Rystad Energy stated that the US and Iran seem to have stepped back from the brink of armed conflict, at least for now, but many oil and gas companies still face serious decisions about their short-term and mid-term plans in neighbouring Iraq, where tensions remain high

There are still some 5000 American troops stationed in Iraq, but their continued presence there has become uncertain.

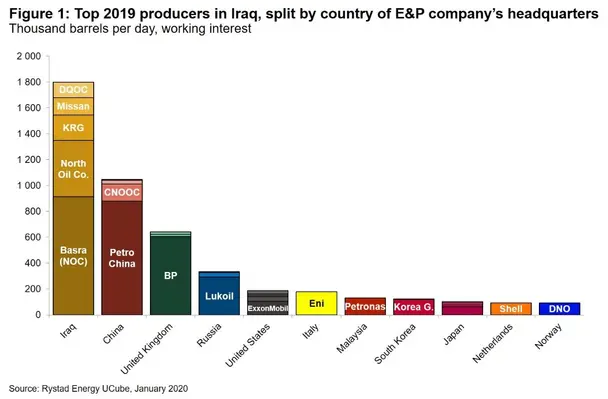

Iraqi oil production averaged more than 4.8 mmbbl per day in 2019, of which about 1.8 mmbbl per day stemmed from the country’s domestic and state-owned players.

International oil companies were thus responsible for the lion’s share of production – in the region of three mmbbl per day. Companies headquartered in China collectively produced more than one mmbbl per day, E&Ps from the UK produced beyond 630,000 bpd, and Russian players had combined average output of around 330,000 bpd.

PetroChina and BP had the largest working interest production for overseas companies, at 880,000 and 606,000 bpd, respectively. US-based companies collectively produced about 180,000 bpd on average last year, led by ExxonMobil with nearly 106,000 bpd.

Matthew Fitzsimmons, vice-president Oilfield Research at Rystad Energy, said, “ExxonMobil spent more than US$250mn last year on its Iraqi upstream operations, and we have projected that this number would likely be ramped up by an additional US$150mn over the next five years as the company aims to increase production through 2024. However, any spending plans in Iraq are likely to be under review given the current circumstances.”

He reasons that ExxonMobil could ultimately decide to divert a portion of its Iraqi spending budget to other regions where the company is investing heavily in production growth, such as Guyana’s offshore sector and the US shale industry.

Among the major oil companies in Iraq, BP has emerged as a clear leader. Before the recent flaring of tensions, BP had been expected to allocate about four per cent of its annual US$25.6bn global oil and gas spending budget towards projects in Iraq. The company has managed an ambitious water injection programme that is helping to boost its output and make BP the third-largest producer in Iraq, but the fate of this programme is now uncertain.

Among the major oil companies in Iraq, BP has emerged as a clear leader. Before the recent flaring of tensions, BP had been expected to allocate about four per cent of its annual US$25.6bn global oil and gas spending budget towards projects in Iraq. The company has managed an ambitious water injection programme that is helping to boost its output and make BP the third-largest producer in Iraq, but the fate of this programme is now uncertain.

“Continued tensions in the region could see BP slow their water injection program down, and limit the high-side of production for the company and for other international players in southern Iraq,” said Fitzsimmons.

After spending nearly US$1bn in 2019 on its Rumaila North and South project, BP was expected to raise its capex to US$1.2bn by 2024. This would have seen BP’s onshore Iraqi oil production eclipse 725,000 bpd by 2024.

“Putting this into context, that tally would be about 70,000 bpd higher than BP is poised to produce from the US shale sector in 2024, and Iraq would emerge as the company’s largest production of one energy resource type in a single country. Only by combining offshore, onshore and shale in the US, could BP’s working interest production in there outweigh its expected interests in Iraq,” concluded Fitzsimmons.