Major oil and gas engineering, procurement, and construction (EPC) companies are increasingly shifting their strategies towards cleaner energy segments, according to GlobalData, a leading data and analytics company

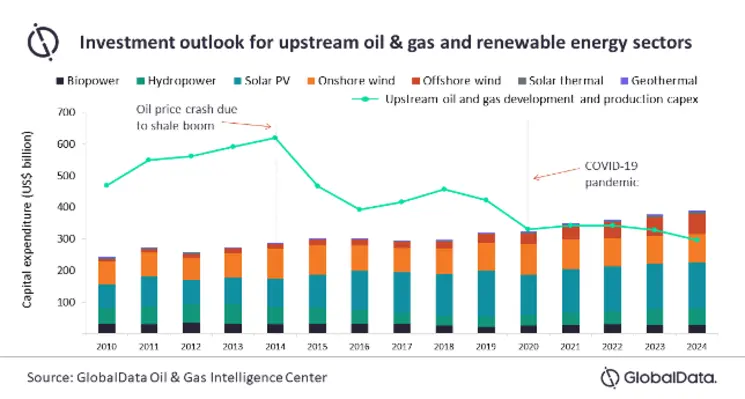

Major oil and gas EPCs have traditionally relied on projects within the oil and gas value chain, building relatively little exposure to renewables. However, with a bleak investment outlook for the sector post-COVID-19 and major oil and gas companies making strategic shifts for the energy transition, these EPCs are looking to renewables and other clean energy sectors for future growth.

Will Scargill, managing oil and gas analyst at GlobalData, commented, “COVID-19 brought a major oil and gas demand shock, delayed projects and raised additional questions about the potential for future oil demand growth. Oil and gas investment is likely to flatline at best over the coming years and companies will need to look to the growth markets of new energy sectors to support their businesses.”

EPC companies are adopting diverse strategies to position themselves for the energy transition. Aker and TechnipFMC have restructured their businesses to create dedicated units for low-carbon projects. Meanwhile, Petrofac is aiming to achieve net zero in Scope 1 and Scope 2 emissions by 2030. Despite these varying approaches, the most common target segments among major oil and gas EPC companies are offshore wind and carbon capture and storage.

Scargill added, “The targeting of offshore wind and carbon capture is common theme among companies from the oil and gas sector looking to adapt for the energy transition due to the potential for knowledge synergies. Oil and gas EPCs looking to target new segments will also hope to benefit from existing partnerships with clients making a similar transition. However, their growth plans will face a challenge from incumbent players in the renewables space.”