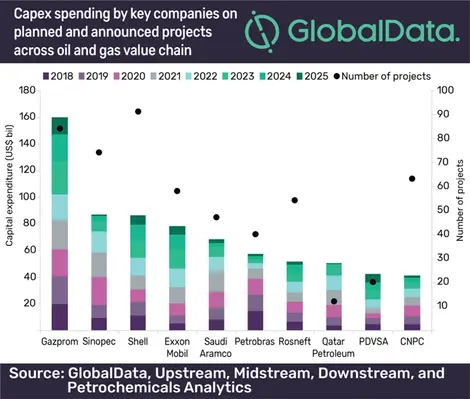

Russia’s Gazprom is expected to spend US$160bn capital expenditure (capex) on 84 oil and gas projects globally by 2025, according to GlobalData, a leading data and analytics company

China Petrochemical Corp (Sinopec) and Royal Dutch Shell follow with US$87bn (74 projects) and US$86bn (91 projects) respectively, said GlobalData on its “H1 2018 Top Global Oil and Gas Companies Planned Projects and Capital Expenditure Outlook” report.

In the upstream sector, Shell leads with an estimated capex of US$58bn to be spent on 53 planned and announced production fields globally. Petrobras follows with US$48bn spent on 33 fields and Gazprom will be in the third position with US$40bn to be spent on 22 fields.

In the midstream sector, Gazprom is expected to lead both pipeline and gas processing segments in terms of capex spending. In the pipeline segment, Gazprom is estimated to spend US$71bn to bring 18 planned and announced projects online by 2025.

In the downstream segment, Saudi Arabian Oil Co is expected to lead with estimated capex of US$47bn on the development of six crude oil refineries globally by 2025. Petroleos de Venezuela SA and China Petrochemical Corp follow with capex of US$34bn to be spent on six upcoming projects and US$31bn to be spent on six new projects respectively.

In the petrochemicals segment, Sinopec is expected to lead with estimated capex of US$11bn to be spent on 36 upcoming petrochemical plants, followed by Carbon Holdings Ltd with US$9bn expected to be spent on 10 new projects.

Raj Sekhar, oil and gas analyst at GlobalData, commented, “In the LNG liquefaction segment, Qatar Petroleum is projected to spend an estimated capex of US$35bn on two upcoming liquefaction terminals by 2025, while China National Offshore Oil Corporation leads in regasification capex, with US$4bn to be spent on three upcoming regasification terminals.”