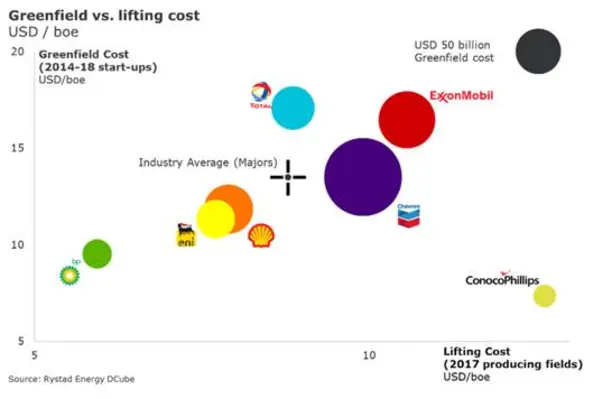

A Rystad Energy review of the performance of their recent projects against those of other operators shows that the three European oil giants, BP, Eni and Shell have outperformed their competitors

Since 2014, these companies have collectively achieved greenfield costs of US$13.50 per boe. These development costs were in addition to their collective US$8.80 per boe lifting costs from 2017.

Matthew Fitzsimmons, vice-president at Rystad Energy, commented, “It is remarkable that BP, Eni and Shell introduced more than US$109bn of new greenfield projects below the industry average greenfield cost and still were able to still achieve industry-leading lifting costs in 2017.”

“BP’s US$6.0bn investment in the Khazzan Phase 1 and Makarem projects in Oman highlighted their execution excellence by achieving greenfield costs below US$5 per boe,” he added.

Looking to build on recent success, BP, Eni and Shell have all been aggressively approving greenfield projects during the downturn. Since 2015, the trio have approved about US$64bn worth of greenfield projects.

Collectively, they are on pace to approve more than US$37bn in projects during the calendar year. More than 30 per cent of those were approved during the second quarter.

“It comes as no surprise that BP, Eni and Shell have led the way in new project investments during the recent downturn. The three majors are well positioned to build on their industry leading greenfield and lifting cost performance,” Fitzsimmons concluded.