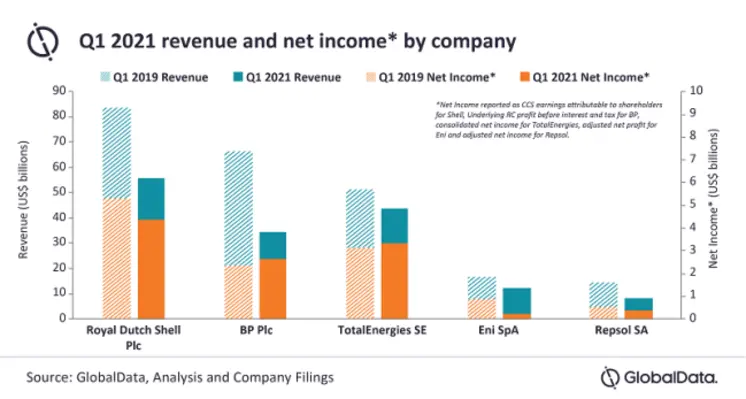

The European oil majors (Shell, BP, TotalEnergies, Eni and Repsol) have benefitted dramatically from elevated oil and gas prices in the Q1 2021 as income returned to near pre-pandemic levels, according to GlobalData, a leading data and analytics company

Daniel Rogers, senior oil and gas analyst at GlobalData, commented, “So far 2021 has gifted the sector with elevated prices as the COVID-19 recovery appears to be well underway and the oil supply build up from last year wanes. The group began to see improved financial performance towards the end of 2020, but Q1 2021 was particularly strong compared to recent quarters. We’ll likely see a continuation of strong performances in Q2 as prices remain elevated and capital discipline measures remain in place.”

The European oil majors saw large losses in 2020 as long-term oil and gas price forecasts were revised lower resulting in multi-billion-dollar asset impairments. Despite Q1 2021 revenue being significantly weaker than in 2019, net income levels remain robust.

Rogers continued, “Although Q1 results were positive, the group continues to see weakened performances from their refining segments, which are clearly still grappling from depressed demand for petroleum products, as movement restrictions remain in place in certain areas and international travel remains well below pre-pandemic levels. Lower refining margins was a trend seen across the group last year and despite improvements in Q1, levels remain low.

“The euro majors have provided guidance for 2021 capital expenditure that sits below levels spent in 2019, suggesting the group remains cautious on spending this year following steep cost cuts seen in 2020 that dropped to levels not seen in over 15 years. Notably, BP and TotalEnergies appear particularly cautious on overspending in 2021 amongst the group.”