GlobalData’s latest thematic report, M&A in Oil and Gas, suggested that mergers and acquisitions (M&A) have played an important role in helping oil and gas companies survive one of the most turbulent times in the last five years

The report stated that oil prices plummeted from US$100 a barrel in 2014 to about US$30 in 2016.

It has revealed that falling revenues and rising debts have forced oil and gas companies to realign their strategic objectives and reshape their portfolios, leading to a large number of M&A deals.

Oil and gas companies have executed around 10,000 M&A deals in the five years to November 2018. More than 60 per cent of the deals concluded were in the upstream sector.

The report showed that the shale patches in the US and the oil and gas fields in the North Sea continental shelf were prominent in these upstream deals.

The slowdown in upstream activity due to low oil prices had a drastic impact on the equipment and services sector, it added.

Ravindra Puranik, oil and gas analyst at GlobalData, commented, “Oil majors, especially Total, ExxonMobil, Chevron, Equinor and Shell were involved in a number of deals as they acquired companies and assets at attractive valuations, while also offloaded the ones that could impact profitability.”

Puranik explained, “As oil and gas companies scaled back their operations and postponed expansion plans, the number of market opportunities declined considerably for oil field service providers, leading to an industry-wide consolidation.”

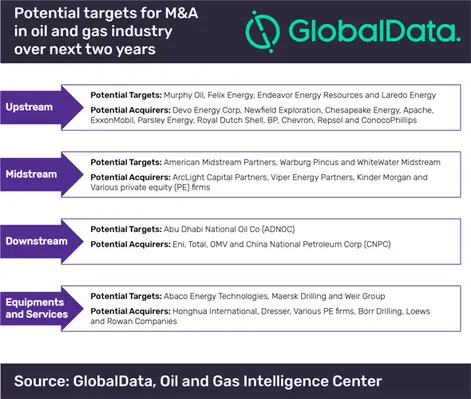

GlobalData’s thematic research identified upstream companies such as Felix Energy, Endeavor Energy Resources and Laredo Energy; and midstream players such as American Midstream Partners and WhiteWater Midstream as potential acquisition targets in the oil and gas industry over the next two years.