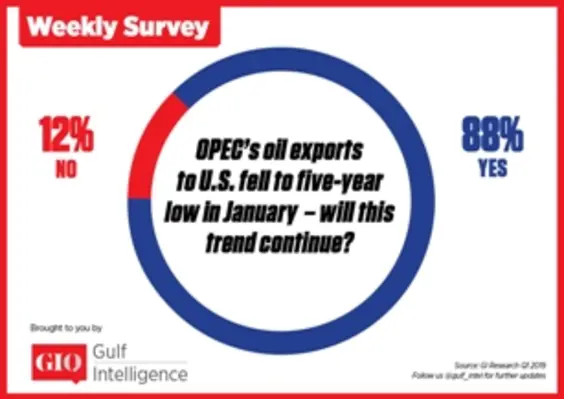

OPEC exports to the US are likely to continue trending downwards, according to the majority (88 per cent) of energy executives surveyed by the Gulf Intelligence

OPEC crude exports to the US dropped to a five-year low in January, while US stockpiles climbed to 3.6 mmbbl in February, according to the US Energy Information Administration (EIA).

Since 2008, US production has increased by a staggering 140 per cent. Some analysts predict that by 2020, the country could be a net exporter of crude and refined products. In February, US output hit 12mn bpd, contrary to previous expectations that this level would not be reached until the second half of the year.

Saudi Arabia, OPEC’s largest oil producer, has seen its crude exports to the US drop steadily in recent years, from 1,361mn bpd in 2012 to 949,000 bpd by 2017 and around 500,000 bpd by the end of last year. In fact, the US imported less crude oil altogether, not just less OPEC crude, from 262.8mn bpd per month at the beginning of 2017 to 226.6mn in October 2018, the last month for which data are available, according to the EIA.

Despite the loss of US market share, however, OPEC and its coalition of non-OPEC producers, including Russia, have continued their strong commitment to comply with the output reduction deal agreed in December, namely to collectively cut production by 1.2mn bpd by at least June 2019.

The agreement by the group of 25 producers, known as OPEC+, follows two years of 1.8mn bpd cuts, which succeeded in reversing a three-year oil price slide and restored a certain amount of stability to the market.

The agreement by the group of 25 producers, known as OPEC+, follows two years of 1.8mn bpd cuts, which succeeded in reversing a three-year oil price slide and restored a certain amount of stability to the market.

The strategy has continued to work with Brent prices comfortably holding in the US$60s bbl range since the beginning of this year. Brent closed at US$68.39 per bbl on March 29, 2019.

OPEC+ coalition compliance in February was nearly 90 per cent, up from 83 per cent in January, according to the Joint Ministerial Monitoring Committee (JMMC). The JMMC convenes bimonthly to assess the market impact of production cuts.

Khalid Al Falih, minister of energy, industry and mineral resources, Saudi Arabia said, “The job of OPEC and its allies is not done yet and the group of oil producers need to stay on course at least until June when the current global cut agreement is due to expire.”

Additional oil price support came from US sanctions on Iran and Venezuela, two major OPEC producers currently exempt from the output cut deal. According to Goldman Sachs, US restrictions on the Venezuelan energy industry have crippled the country’s oil exports, which dropped by 40 per cent in the first full month after sanctions were initiated in early February, removing 330,000 bpd of supply from the global market.

Iran’s exports have hovered over one million bpd so far this year, dropping in the past year from a level of 2.5mn in April 2018, a month before the US decided to re-impose sanctions.