The global oilfield service market will not return to its previous high until 2025, according to research and business intelligence firm Rystad Energy

Audun Martinsen, Rystad Energy’s head of oilfield service research, said, “This will be the longest slump faced by the oilfield service industry since the 1980s, with about US$2.3 trillion in revenues lost along the way.”

“On the bright side, in only three years’ time, activity levels will be higher than they were in 2014, although the cost cuts achieved in the sector means spending levels will only be 80 per cent of what was seen in that peak year.”

Rystad Energy predicts that global service market revenues will continue to rise from 2026 to 2030, which is the end of its projection period. These revenues are expected to hit 80 per cent of the figure for 2014 in 2022.

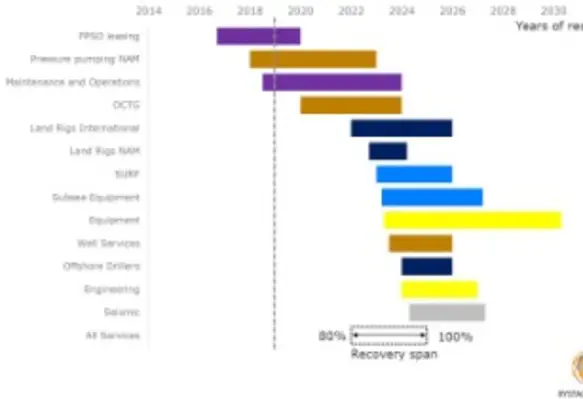

The recovery will be spread unevenly between the segments.

- The FPSO leasing sector has seen the fastest recovery, emerging from the relatively unscathed downturn. It is forecast to return to 100 per cent by 2020.

- North America’s pressure pumping industry is likely to reach only 100 per cent of its previous peak in 2023.

- It is not expected that the offshore drillers and seismic contractors will see a full recovery until 2027.

“As for the offshore market, we expect the recovery to be slower than for onshore and North American services. The offshore market bottomed out in 2018, and it will take some time to turn around fully, as capital investments are ramping up slowly and some cost efficiencies have yet to be realised,” he noted.

“As for the offshore market, we expect the recovery to be slower than for onshore and North American services. The offshore market bottomed out in 2018, and it will take some time to turn around fully, as capital investments are ramping up slowly and some cost efficiencies have yet to be realised,” he noted.

“Offshore drillers and seismic contractors are the last segments expected to return to their former glory, as recovery is slowed by multiple factors, a supply overhang, higher drilling efficiency, low utilisation and scant interest in exploration,” he remarked.