higher food and fuel prices and stem the social unrest, governments in the region have been expanding subsidies, raising wages and pensions, making additional cash transfers, stepping up other public spending, and reducing taxes.

Ahmed said the cost of these new measures ranges widely across countries, but is, in many cases, substantial. "Additional spending in the near term is understandable and necessary to ensure social cohesion, but will add to the strain on public finances," he added.

Managing Director Dominique Strauss-Kahn said recently that the IMF could provide support of up to US$35 billion to help Middle Eastern oil-importing countries meet financing needs.

Windfall for oil exporters

With higher oil prices and increased oil production, the combined external current account balance for regional oil exporters (excluding Libya) is expected to more than double to $380 billion in 2011 (Chart 1). Their fiscal position will also improve, despite the additional spending, which will be more than offset by higher oil revenues.

Overall, real GDP growth in these economies (excluding Libya) is projected to increase to 4.9 percent in 2011. While for the group as a whole, non-oil GDP growth is projected to remain flat at 3.5 per cent, in the GCC, higher spending will result in an increase in non-oil GDP growth to 5.3 per cent in 2011 from 4.2 per cent in 2010.

Despite this overall positive outlook, the region's oil exporters continue to face challenging structural issues, such as the need for greater diversification of their economies, job creation for their populations, further financial development to support economic growth, and improvements in the management of public resources.

Challenges for oil importers

Oil importers face a difficult economic year as they manage political, social, and economic pressures. The deterioration in the terms of trade resulting from higher food and fuel prices is expected to inflate their import bill by about $15 billion, or nearly 3 per cent of GDP, on average, the IMF outlook says. This will, in turn, translate into either higher inflation or a worsened fiscal balance, depending on the extent of subsidies.

For many oil importers, political turmoil is expected to weigh on tourism and investment which, together with higher interest rates and pressures for higher spending across the region, will add to fiscal pressures.

Pressures on macroeconomic and financial stability - if not addressed quickly - could impede the pursuit of a new socially inclusive growth agenda and hamper job creation. To this end, governments that are faced with limited fiscal space will need to consider offsetting partially some of the additional spending in priority areas through cuts elsewhere.

In the medium term, policies to alleviate social tensions cannot be perpetually financed through deficits, and will require measures to raise revenues, well targeted social safety nets to replace subsidies, and actions to reduce waste in public spending.

Throughout the region, the slow growth equilibrium of the past years did not generate enough jobs for the growing labor force in a region where youth unemployment rates register well above 20 percent in a number of countries (Chart 2). "Moreover, there was an increasing sense that business environments were suffering from unfair competition, with systems benefitting a privileged few," the report said.

Common goals

Each country will need to find its own homegrown path for development, the report said, but all will need to respond to some common goals. These include:

• A stable macroeconomic environment to provide confidence and attract investment

• Enough private sector jobs to absorb the currently unemployed and a fast-growing labor force

• Access to economic opportunity for citizens to realize their potential

• Social protection for the vulnerable

• Strong and transparent institutions that ensure accountability and good governance

"The aim is not just sustained high growth, but also growth that generates employment, is more inclusive, and results in broadly shared development gains," the IMF report said.

It noted that the region has many strengths: a dynamic and young population, vast natural resources, a large regional market, an advantageous geographic position, and access to key markets. "While the months ahead will be challenging and inevitably marked by setbacks, there is now momentum for change to build upon."