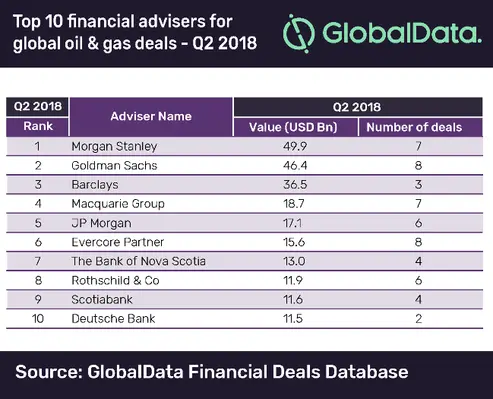

Morgan Stanley has claimed the top position in the latest oil and gas industry M&A financial advisers M&A league table for Q2 2018, compiled by leading data analytics company GlobalData

The investment bank worked on seven deals worth a total of US$49.9bn, surpassing competitors Goldman Sachs and Barclays, which came second and third, respectively, in value terms.

Prakhar Baghmar, financial deals analyst at GlobalData, said, “Morgan Stanley’s involvement in three transactions worth more than US$10bn in addition to a few smaller deals helped it gain the top spot.”

According to GlobalData, Goldman Sachs was involved in eight deals worth a total of US$46.4bn, while Barclays worked on three deals with a combined value of US$36.5bn.

Marathon Petroleum’s acquisition of Andeavor for US$35.6bn was recorded as the quarter’s top deal for the industry.

Goldman Sachs and Evercore Partners emerged as the leading players by volume with eight deals each, followed by Morgan Stanley and Macquarie Group with seven deals each.

Global oil and gas deals market Q2 2018

The total global oil and gas deals market has grown in value by almost 60 per cent year-on-year, compared to a 12.64 per cent drop in volume. Deal value for the quarter was US$82.3bn compared to US$51.6bn in Q2 2017, with Q2 2018 recording 311 deals, 45 less than in Q2 2017.

Both Morgan Stanley and Goldman Sachs held the same ranking, first and second respectively, in the global league table of the top 20 M&A financial advisers released by GlobalData recently.

M&A legal advisers ranking

American law firm Sullivan & Cromwell claimed the first position in the list of the top 10 M&A legal advisers for oil and gas deals in Q2 2018. The company worked on four transactions worth US$45.7bn, including the industry’s top deal of the quarter, the US$35.6bn Andeavor acquisition.

Jones Day came second in the league table with nine deals worth a total of US$38.8bn, while Cleary Gottlieb, with three deals worth US$35.6bn, claimed the third spot. In volume terms, Jones Day led the competition.