National Oil Companies (NOCs) are diversifying beyond their upstream oil and gas core, with major NOCs forecast to spend more than US$116bn in new petrochemicals projects, according to GlobalData, a data and analytics company

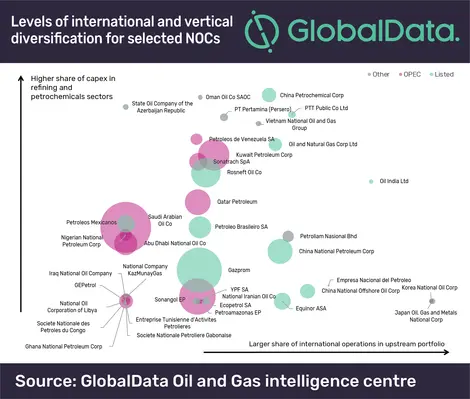

The company’s analysis of NOCs’ portfolios shows that while many NOCs have historically diversified internationally, this strategy was generally not adopted by the most resource-rich. However, as the energy market transitions, even NOCs from OPEC countries are putting a greater emphasis on areas outside exploration and production.

Will Scargill, senior oil and gas analyst for GlobalData commented, “The growing importance of petrochemicals is highlighted by the strategy of NOCs such as Saudi Aramco. Its upcoming projects represent more than US$16bn in capital expenditure and it has announced plans to acquire a 70 per cent in Saudi Basic Industries Corp, which has a market capitalisation of around US$100bn.”

As the global economy turns to new sources of energy other than oil and gas, petrochemicals are seen as a crucial sector, with demand for high-value hydrocarbon-derived products expected to continue to grow strongly. In addition to this, some NOCs are also investing in renewables such as wind and solar.

Scargill adds, “Renewables are a good way for many NOCs to both meet their domestic energy supply mandates while freeing up oil and gas production for supply to higher value markets. However, the leader in renewables is Norway’s Equinor, leveraging its offshore expertise to develop wind assets internationally, with 3,685MW of generation capacity in the pipeline.”